A Profit and Loss (P&L) statement helps a manager get a transparent measurement of a company’s sales and expenses over a period of your time . The P&L statement helps managers get a sensible view of finances, showing the totals of all to revenue sources. On the P&L template, you’ll subtract all expenses associated with the company’s income, supplying you with a transparent overview of the financial progress you’ve remodeled the amount of your time . Small businesses tend to use a P&L statement monthly , but larger companies may only do the maths quarterly for purposes of reporting back to stakeholders, like your board of directors, stockholders, or other investors.

A profit and loss statement is one among the main financial documents t hat is ready by business owners or their accountants. Business owners and accountants use it alike. this is often important because it can very clearly show the financial success of your business over a period of your time – and it also can show where you’re arising short. for instance , many online retailers consider the Xmas season to be the foremost important time of year for his or her trade, and keeping an earnings report for this point period can help them check their own profits against the present trends in their industry. However, for much of the remainder of the year, retailers tend to try to to much less business overall. Some months, a retailer will find that they’re barely breaking even. However, if you include a whole quarter’s worth of sales, expenses, and profits, you’ll find that overall, your business is excelling.

A Profit and Loss Statement is additionally sometimes called an “income statement” or “earnings statement.” The template and categories included within the template are going to be relatively an equivalent as a P&L statement.

