Payment plan agreements are a common way for individuals and businesses to manage their finances. These agreements outline the terms of payment for goods or services over a specified period of time, allowing the payer to spread out the cost rather than making a single lump sum payment. In today’s economy, payment plans have become increasingly popular as they offer flexibility and convenience to both parties involved. Whether you are a consumer looking to purchase a big-ticket item or a business seeking to offer payment options to your clients, understanding how payment plan agreements work is essential.

What is a Payment Plan Agreement?

A payment plan agreement is a contract between a buyer and a seller that outlines the terms of payment for a purchase. This agreement specifies the total amount due, the payment schedule, any interest or fees that may apply, and the consequences for late or missed payments. Payment plan agreements can vary in length, with some lasting just a few months and others spanning several years. These agreements are legally binding documents that protect both parties by clearly defining their financial obligations.

The Purpose of Payment Plan Agreements

Image Source: website-files.com

The primary purpose of a payment plan agreement is to provide a structured way for individuals and businesses to make purchases or receive services without having to pay the full amount upfront. By breaking the total cost into smaller, more manageable payments, payment plan agreements make it easier for people to budget and afford the items they need. For businesses, offering payment plans can attract more customers and increase sales by making products or services more accessible to a wider range of clients. Additionally, payment plan agreements help establish trust between buyers and sellers by setting clear expectations and ensuring that both parties fulfill their obligations.

Why Use Payment Plan Agreements?

There are several reasons why payment plan agreements are beneficial for both buyers and sellers. For buyers, payment plans offer the following advantages:

– Ability to make large purchases without depleting savings

– Flexibility to spread out payments over time

– Opportunity to improve credit score through timely payments

– Access to desired products or services without immediate financial strain

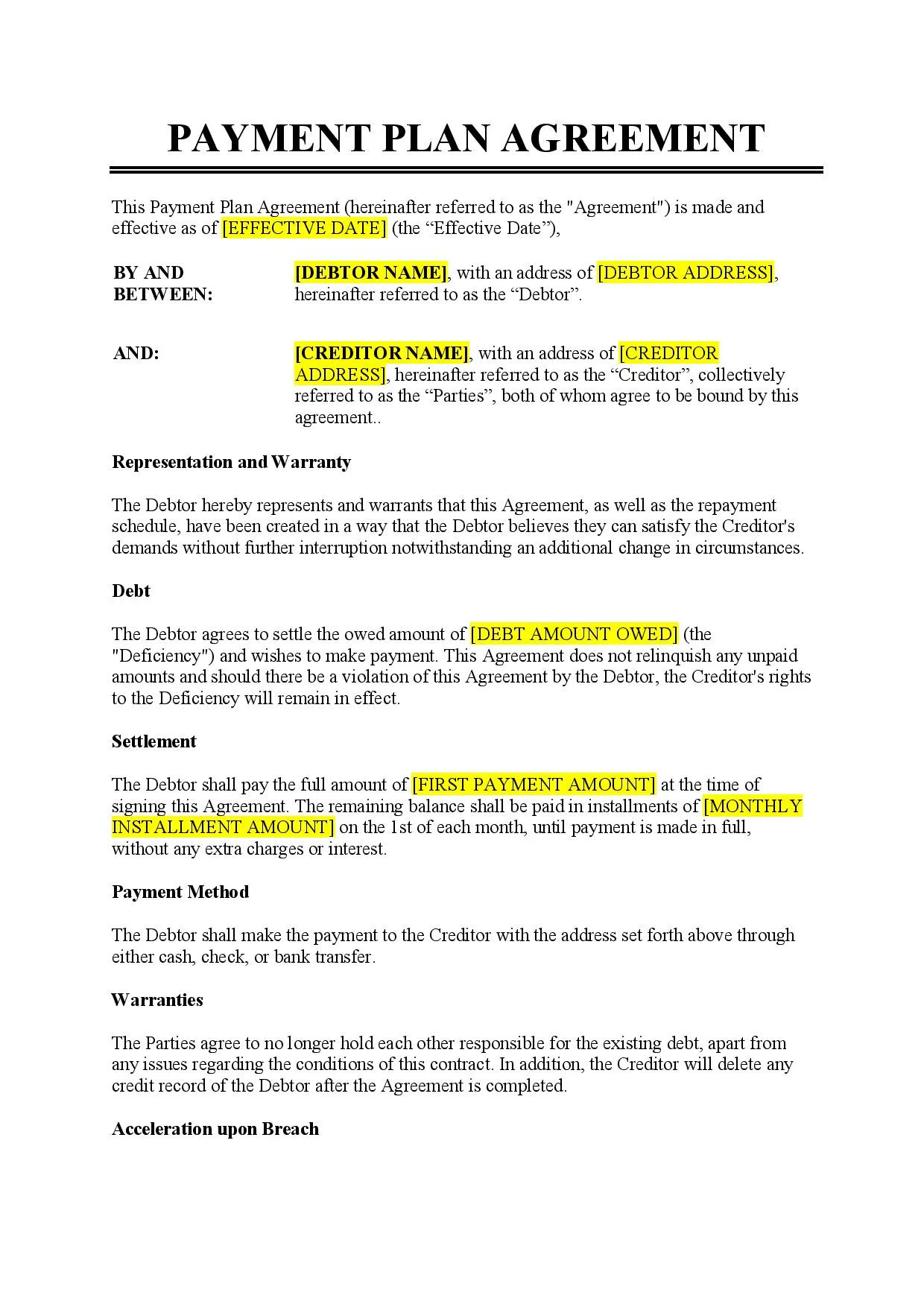

Image Source: easylegaldocs.com

For sellers, payment plans provide the following benefits:

– Increased sales by attracting more customers

– Competitive advantage in the market

– Predictable cash flow from regular payments

– Stronger customer relationships built on trust and convenience

How to Create a Payment Plan Agreement

Creating a payment plan agreement involves several key steps to ensure that all terms are clearly defined and agreed upon by both parties. Here are some tips for successfully drafting a payment plan agreement:

1. Outline the Total Amount Due

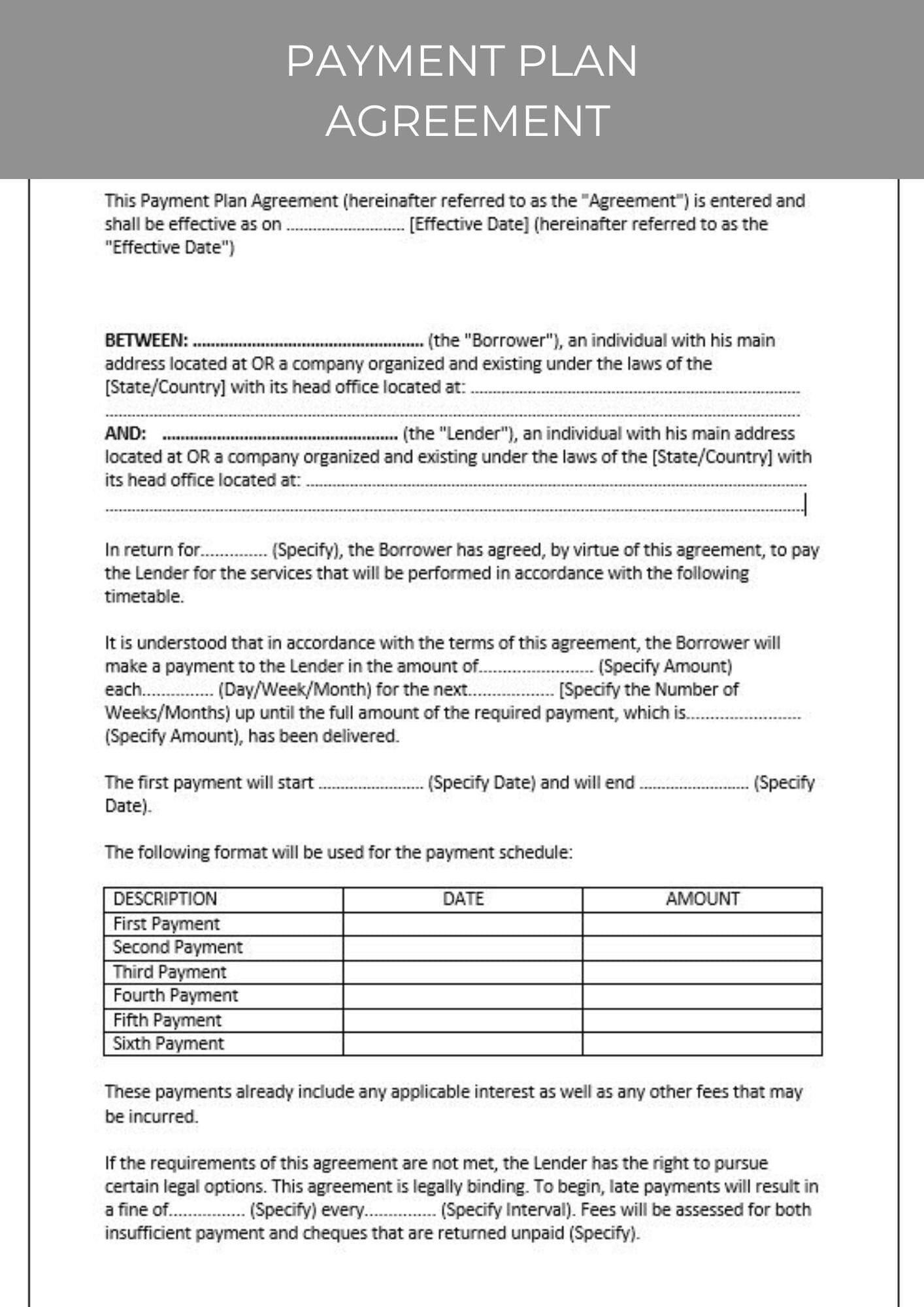

Image Source: etsystatic.com

Clearly specify the total amount owed by the buyer, including any taxes or fees that may apply. Break down the cost of the purchase and calculate the monthly payment based on the agreed-upon payment schedule.

2. Define the Payment Schedule

Detail the frequency and amount of each payment, whether it be weekly, bi-weekly, or monthly. Include the due dates for each payment to avoid confusion and late payments.

