A Profit and Loss (sometimes called “P&L” for brevity’s sake) statement helps a manager get a transparent measurement of a company’s sales and expenses over a period of your time . The P&L statement helps managers get a sensible view of finances, showing the totals of all to revenue sources. On the P&L template, you’ll subtract all expenses associated with the company’s income, supplying you with a transparent overview of the financial progress you’ve remodeled the amount of your time . Small businesses tend to use a P&L statement monthly , but larger companies may only do the maths quarterly for purposes of reporting back to stakeholders, like your board of directors, stockholders, or other investors.

A profit and loss statement is one among the main financial documents t hat is ready by business owners or their accountants. Business owners and accountants use it alike. this is often important because it can very clearly show the financial success of your business over a period of your time – and it also can show where you’re arising short. for instance , many online retailers consider the Xmas season to be the foremost important time of year for his or her trade, and keeping an earnings report for this point period can help them check their own profits against the present trends in their industry. However, for much of the remainder of the year, retailers tend to try to to much less business overall. Some months, a retailer will find that they’re barely breaking even. However, if you include a whole quarter’s worth of sales, expenses, and profits, you’ll find that overall, your business is excelling.

How to Use Profit and Loss Statements

Whether a business sells goods or provides services, a P&L statement can help determine how it’s been performing within the past and predict how it’s going to perform within the future. for brand spanking new businesses, a profit and loss statement will offer you an honest idea of how things are going. no matter the sort of business, the primary step is to work out the amount of your time to be evaluated — usually for 1 / 4 but are often a month, a year, or maybe every week .

P&L statements are typically prepared by owners or accountants, and employed by owners, officers, and shareholders to urge a pity the state of the business. A P&L statement also can give potential investors or buyers a fast view of the state of the business.

Individuals also can use a profit and loss template to trace their personal expenses and income in order that they know if they’re saving money or spending quite they create .

Profit and loss statements are often prepared automatically by accounting software packages, but if your business doesn’t use one, you’ll choose between the variability of free profit and loss templates below. These templates are available in Microsoft Excel format, and you’ll download and customize them to suit your business requirements. you’ll also expand the templates to trace income from multiple sources, and use them to look at the your P&L profits and losses during various time periods (monthly, quarterly, annually, etc.).

Steps to Fill Out a P&L Statement

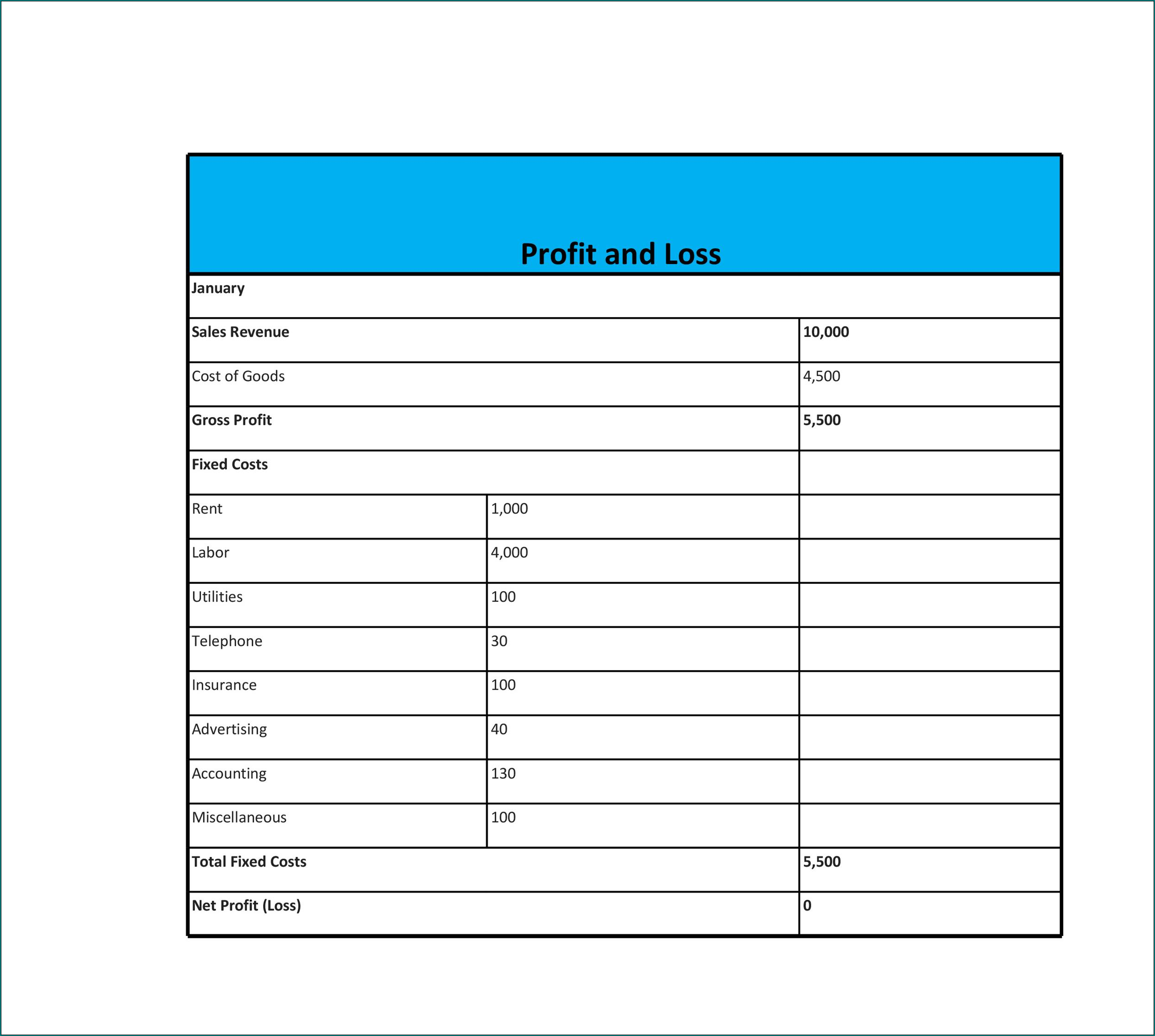

After you’ve determined the amount of your time to be evaluated, complete the subsequent high-level steps to fill out a P&L statement:

Enter internet revenue from your primary commercial activity .

Subtract returns and allowances.

Subtract cost of products sold (i.e., expenses directly associated with producing your product, like labor/salary and wages, materials, etc.).

Subtract recurring expenses (i.e. rent, insurance, sales and marketing, transportation, office equipment, rent, administrative, R&D, etc.).

Add any non-primary business revenue (e.g. interest, sale of assets).

Subtract taxes and interest.

Subtract depreciation and amortization.

Subtract non-recurring expenses (e.g. theft, action , fire damage, delinquent accounts etc.).

Once you’ve completed these steps, you’ll see your net income or loss.

Samples of Simple Profit And Loss Template :

Additionally, note that operating income are often determined by subtracting gross profit margin from total expenses, which operating expenses are often determined by adding all expenses.

Simple Profit And Loss Template | Excel download