In the world of non-profit organizations, managing finances effectively is crucial to ensure the success and sustainability of the mission. One key tool that can help non-profits stay on track financially is a simple budget template. A budget template provides a clear framework for organizing income and expenses, tracking spending, and making informed financial decisions. By utilizing a budget template, non-profits can better allocate resources, plan for the future, and demonstrate financial responsibility to donors and stakeholders.

What is a Non-Profit Budget Template?

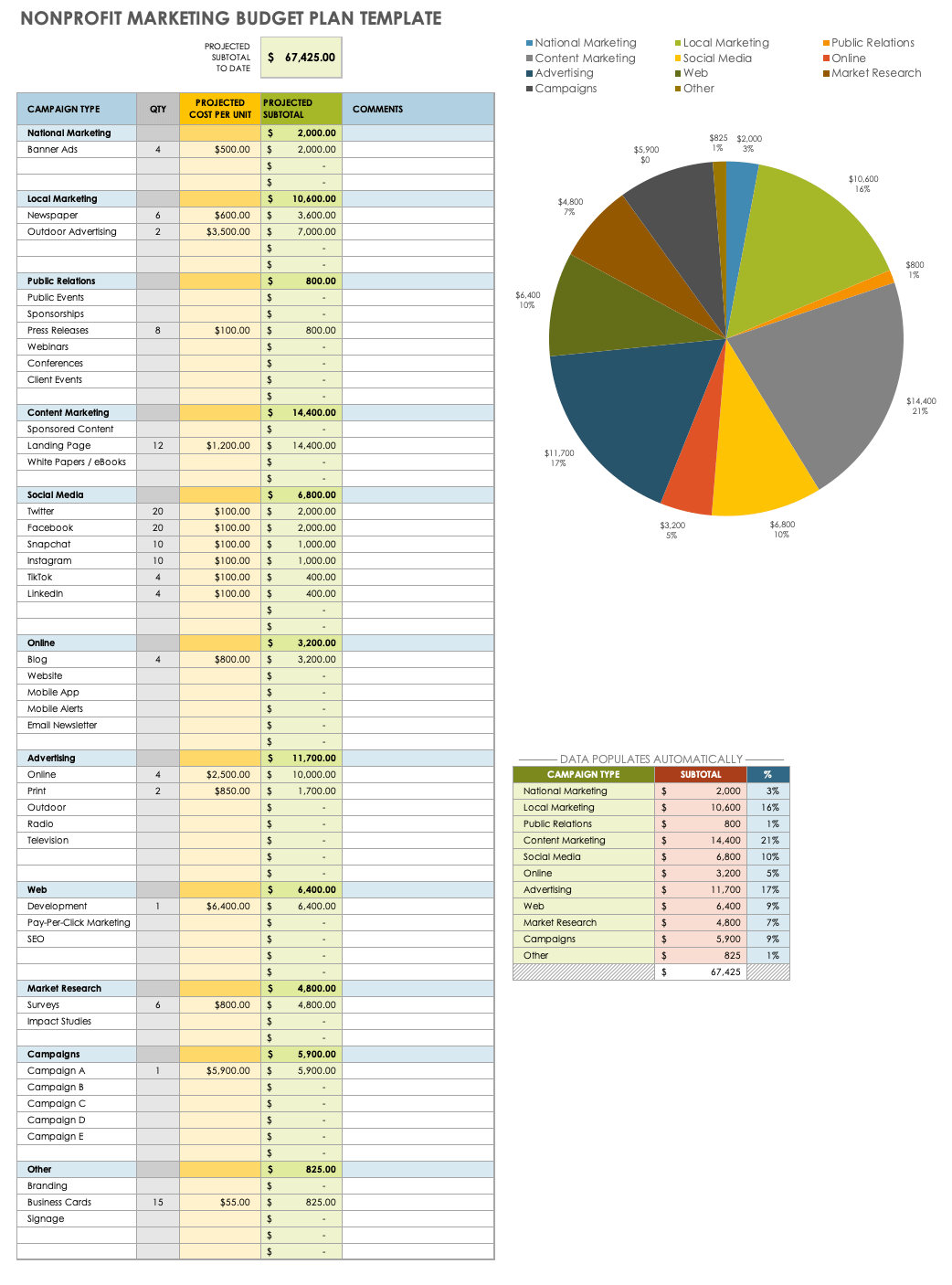

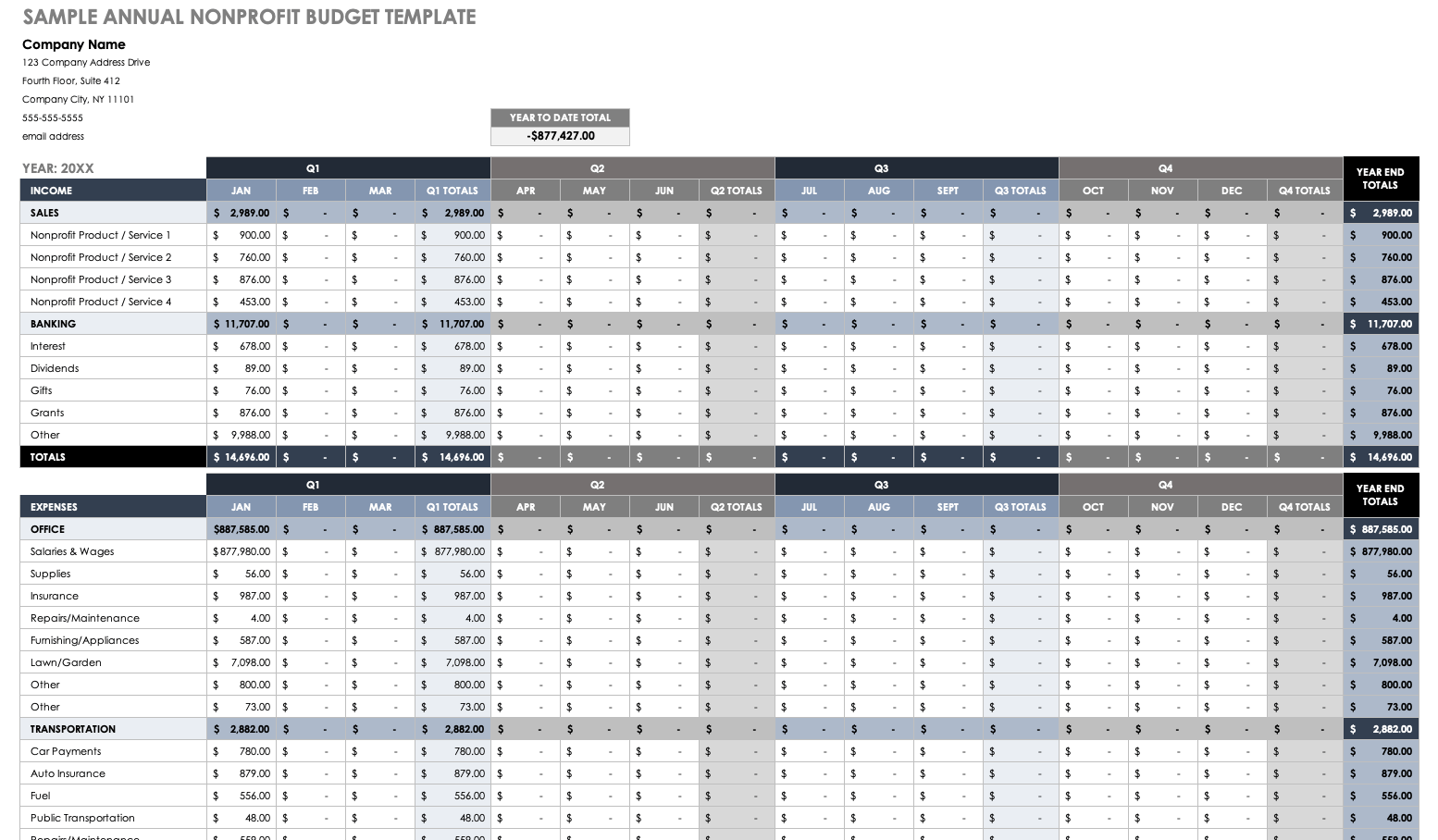

A non-profit budget template is a pre-designed spreadsheet or document that helps organizations outline their anticipated revenue and expenses for a specific period, typically a fiscal year. This template serves as a roadmap for financial planning and management, allowing non-profits to set financial goals, monitor cash flow, and make strategic decisions to ensure financial stability. A well-designed budget template should include categories for income sources, expenses, fundraising initiatives, and reserves, providing a comprehensive overview of the organization’s financial health.

