A weekly expense report is a tool that helps businesses and individuals track their expenses every week. It allows them to record their spending in different categories and provides a clear overview of their financial activities.

This report can be printed out and used as a reference to analyze spending patterns, identify areas of improvement, and make informed financial decisions.

Why Use a Weekly Expense Report?

Keeping track of expenses is important for both businesses and individuals.

By using a weekly expense report, you can:

- Track Expenses: The report helps you keep a record of all your expenses, including small purchases that might otherwise be overlooked.

- Identify Spending Patterns: By categorizing your expenses, you can identify patterns and trends in your spending habits. This can help you make adjustments and cut down on unnecessary expenses.

- Make Informed Financial Decisions: With a clear understanding of your spending habits, you can make more informed decisions about budgeting, saving, and investing.

How to Create a Weekly Expense Report

Creating a weekly expense report is a straightforward process. Here’s how you can do it:

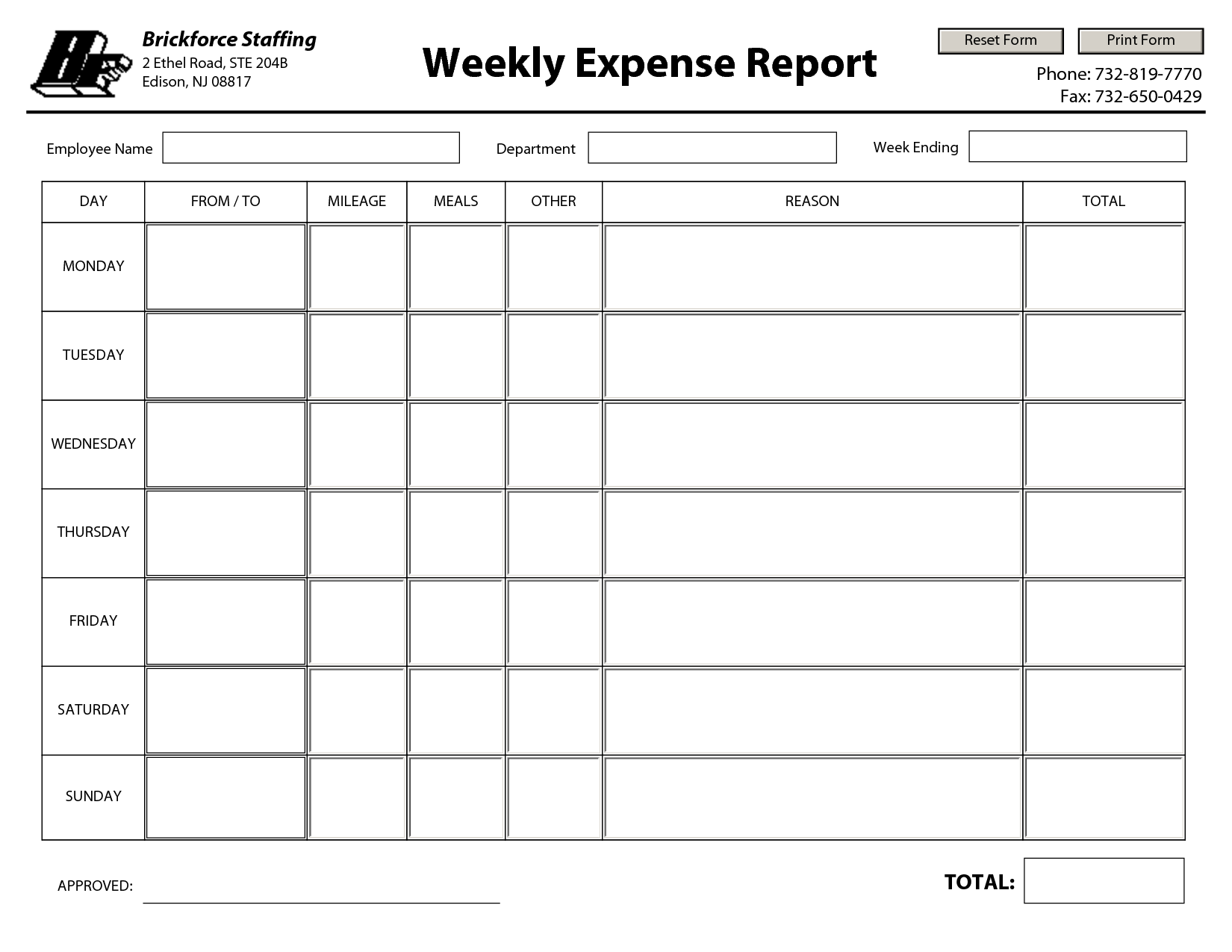

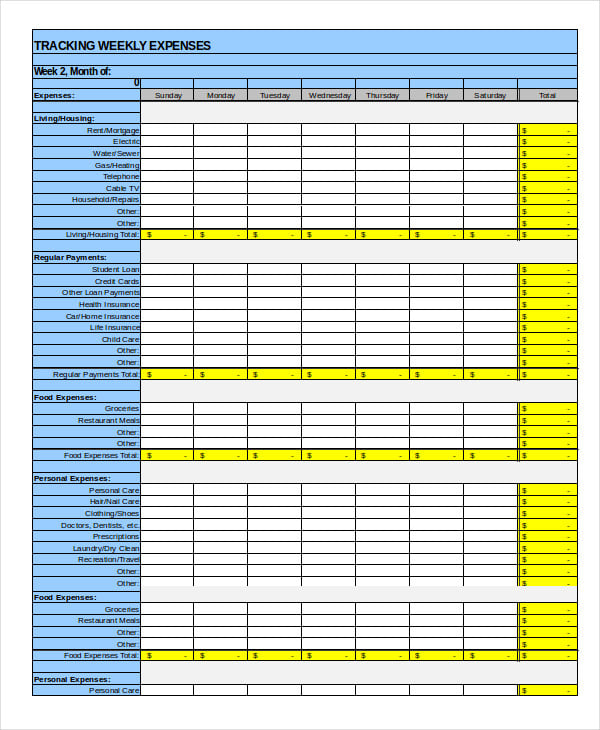

- Choose a Template: Look for an expense report template that suits your needs. There are various templates available online, both free and paid.

- Customize the Template: Once you have chosen a template, customize it according to your preferences. Add your company logo or personal details to make it more personalized.

- Set Up Expense Categories: Create different categories that reflect your spending habits. Common categories include groceries, transportation, utilities, entertainment, and miscellaneous expenses.

- Record Your Expenses: On a weekly basis, record all your expenses in the appropriate category. Be sure to include the date, description, and amount for each expense.

- Review and Analyze: At the end of each week, review your expenses and analyze the patterns. Look for areas where you can cut down on spending or make adjustments.

