Budgeting is a crucial aspect of managing your finances effectively. It helps you track your income and expenses, plan for the future, and achieve your financial goals. Creating a simple home budget template can make the process of budgeting easier and more organized. Whether you are new to budgeting or looking to revamp your current budgeting system, a well-designed budget template can be a valuable tool in helping you take control of your finances.

What is a Simple Home Budget Template?

A simple home budget template is a document or spreadsheet that helps you track your income, expenses, savings, and financial goals in one place. It provides a clear overview of your finances and allows you to plan your spending accordingly. The template typically includes sections for income sources, fixed expenses, variable expenses, savings goals, and a summary of your overall financial situation. By using a budget template, you can easily see where your money is going, identify areas where you can cut back, and make informed financial decisions.

The Purpose of Using a Simple Home Budget Template

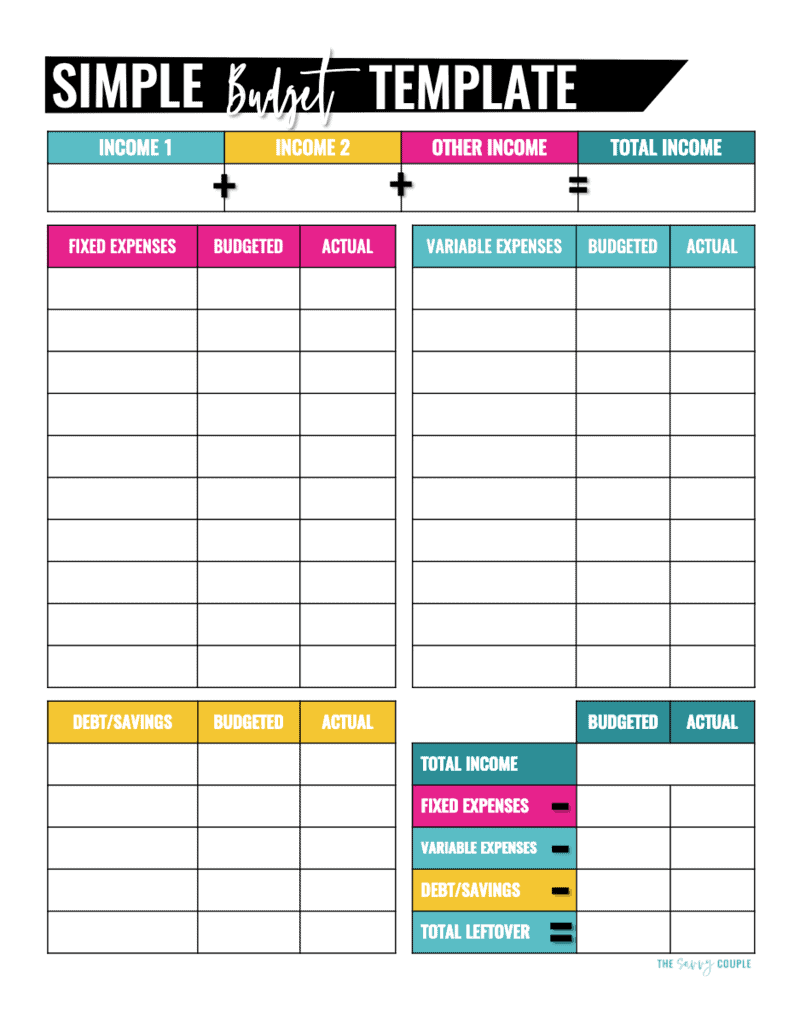

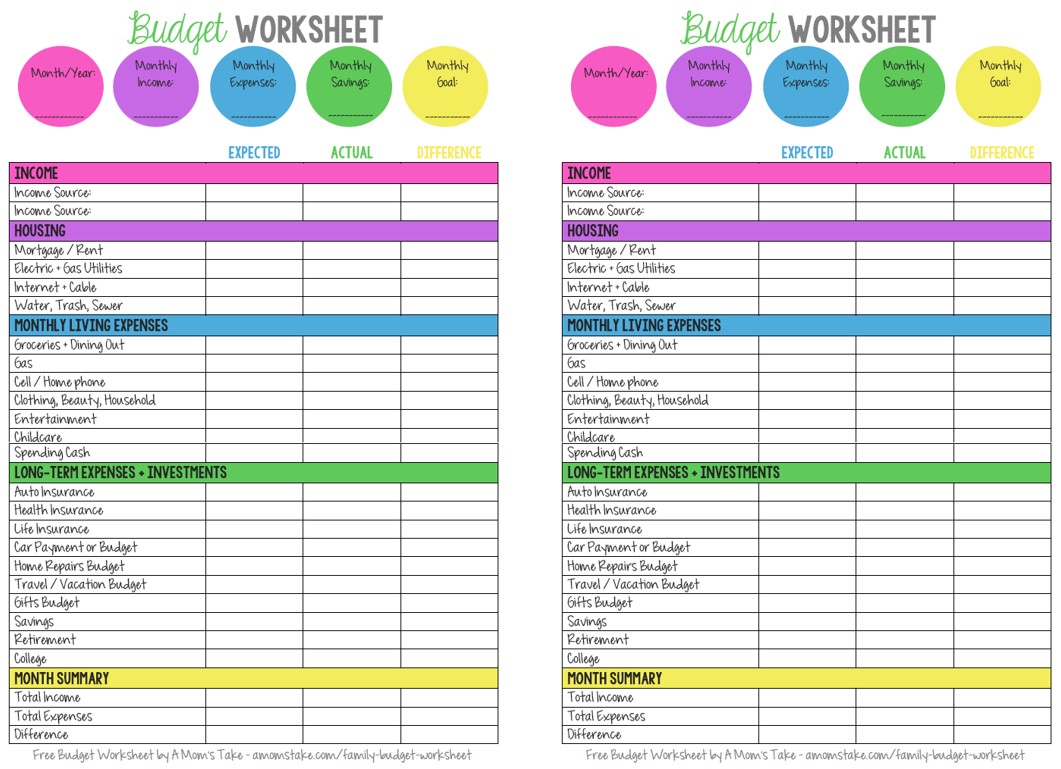

Image Source: thesavvymama.com

The main purpose of using a simple home budget template is to help you manage your finances more effectively. By documenting your income and expenses in a structured format, you can gain a better understanding of your financial situation and make informed decisions about your spending habits. A budget template can also help you set realistic savings goals, track your progress towards those goals, and make adjustments as needed. Ultimately, the goal of using a budget template is to achieve financial stability, reduce financial stress, and work towards your long-term financial objectives.

Why You Should Use a Simple Home Budget Template

There are several reasons why you should consider using a simple home budget template. First and foremost, a budget template provides a clear visual representation of your finances, making it easier to see where your money is going and identify areas where you can save. Additionally, a budget template can help you stay organized by keeping all your financial information in one place. By using a budget template, you can also set specific financial goals, track your progress, and make adjustments as needed to stay on track. Overall, a simple home budget template can help you take control of your finances, reduce financial stress, and work towards achieving your financial goals.