3. Include Interest or Fees (if applicable)

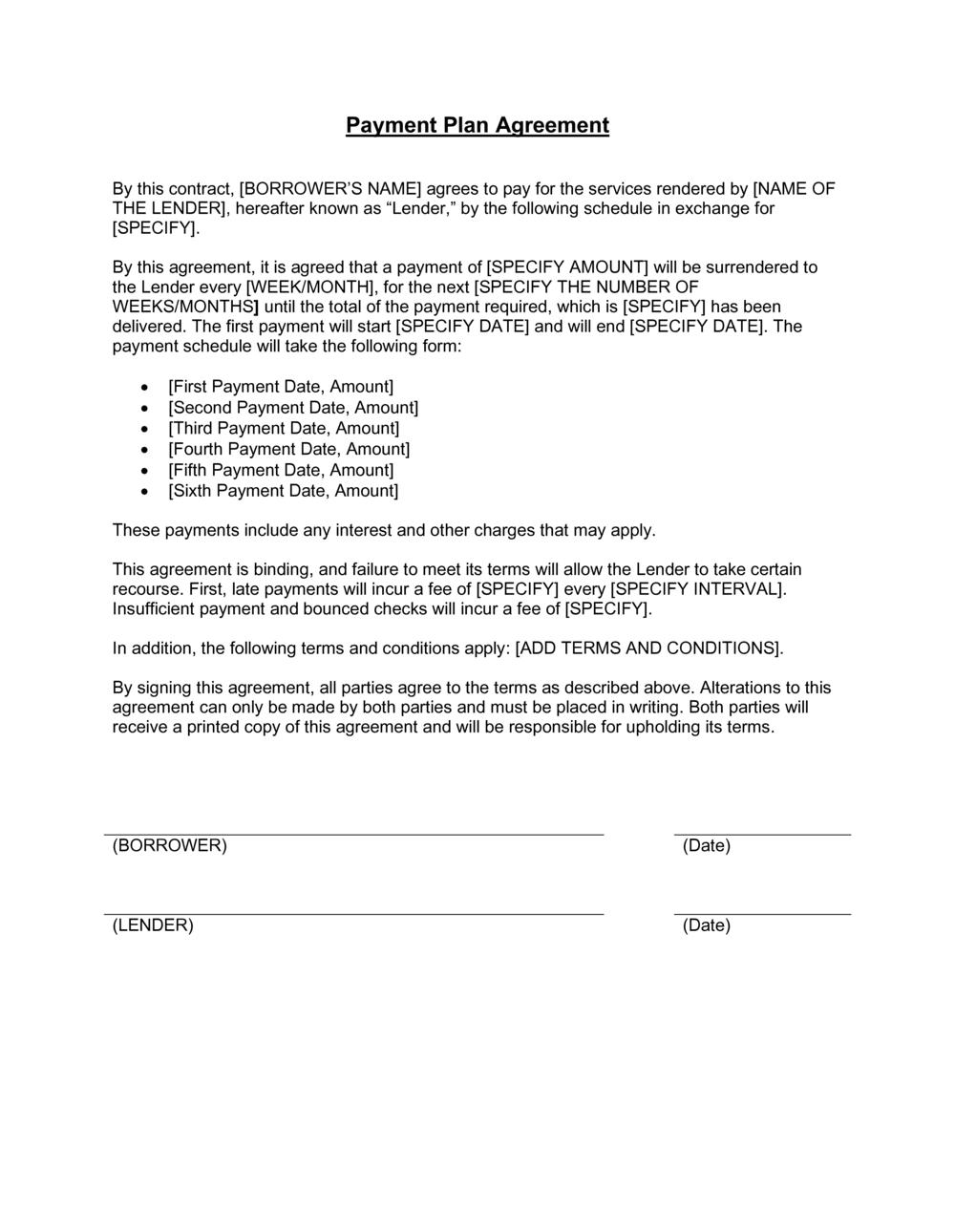

Image Source: signaturely.com

If there is any interest or fees associated with the payment plan, disclose this information in the agreement. Clearly state the rate of interest and when it will be applied to the outstanding balance.

4. Specify Consequences for Late Payments

Outline the consequences for late or missed payments, such as late fees or penalties. Clearly communicate the repercussions of failing to adhere to the payment schedule.

5. Include Terms for Early Repayment

Image Source: business-in-a-box.com

If the buyer wishes to pay off the balance early, include terms for early repayment in the agreement. Specify whether there are any penalties or fees for paying off the balance ahead of schedule.

6. Sign and Date the Agreement

Both parties should sign and date the payment plan agreement to indicate their acceptance of the terms. Keep a copy of the signed agreement for record-keeping purposes.