- Make Adjustments: Based on your analysis, make adjustments to your budget or spending habits. Set goals for the following week and track your progress.

Examples

Tips for Successful Expense Tracking

To make the most out of your weekly expense report, consider the following tips:

- Be Consistent: Make it a habit to record your expenses regularly, preferably on a daily basis. This will ensure that you don’t miss any transactions.

- Be Specific: Provide detailed descriptions for each expense. This will help you remember what the expense was for and make it easier to categorize.

- Review Regularly: Take the time to review your expenses on a weekly or monthly basis. Look for patterns, identify areas of improvement, and set goals for the future.

- Automate when Possible: Consider using expense tracking apps or software that can automate the process for you. This can save time and make tracking easier.

- Set Realistic Goals: When analyzing your expenses, set realistic goals for yourself. Don’t try to cut down on all expenses at once, but rather focus on one category at a time.

- Seek Professional Help: If you struggle with managing your finances or need expert advice, consider seeking help from a financial advisor or accountant.

- Stay Motivated: Tracking expenses can sometimes feel tedious, but remember the benefits it brings. Stay motivated by reminding yourself of your financial goals and the progress you are making.

Conclusion

A weekly expense report is a valuable tool for businesses and individuals to track their expenses, identify spending patterns, and make informed financial decisions. By regularly recording and analyzing your expenses, you can gain a better understanding of your financial habits and take steps toward achieving your financial goals.

Remember to be consistent, sand pecific, and review your expenses regularly to make the most out of your expense tracking efforts.

Weekly Expense Report Template – Download