The Purpose of Using a Non-Profit Budget Template

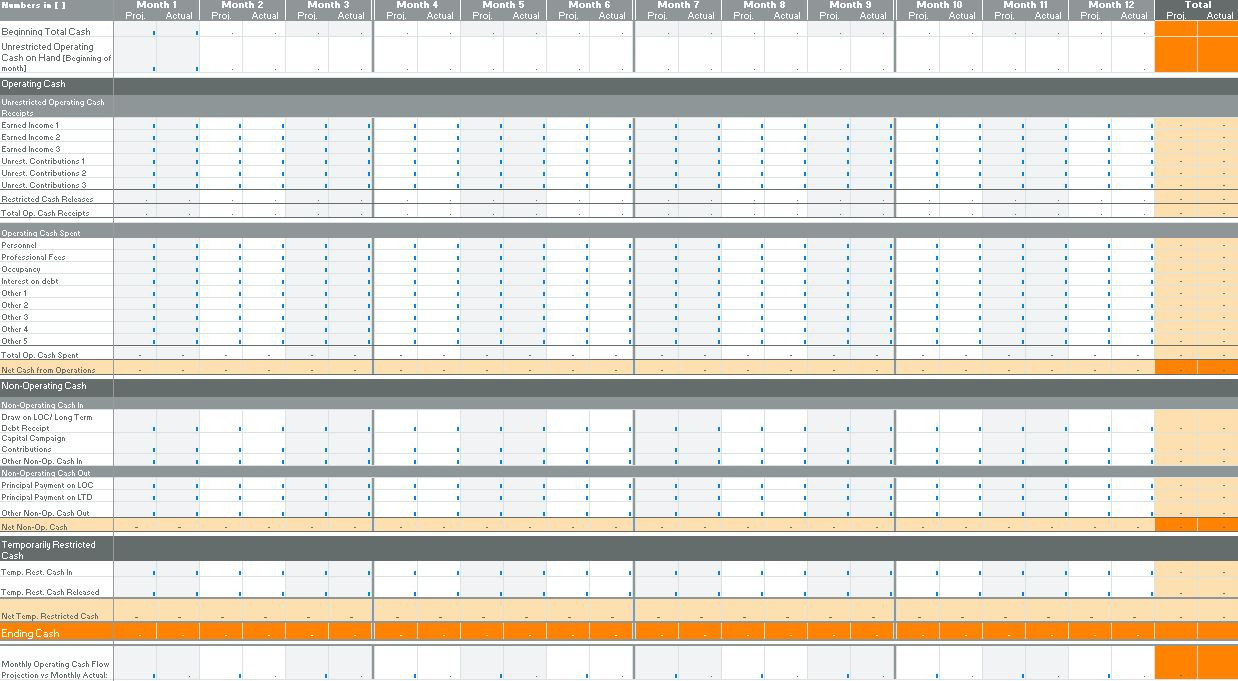

Image Source: ctfassets.net

The primary purpose of using a non-profit budget template is to help organizations effectively manage their financial resources and achieve their mission-driven goals. By creating a budget template, non-profits can:

1. Establish Financial Goals: A budget template allows non-profits to set clear financial goals and objectives, such as fundraising targets, program expenses, and administrative costs.