How to Create a Simple Home Budget Template

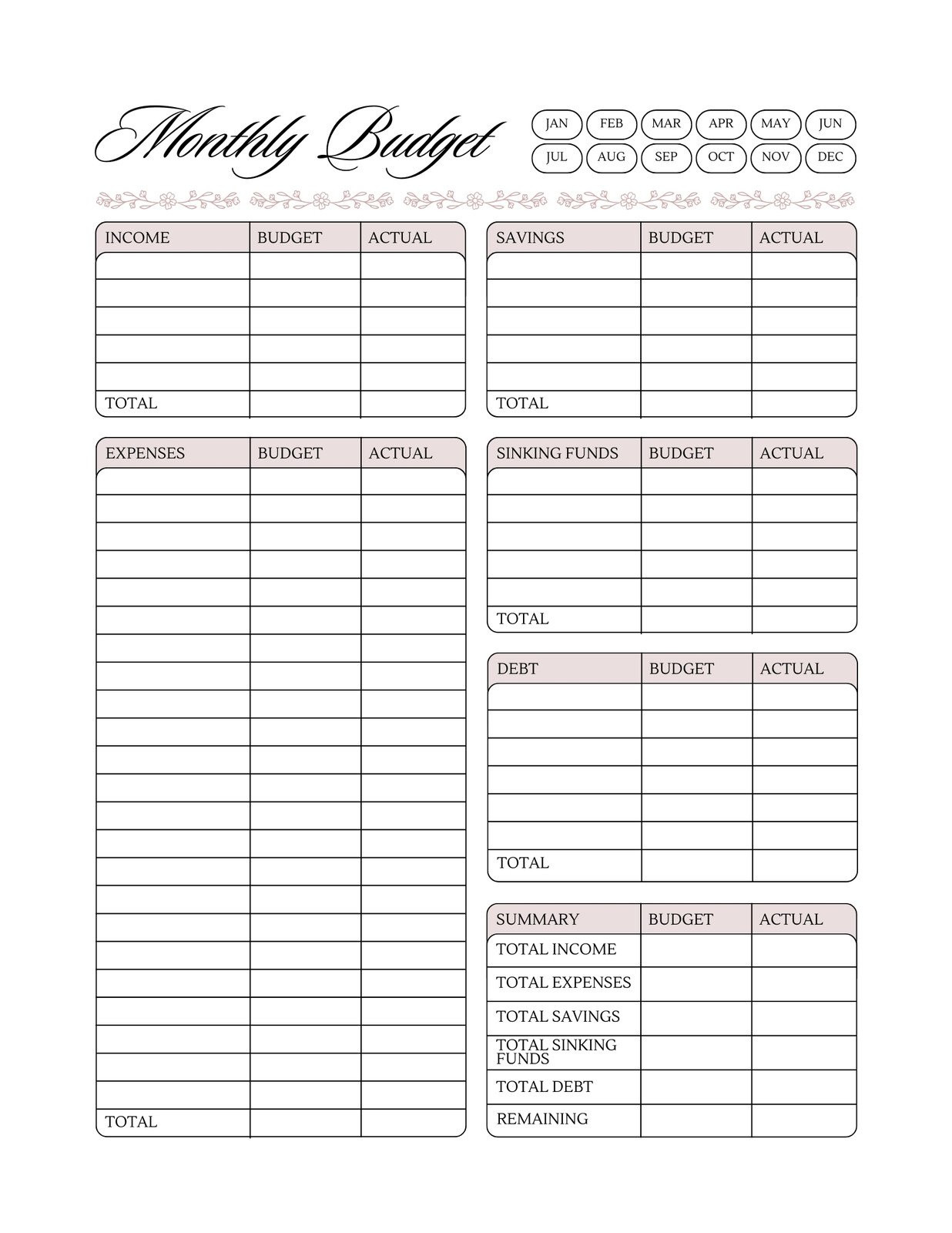

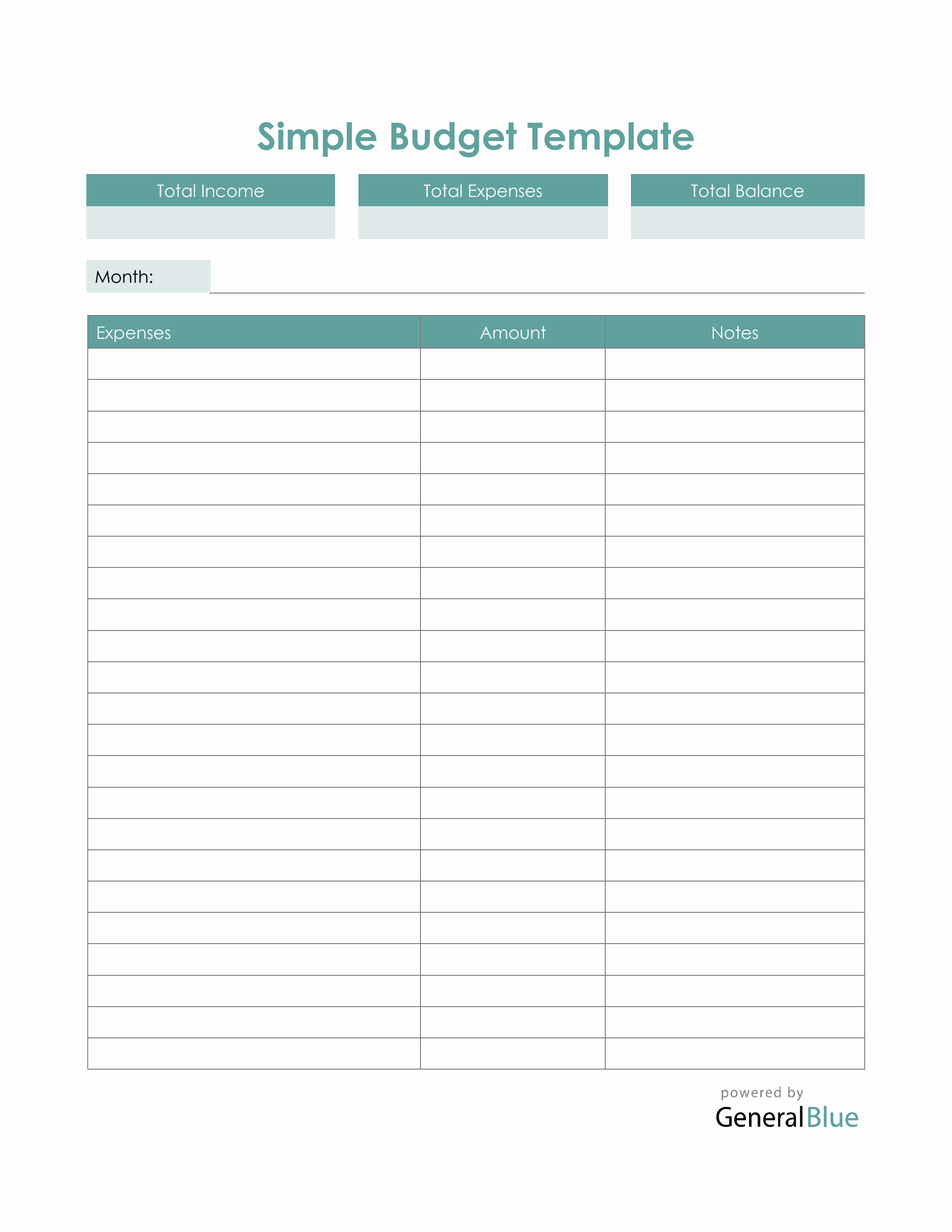

Image Source: canva.com

Creating a simple home budget template is easy and straightforward. Here are some steps to help you get started:

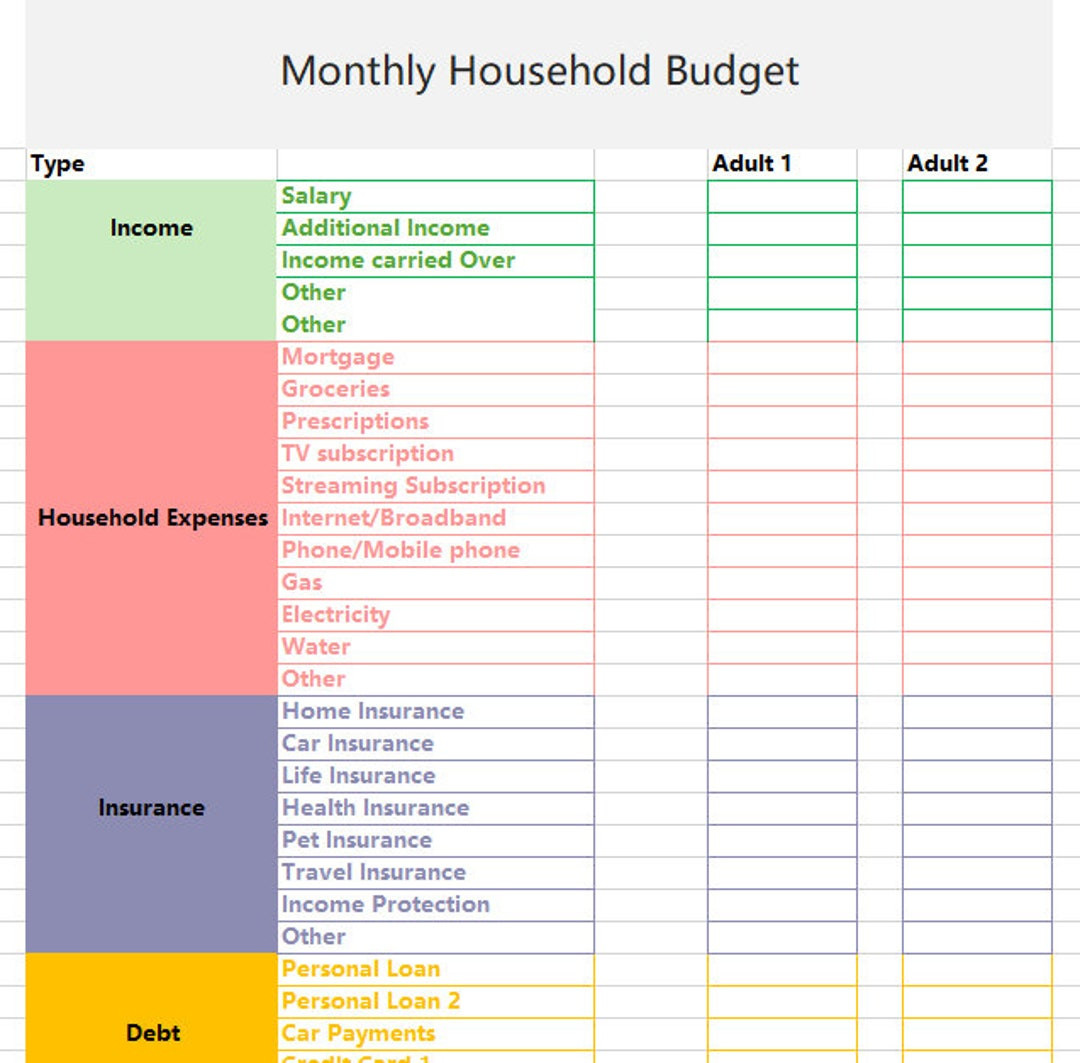

1. Determine Your Income Sources

Begin by listing all your sources of income, including your salary, bonuses, side hustles, and any other money coming in each month.

