A purchase order is significantly more than simply a form; it’s a form that speaks to a lifestyle for some organizations that order enormous amounts of crude products or supplies from a seller consistently. The purchase order fills in as an offer, on paper, to purchase a particular item, in a particular sum, at a particular cost. When a merchant acknowledges a purchase order, it turns into an agreement among purchaser and vender. The merchant will send your organization the products you require, and send your organization a receipt that is typically net 30 or net 60 days, contingent upon your concurrence with the seller.

Numerous organizations depend on purchase order financing to help them purchase bigger amounts of merchandise and supplies without hurting their income. Numerous sellers will acknowledge purchase orders of net 30 or net 60 days, giving you an opportunity to recover the cash you’ve spent while attempting to develop your business. A purchase order layout, dissimilar to an order form format, is just utilized in the business-to-business commercial center. Retailers, development firms, advertisement organizations and different merchants regularly acknowledge purchase orders from organizations they accept are credit-commendable; ordinarily, this implies you are viewed as a decent client who pays on schedule.

A purchase order is set up to permit you to keep a similar income until the receipt is expected. For some entrepreneurs, this is a crucial capacity that develops the business.

Numerous organizations utilizing purchase order forms to order products using a loan. Keep in mind, a purchase order, when acknowledged by the seller, is viewed as a lawful agreement that you are ensuring installment for.

For instance, a retailer who expects an especially bustling Xmas season may submit an additional huge request to stay aware of the foreseen request. In the event that the retailer utilizes just his income for this reason, he would just have the option to order a restricted stock of products, and would hazard passing up benefits before the shopping season closes.

Ensure you stay up with the latest and consistently ensure your order forms are decipherable, appropriately formatted, and approved by the party in question, for example, the entrepreneur or the acquirement office. A purchase order form format will help keep things normalized, regardless of the number of workers your organization has.

At the point when you compose a purchase order, you will add your own “fine print.” If you pay solicitations net 30 or 60 days, you will need this obviously recorded on your purchase order form format. Ensure you make numerous duplicates; one for your own records, one for the seller, and one for the bookkeeping office. On the off chance that you decide to fax your purchase over to your merchant, ensure that you send a printed copy via the post office, stepped “Copy” in red letters. (You can order this sort of stamp from an office supply store.)

Work with your merchants to create unit costs for the things or administrations you order consistently – this will save your business relationship much of the time. With standard costs, you’ll quickly know whether you’re being cheated, and with a decent purchase order format, you’ll generally have the information you need, for each order with your seller.

Ensure that you limit who can approve a purchase order. Certainly, you need administrators and salesmen to have the option to put orders, yet you’ll need a believed individual from upper administration to audit each purchase order. You ought to have at any rate two signatories; in the event that one individual is missing the day a critical purchase order should be sent.

At the point when you use purchase order financing, you’ll have the option to hold working capital while getting the provisions you need. Here and there, a business will utilize purchase order financing to help secure a major venture. Despite the fact that they might not have the working cash-flow to make the purchases altogether, an entrepreneur can “order against” a foreseen huge installment. Here’s the way it works:

Settle on a standard purchase order form layout and ensure you use it in each exchange. Sooner or later, it will appear to be a natural to round out these forms.

Ensure your merchant gives you item numbers and information on amount limits. Each purchase order you send should mirror the value you have concurred on for the amount you plan on ordering.

Discover which of your merchants take orders by means of purchase order and any limitations they have.

Discover what amount of time you are permitted to require to pay the receipt produced from the purchase order. Normal time spans are net 30 days and net 60 days.

A few organizations will make sure about your purchase orders through your own reliability, while others will utilize a financing organization. The financing organization will relegate you a credit extension that is basically a stock advance. Your seller will pull out assets as installment for the dispatched product, and you’ll get more supplies to work with that you’ll take care of later.

