Are you in the process of buying a new home? One crucial document you’ll encounter during this process is the home purchase agreement. This legally binding contract outlines the terms and conditions of the sale, ensuring that both the buyer and seller are on the same page regarding the transaction. Understanding the home purchase agreement is essential to protect your interests and ensure a smooth home buying process.

What is a Home Purchase Agreement?

A home purchase agreement, also known as a purchase agreement or sales contract, is a document that outlines the specifics of a real estate transaction between a buyer and a seller. This contract includes details such as the purchase price, earnest money deposit, closing date, contingencies, and any other terms agreed upon by both parties. Once both the buyer and seller have signed the agreement, it becomes a legally binding contract.

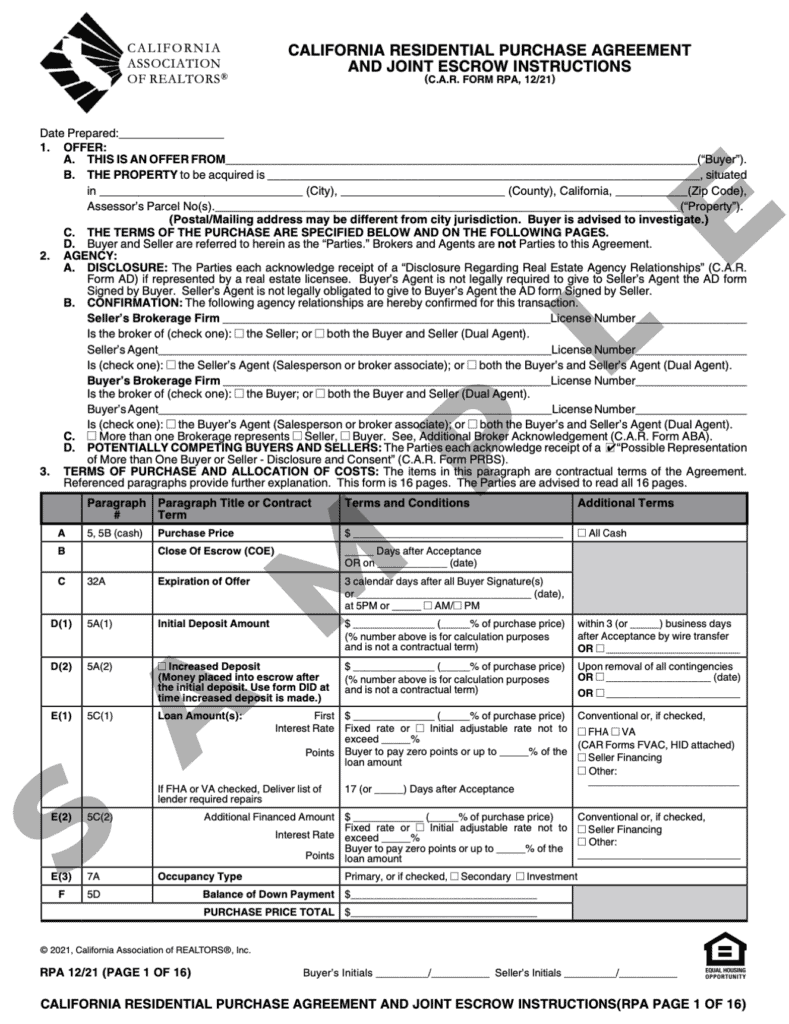

The Purpose of a Home Purchase Agreement

Image Source: cloudinary.com

The primary purpose of a home purchase agreement is to clearly outline the terms and conditions of the sale to prevent any misunderstandings or disputes between the buyer and seller. This document serves as a roadmap for the transaction, providing a framework for the entire home buying process. Additionally, the home purchase agreement offers legal protection to both parties and ensures that their rights and obligations are clearly defined.

Why Do You Need a Home Purchase Agreement?