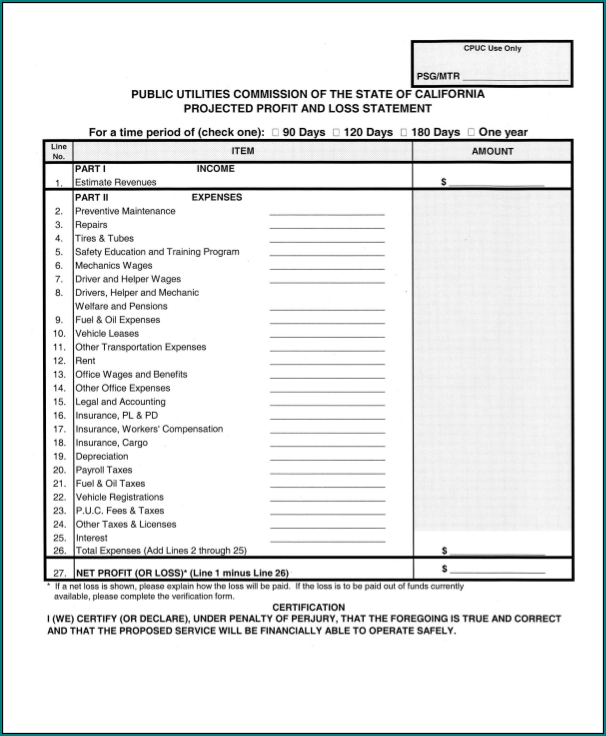

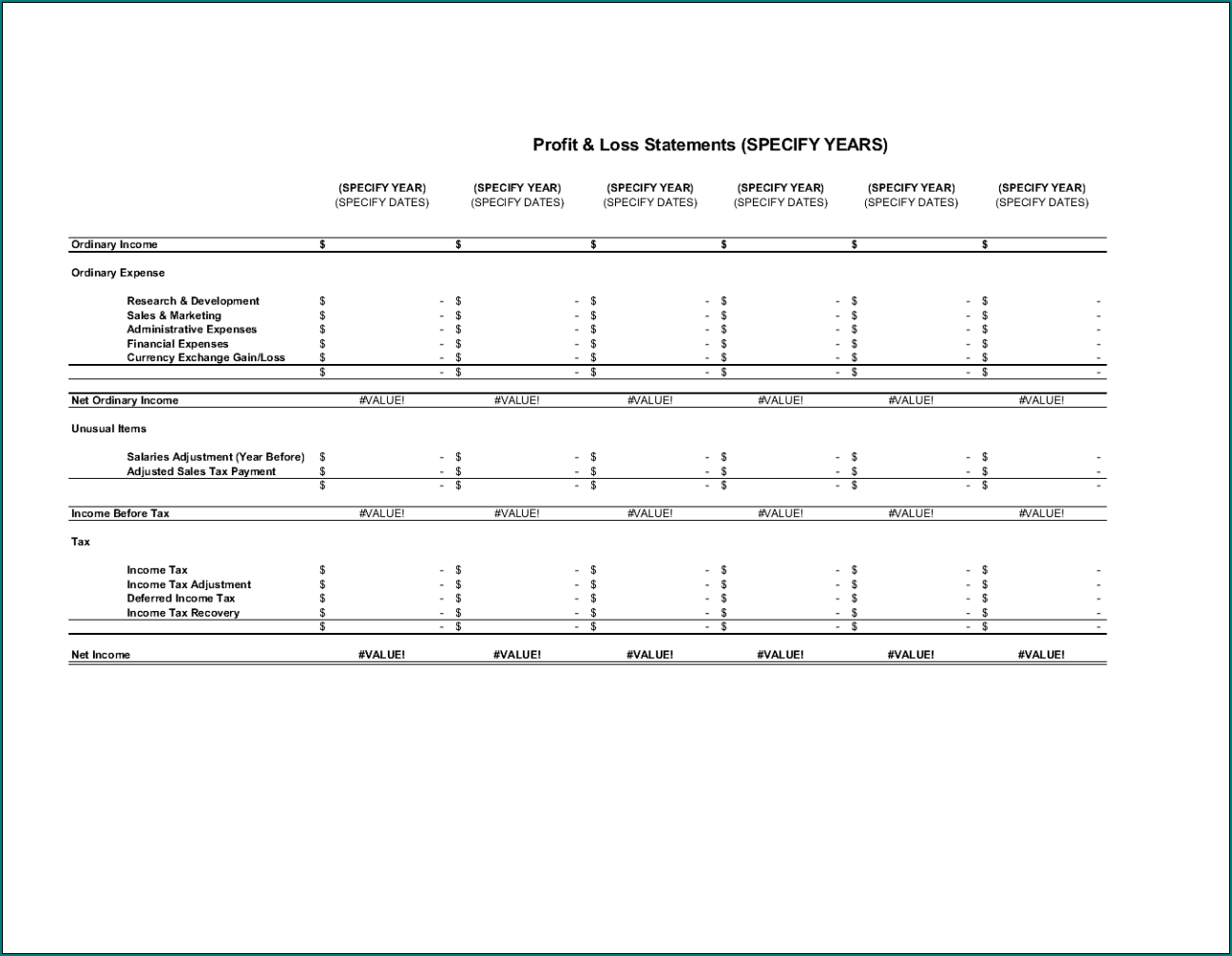

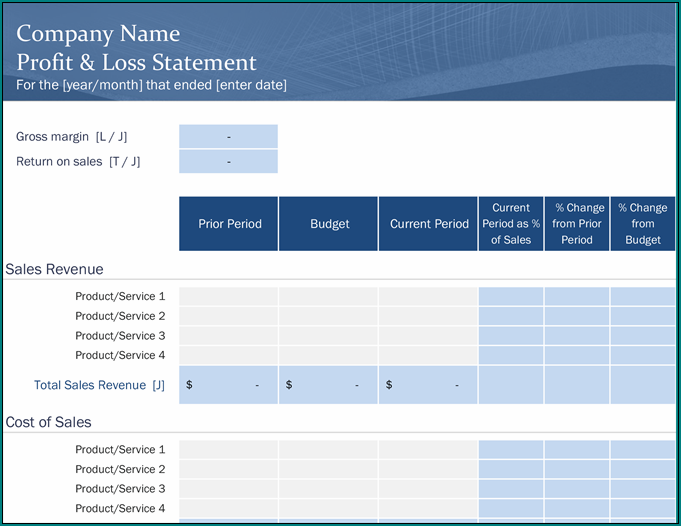

The P&L statement contains different categories of sales and expenses, including:

Net sales

Cost of products sold

Gross margin

Selling and administrative expenses/operating expenses

Net profit

The Profit and Loss statement template will offer you , as a manager or business owner, a pity your income and regular expenses.

There are multiple reasons to organize a Profit and Loss statement template. One reason is that the simple accounting of the P&L statement answers the question, “Am I making any money?” All of your credits and debits are laid out accordingly within the statement, allowing you to seem at regular expenses and your return on investment when it involves advertising and marketing. In other words, as a business owner or manager, it’s a valuable tool to watch operations. Most of the time, you’ll prepare the P&L statement on a quarterly or monthly basis.

A monthly check out your P&L statement can assist you discover what, if any, adjustments could be necessary to recoup losses or decrease expenses. for instance , maybe your business is paying an excessive amount of in interest on its line of credit or credit cards. Are there some purchases which will prevent money by purchasing directly from your cash flow? you’ll also find that you’re ordering certain supplies from companies on a weekly basis. wouldn’t it serve you better to shop for these supplies in bulk on a monthly basis, instead? Where will your company get the b est. discount? Are there other vendors that provide similar supplies and better deals if you purchase in bulk?

In addition to supplying you with an honest view of your operational expenses, the profit and loss statement template also can help outsiders – like potential investors or creditors — to guage your ability to manage and use your company’s resources.

Another vital reason, if you’re within the us , to organize a Profit and Loss statement is because it’s a requirement for paying your business taxes. The P&L Statement may be a record of companies operations and it’s wont to assess that taxes on profits earned. In fact, if you’re located within the US, it’s actually the sole budget required by the IRS. Other countries will still need the foremost important numbers from your statement, including income , profit and loss.

What sorts of Profit and Loss Statement Templates Are There?

P&L statements are often prepared using two methods, the Multi Step earnings report and Single Step earnings report . Multi Step income statements, because the name suggests, are more complicated and detailed than Single Step statements, and are typically employed by large businesses. Single Step P&L Statements are best employed by beginners and little businesses, so that’s what we’ll explain on this website.

Samples of Profit And Loss Statement Excel :

An inaccurate P&L statement can cause some horrible decisions to be made and may even be an entire waste of your time for you. confirm the info you set into the template is accurate and complete. You don’t want to feature in additional losses after-the-fact – it causes you to look, at best, disorganized. At worse, it can cause you to appear incompetent.

Using digital records like receipts, account statements and other bills will assist you confirm your information is accurate.

Make sure you furthermore may place the numbers within the correct category. for instance , office supplies belong within the “operating expense” section, not the “cost of products sold” section. Accuracy is an important a part of good business practices. Take your statement out and compare it to prior statements, also because the paperwork you created it from. If something looks wrong, or drastically different than the last time you probably did it, confirm to double-check all of your headings and numbers.

Profit And Loss Statement Excel | download