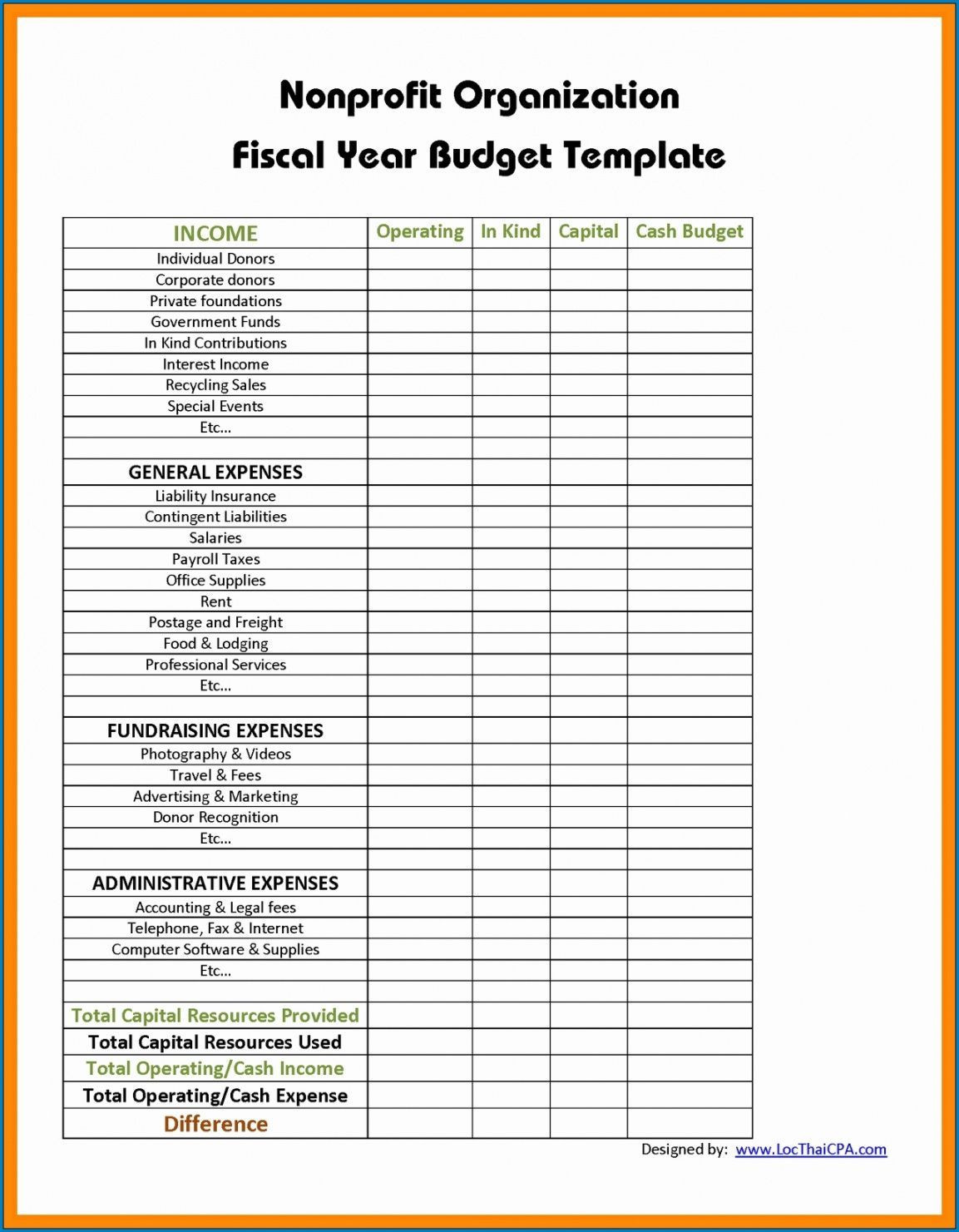

Image Source: donorbox.org

2. Monitor Cash Flow: By tracking income and expenses in a budget template, organizations can monitor cash flow, identify potential financial challenges, and make necessary adjustments to ensure financial stability.