2. Identify Your Fixed Expenses

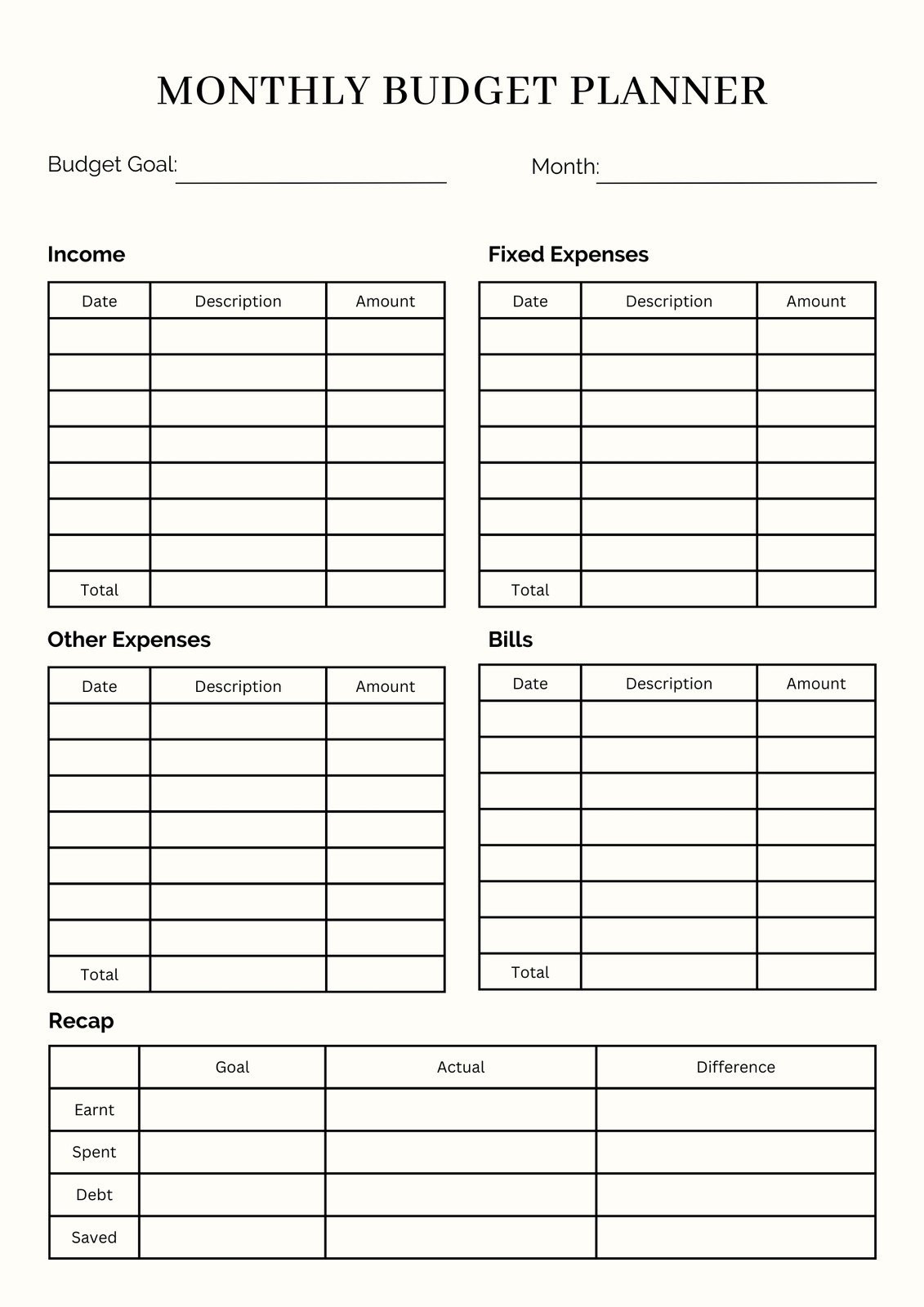

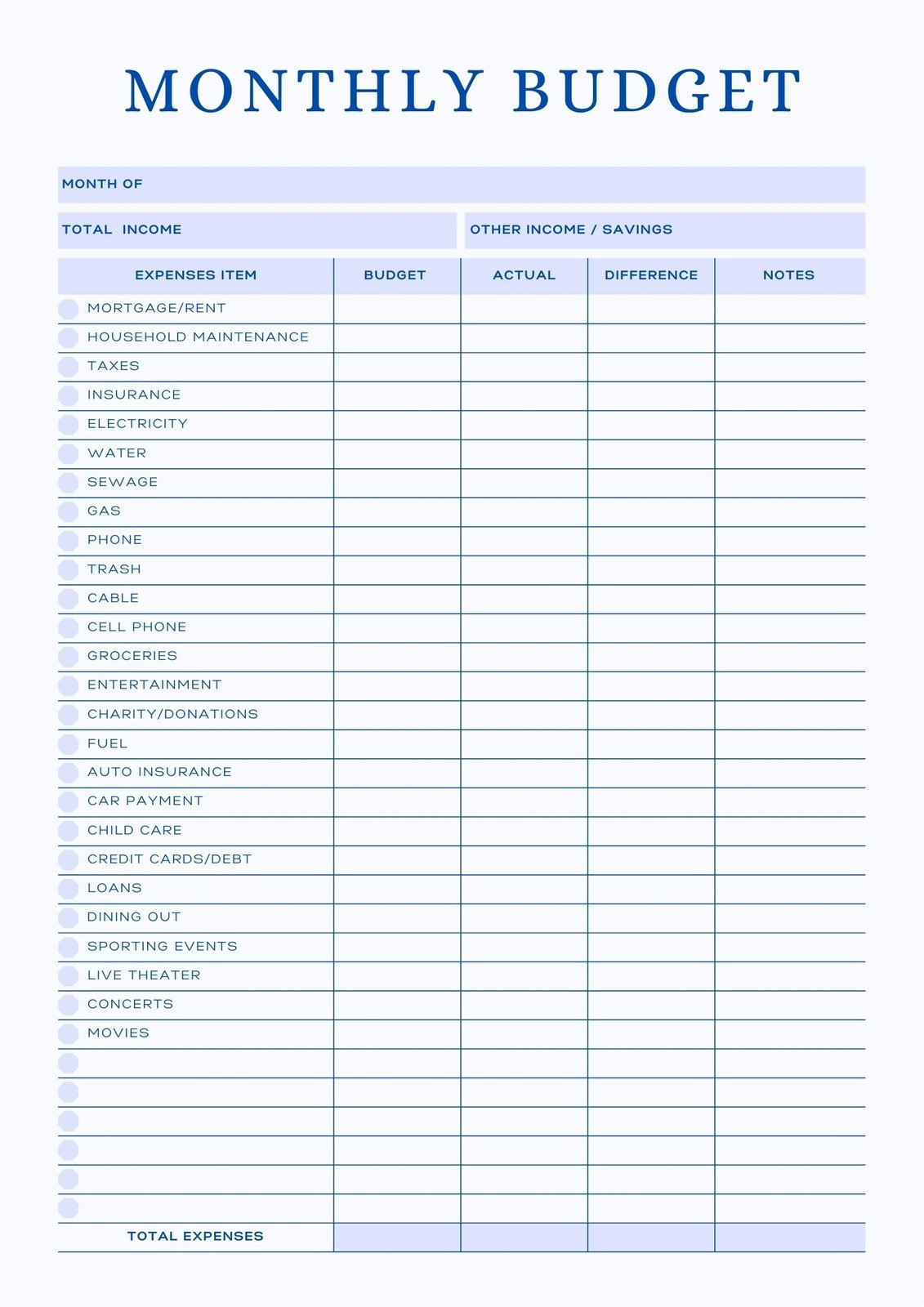

Image Source: canva.com

Next, list all your fixed expenses, such as rent/mortgage, utilities, insurance, and loan payments. These are expenses that stay the same each month.

3. List Your Variable Expenses

Include variable expenses like groceries, entertainment, dining out, and shopping. These expenses may fluctuate each month.