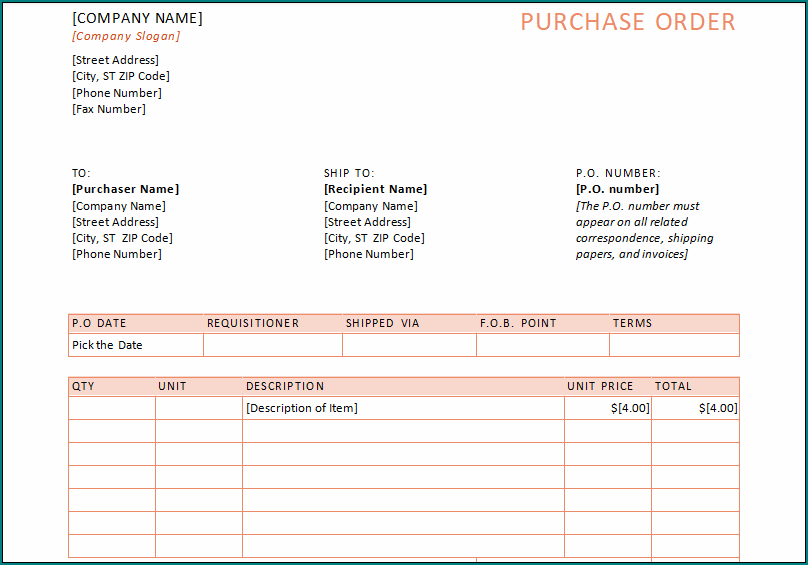

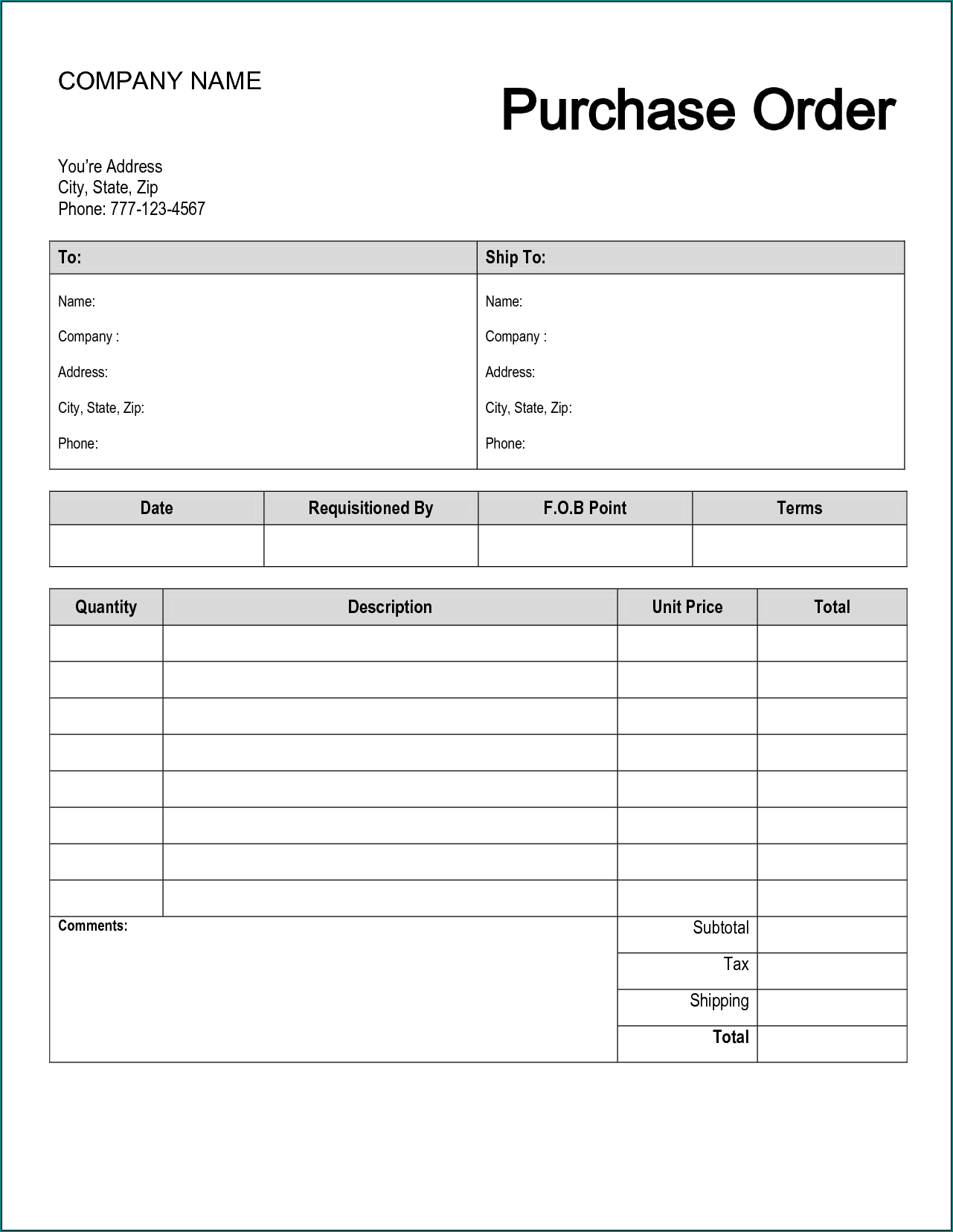

Samples of Purchase Order Form :

Keep a decent connection with your merchants, and don’t be reluctant to arrange. In case you’re a continuous client and purchase a great deal of provisions in mass, you may meet all requirements for exceptional valuing or different impetuses.

Utilizing purchase orders to develop your business isn’t as hard as you might suspect, and it makes the ways for some different chances, for example, a minute ago orders or agreements from your own clients. A purchase order can loan you the limit with regards to fast, and powerful development, less the ordinary developing agonies numerous private ventures insight in the midst of thriving.

Purchase Order Form | Word download