3. Plan for the Future: A budget template enables non-profits to forecast future financial needs, allocate resources strategically, and plan for long-term sustainability and growth.

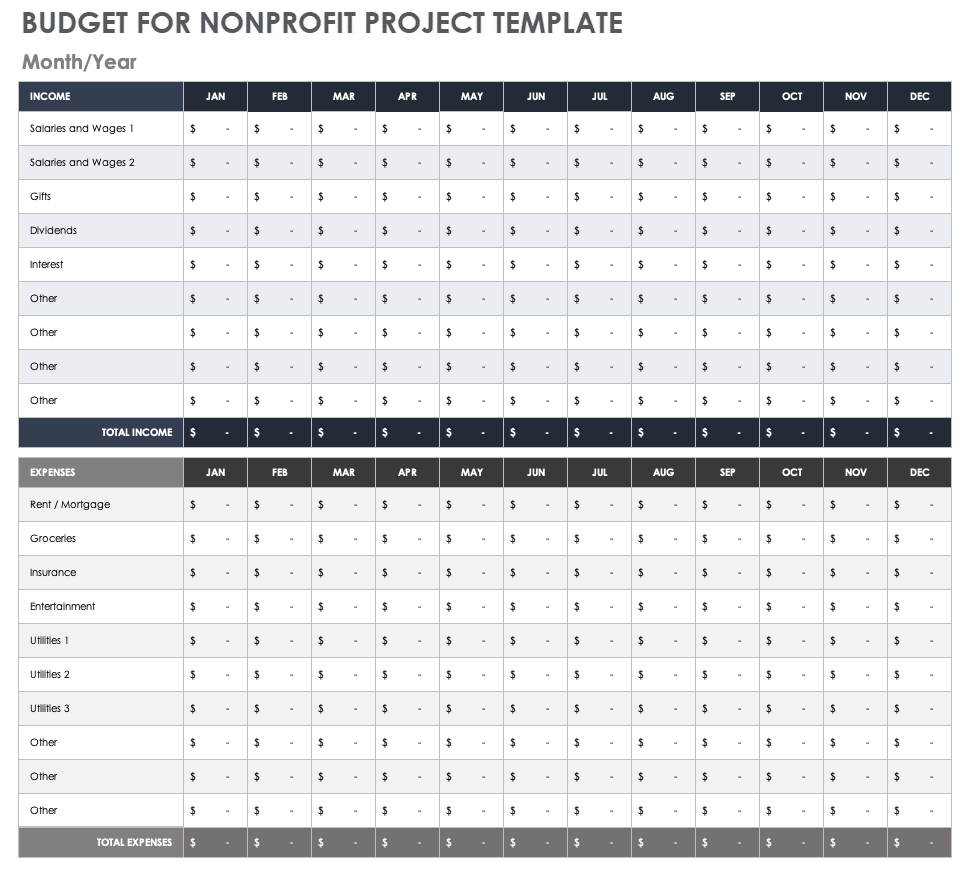

Image Source: pinimg.com

4. Demonstrate Accountability: Using a budget template helps non-profits demonstrate financial accountability and transparency to donors, funders, and stakeholders, enhancing trust and credibility.

