One of the key elements of financial stability is having a well-planned budget in place. A household yearly budget template can be a valuable tool in helping you manage your finances effectively. By tracking your income and expenses throughout the year, you can gain a clear understanding of where your money is going and make informed decisions about your spending habits. In this article, we will explore the importance of using a household yearly budget template, the purpose it serves, why it is essential for financial success, how to create one, and provide tips for successful budgeting.

What is a Household Yearly Budget Template?

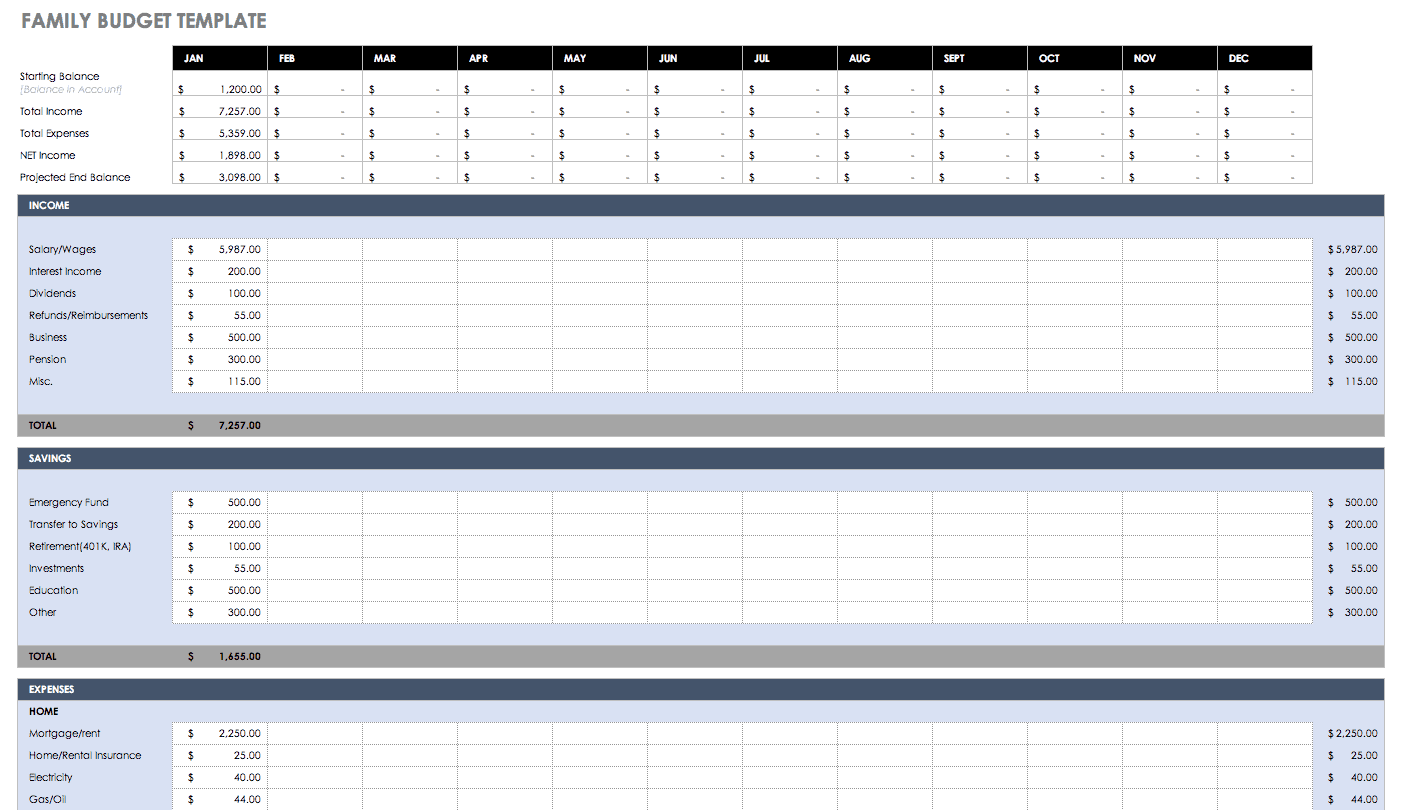

A household yearly budget template is a document that outlines your projected income and expenses for the upcoming year. It typically includes categories such as housing costs, transportation, groceries, utilities, entertainment, savings, and debt payments. By detailing these expenses in advance, you can create a plan for how you will allocate your money throughout the year.

The Purpose of a Household Yearly Budget Template

Image Source: etsystatic.com

The primary purpose of a household yearly budget template is to help you track your finances and ensure that you are living within your means. By setting financial goals and monitoring your progress throughout the year, you can make adjustments as needed to stay on track. Additionally, a budget template can help you identify areas where you may be overspending and find opportunities to save money.

Why You Need a Household Yearly Budget Template

Having a household yearly budget template is essential for achieving financial success. Without a clear plan in place, it can be easy to overspend, accumulate debt, and struggle to meet your financial goals. By using a budget template, you can take control of your finances, reduce stress, and work towards building a secure financial future for yourself and your family.

How to Create a Household Yearly Budget Template

Image Source: smartsheet.com

Creating a household yearly budget template is a straightforward process that involves gathering information about your income and expenses, setting financial goals, and allocating funds accordingly. Start by listing all sources of income, including your salary, bonuses, and any additional income streams. Next, detail your monthly expenses, such as rent or mortgage payments, utilities, groceries, and transportation costs. Finally, allocate a portion of your income towards savings, debt repayment, and other financial goals.

1. Gather Information

To create a household yearly budget template, gather all relevant financial documents, such as pay stubs, bank statements, and bills.

2. Set Financial Goals

Image Source: i0.wp.com

Determine your short-term and long-term financial goals, such as saving for a vacation, paying off debt, or building an emergency fund.

3. Allocate Funds

Divide your income into categories based on your expenses and financial goals, ensuring that you have a plan for every dollar you earn.

4. Monitor Your Progress

Image Source: pinimg.com

Regularly track your spending and compare it to your budget to identify areas where you may need to make adjustments.

5. Make Adjustments

If you find that you are consistently overspending in certain categories, consider reallocating funds or finding ways to cut expenses.

6. Stay Flexible

Image Source: etsystatic.com

Life circumstances can change, so be prepared to adjust your budget as needed to accommodate unexpected expenses or changes in income.

7. Seek Professional Help

If you are struggling to create or stick to a budget, consider seeking help from a financial advisor or counselor who can provide guidance and support.

8. Celebrate Your Successes

Image Source: wpscdn.com

Recognize and celebrate your financial achievements, whether big or small, to stay motivated and on track with your budgeting goals.

Tips for Successful Budgeting

Creating and sticking to a household yearly budget template can be challenging, but with the right strategies in place, you can set yourself up for financial success. Here are some tips to help you make the most of your budgeting efforts:

Image Source: dollarsplussense.com

Track Your Spending. Keep a detailed record of your expenses to identify where your money is going.

Review Your Budget Regularly. Check in on your budget monthly or quarterly to ensure you are staying on track.

Be Realistic. Set achievable financial goals and budget amounts to avoid feeling discouraged.

Use Tools and Resources. Take advantage of budgeting apps, spreadsheets, and online resources to help streamline the process.

Communicate with Your Family. If you share finances with a partner or family members, discuss your budgeting goals and work together to achieve them.

Stay Motivated. Keep your financial goals in mind and stay focused on the benefits of budgeting, such as financial security and peace of mind.

Image Source: smartsheet.com