A restaurant receipt is a record given to clients at a restaurant that maintains track of their control. The receipt records every thing the client requested and the amount it cost. Plans are given to clients so they can see a precise breakdown of the bill. Restaurant receipts likewise show the expense, tip sum, any limits or coupons that were applied to the bill, and the absolute of the request.

What is an Itemized Restaurant Receipt?

An ordered restaurant receipt is a receipt that contains five explicit subtleties: the name of the paying client, the name of the restaurant, the date the supper was bought, the things bought and cost of every thing, and the absolute expense of the bill, including the assessment and tip sums.

What Details Should be Included on a Restaurant Receipt?

Standard restaurant receipts will remember the accompanying subtleties for a reasonable and coordinated way:

Restaurant Contact Information: The name of the restaurant ought to be incorporated at the highest point of the receipt. Furthermore, any pertinent contact data ought to be incorporated, like the restaurant’s location, telephone number, and perhaps site, if appropriate. This gives the client a simple method of reaching the restaurant with any inquiries or concerns.

Receipt Number: Each receipt accompanies its number for accommodation. On the off chance that the client needs to pose any inquiries about their request, or if the restaurant needs to look into a past request, they can do as such by looking into the receipt number.

Date: Including the date on the restaurant receipt helps the client and restaurant keep coordinated records about when deals were made.

Subtleties of Purchased Items: Each thing bought, alongside the cost of every thing, ought to be plainly recorded on the receipt. This gives the client a precise breakdown of what they paid for. It additionally assists the client with figuring the legitimate tip sum.

Subtotal of Purchased Items: The subtotal is the sum before the assessment, and the tip is added. This number is kept separate from the complete so the client can see the cost of the food and refreshment they requested before different expenses are applied.

Deals Tax: If there is a business charge, this sum will be incorporated independently from the subtotal. This assists the client with seeing the duty expenses and the amount it will put on the tab.

Tip Amount: Including the tip sum on the restaurant receipt shows both the client and the restaurant how much cash the client energetically put on the tab.

Absolute: The aggregate sum of the bill ought to be incorporated at the lower part of the restaurant receipt, ordinarily in the intense or amplified textual style for lucidity.

Technique for Payment: Restaurant receipts ought to incorporate the client’s strategy for installment, regardless of whether money, card, check, or gift voucher.

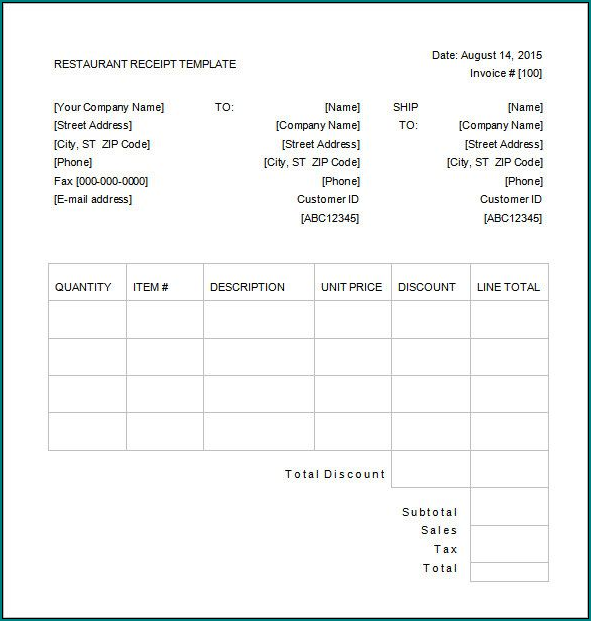

Samples of Restaurant Receipt Template :

Is it Necessary for Restaurants to Issue Receipts?

While there may not be government laws necessitating that restaurants give receipts to their clients, it is certainly to the greatest advantage of the restaurant to give exact receipts for each request. Doing so guarantees that paying clients have a record of what they were charged for and the sum they paid. Giving receipts helps the restaurant keep a decent record of their deals. This will be useful for the restaurant when recording charges. Similarly, receipts help clients by giving them an approach to monitor their costs.

Restaurant Receipt Template | Excel download