Why You Need a Non-Profit Budget Template

Non-profit organizations face unique financial challenges, including reliance on donations, fluctuating revenue streams, and limited resources. A budget template provides a structured approach to financial management, helping organizations navigate these challenges and make informed decisions. Here are some key reasons why non-profits need a budget template:

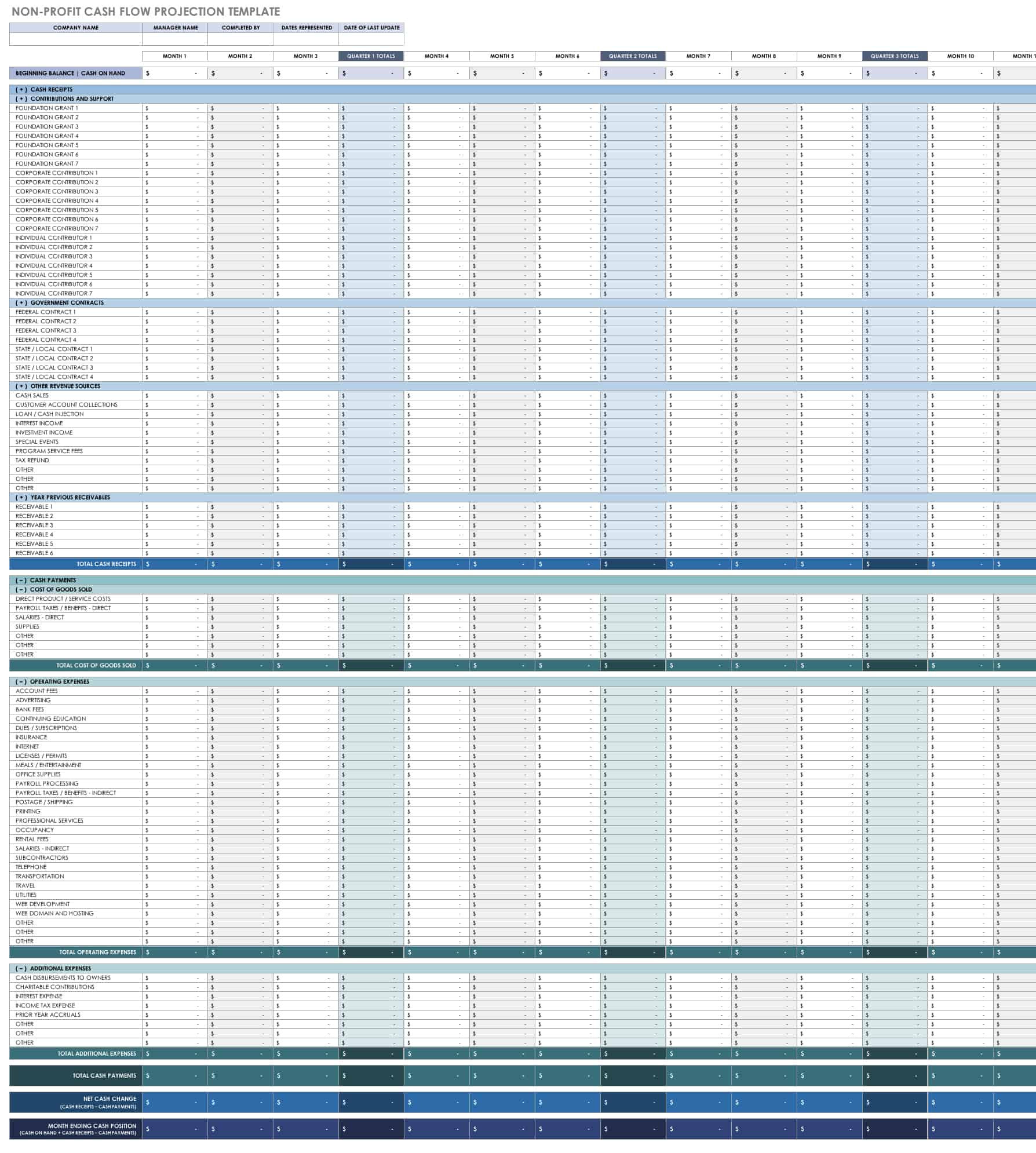

Image Source: smartsheet.com

1. Financial Planning: A budget template enables non-profits to create a roadmap for financial planning, setting priorities, and allocating resources effectively to support their mission.