7. Communicate Regularly

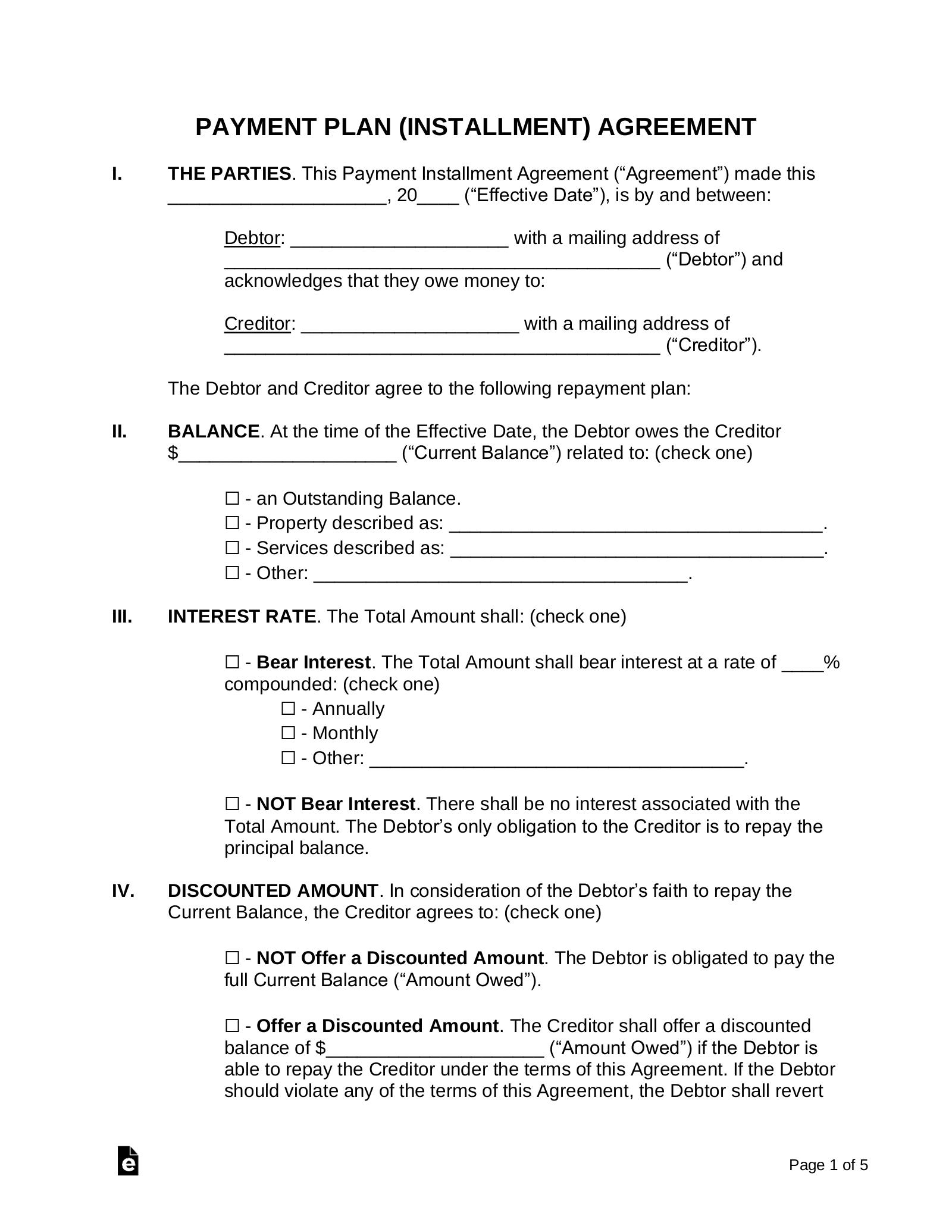

Image Source: eforms.com

Maintain open communication with the buyer throughout the payment plan period. Send reminders about upcoming payments and address any questions or concerns promptly.

8. Monitor Payments and Adjust if Necessary

Regularly monitor payments to ensure that the buyer is fulfilling their obligations. If there are any issues or changes in circumstances, be prepared to adjust the payment plan agreement accordingly.

Tips for Successful Payment Plan Agreements

When entering into a payment plan agreement, consider the following tips to ensure a successful outcome for both parties:

Be Transparent: Clearly communicate all terms and conditions of the agreement upfront to avoid misunderstandings.

Set Realistic Payment Terms: Establish a payment schedule that is manageable for the buyer based on their financial situation.

Provide Flexibility: Be open to negotiating terms and adjusting the agreement if needed to accommodate changes in circumstances.

Keep Records: Maintain detailed records of payments, correspondence, and any modifications to the agreement for reference.

Seek Legal Advice if Necessary: If you are unsure about any aspect of the payment plan agreement, consult with a legal professional to ensure compliance with relevant laws and regulations.

Build Trust: Foster a positive relationship with the buyer by demonstrating reliability, professionalism, and a willingness to work together towards a mutually beneficial outcome.

In conclusion

Payment plan agreements are a valuable tool for managing financial transactions and promoting trust between buyers and sellers. By understanding the purpose of payment plan agreements, following best practices for creating and implementing them, and incorporating tips for success, both parties can benefit from a positive and successful payment arrangement. Whether you are a consumer looking to make a purchase or a business seeking to offer payment options, payment plan agreements can help you achieve your financial goals effectively.