4. Set Savings Goals

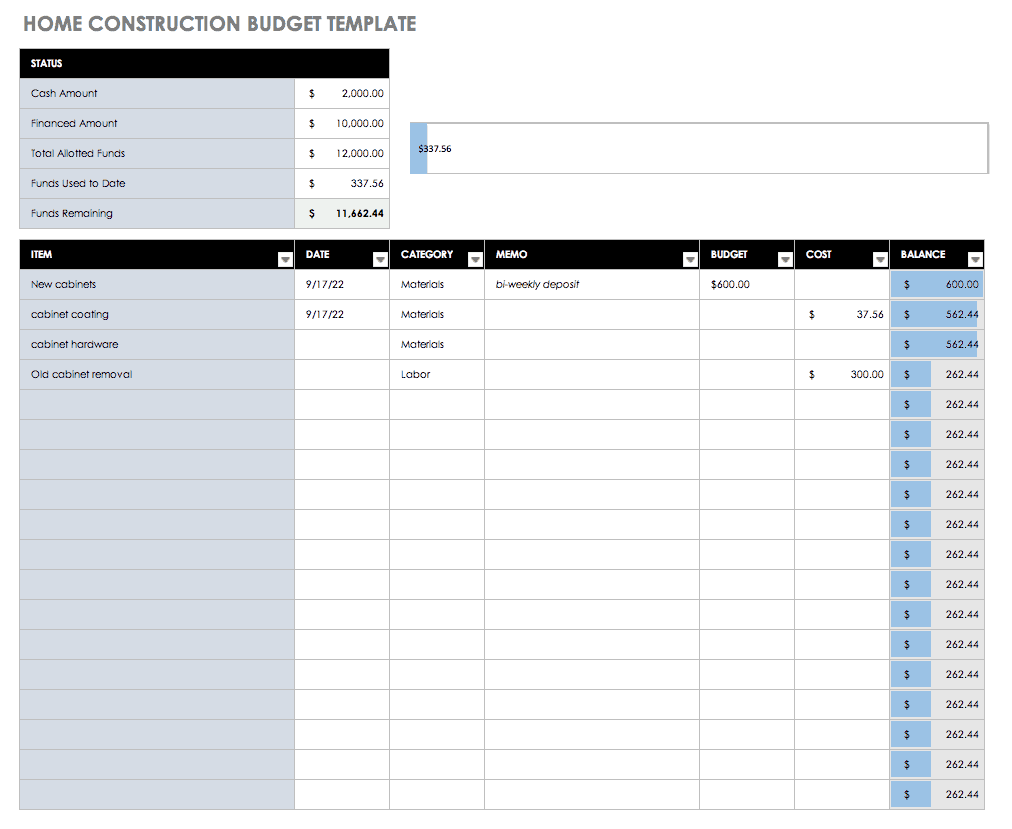

Image Source: smartsheet.com

Decide on your savings goals, whether it’s for an emergency fund, a vacation, or a big purchase. Allocate a portion of your income towards these goals.

5. Calculate Your Total Income and Expenses

Add up your total income and total expenses to see if you are living within your means. Make adjustments as needed to ensure you are not overspending.

6. Track Your Spending

Image Source: amomstake.com

Keep track of your spending throughout the month to see if you are sticking to your budget. Adjust your budget as necessary to stay on track.

7. Review and Adjust Your Budget Regularly

Review your budget regularly to see if you are meeting your financial goals. Make adjustments as needed to accommodate any changes in your income or expenses.

8. Use Budgeting Apps or Software

Image Source: generalblue.com

Consider using budgeting apps or software to automate the budgeting process and make it easier to track your finances on the go.

Tips for Successful Budgeting with a Simple Home Budget Template

To make the most of your simple home budget template, consider the following tips:

Image Source: canva.com

Be Realistic: Set achievable financial goals and make sure your budget is realistic.

Track Your Spending: Keep a close eye on your expenses to see where you can cut back.

Plan for Unexpected Expenses: Include a buffer in your budget for any unexpected expenses that may arise.

Stay Disciplined: Stick to your budget and avoid unnecessary spending to reach your financial goals.

Review and Adjust: Regularly review your budget and make adjustments as needed to stay on track.

Celebrate Milestones: Celebrate your financial achievements and milestones to stay motivated.

In Conclusion

Image Source: etsystatic.com

Creating and using a simple home budget template can help you take control of your finances, reduce financial stress, and work towards achieving your financial goals. By following the steps outlined above and implementing the tips for successful budgeting, you can effectively manage your income and expenses, set realistic savings goals, and make informed financial decisions. Remember, budgeting is a continuous process, so be sure to regularly review and adjust your budget to stay on track towards financial stability.