2. Decision-Making: By using a budget template, organizations can make data-driven decisions about programmatic investments, fundraising strategies, and expense management.

Image Source: gdoc.io

3. Resource Allocation: With a budget template, non-profits can track income and expenses, identify areas of overspending or underspending, and reallocate resources to maximize impact.

4. Stakeholder Communication: A budget template provides a clear and concise way to communicate financial information to board members, staff, donors, and other stakeholders, fostering transparency and accountability.

How to Create a Non-Profit Budget Template

Image Source: smartsheet.com

Creating a non-profit budget template can seem like a daunting task, but with careful planning and attention to detail, organizations can develop a comprehensive and effective tool for financial management. Here are some steps to help you create a non-profit budget template:

1. Identify Income Sources: Start by listing all sources of income for your organization, including donations, grants, fundraising events, and program fees.

Image Source: smartsheet.com

2. Outline Expenses: Next, categorize your expenses into fixed costs (e.g., rent, utilities) and variable costs (e.g., program expenses, fundraising).

3. Set Financial Goals: Define your financial goals and objectives, such as revenue targets, expense limits, and reserves, to guide your budgeting process.

Image Source: smartsheet.com

4. Allocate Resources: Use your budget template to allocate resources to different programs, activities, and initiatives based on their importance and impact.

5. Monitor and Adjust: Regularly monitor your budget template, track actual income and expenses, and make adjustments as needed to stay on track with your financial goals.

Image Source: ctfassets.net

6. Seek Input: Involve key stakeholders, such as board members, staff, and finance committee members, in the budgeting process to ensure buy-in and support for the budget.

7. Use Technology: Consider using budgeting software or tools to automate budgeting processes, streamline financial reporting, and improve accuracy and efficiency.

Image Source: smartsheet.com

8. Review and Revise: Periodically review your budget template, assess its effectiveness in achieving financial goals, and make revisions as needed to adapt to changing circumstances.

Tips for Successful Non-Profit Budgeting

Creating a non-profit budget template is only the first step in effective financial management. To ensure success and sustainability, non-profits should follow these tips for successful budgeting:

Involve Key Stakeholders: Engage board members, staff, finance committee members, and other stakeholders in the budgeting process to gain diverse perspectives and ensure alignment with organizational goals.

Be Realistic: Set achievable financial goals and budget targets based on historical data, market trends, and organizational capacity to avoid overestimating income or underestimating expenses.

Monitor Performance: Regularly review financial reports, track budget variances, and analyze spending patterns to identify areas of concern and make informed decisions to address financial challenges.

Communicate Effectively: Use your budget template as a communication tool to inform stakeholders about financial priorities, challenges, and successes, fostering transparency and accountability within the organization.

Plan for Contingencies: Anticipate unforeseen expenses, revenue fluctuations, and economic uncertainties by building reserves, creating a contingency fund, or developing a financial risk management plan to mitigate financial risks.

Seek Professional Guidance: Consider consulting with financial advisors, accountants, or nonprofit consultants to gain expertise in budgeting best practices, compliance requirements, and financial reporting standards to enhance financial management capabilities.

Conclusion

In conclusion, a simple non-profit budget template is a valuable tool for financial planning, management, and decision-making for organizations seeking to achieve their mission-driven goals and ensure long-term sustainability. By creating and using a budget template, non-profits can establish clear financial goals, monitor cash flow, allocate resources effectively, and communicate financial information transparently to stakeholders. With careful planning, attention to detail, and adherence to best practices, non-profit organizations can leverage a budget template to navigate financial challenges, make informed decisions, and achieve financial stability and success.