Having a home purchase agreement in place is crucial for several reasons. Firstly, it helps protect both the buyer and seller by clearly stating the terms of the sale. This document can help prevent misunderstandings or disagreements that may arise during the home buying process. Additionally, a home purchase agreement provides legal recourse in case either party fails to fulfill their obligations as outlined in the contract.

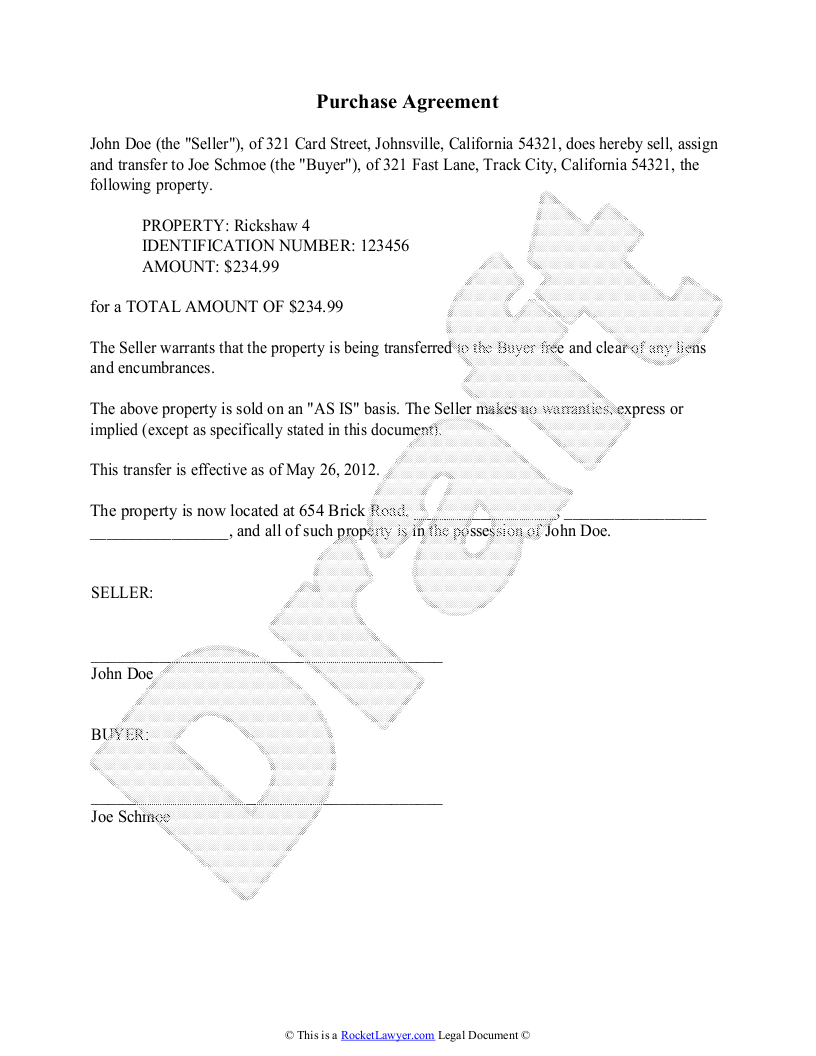

How to Draft a Home Purchase Agreement

Image Source: rocketlawyer.com

Drafting a home purchase agreement can be a complex process, as it requires attention to detail and a thorough understanding of real estate laws and regulations. If you’re not familiar with legal jargon or real estate terminology, it’s best to seek the help of a real estate agent or attorney to ensure that the agreement is drafted correctly. Here are some key steps to follow when drafting a home purchase agreement:

1. Include the Basic Information

When drafting a home purchase agreement, be sure to include basic information such as the names of the buyer and seller, the property address, and the purchase price. This information is essential to identify the parties involved in the transaction and the property being sold.

2. Outline the Terms and Conditions

Image Source: typecalendar.com

Clearly outline the terms and conditions of the sale, including any contingencies, financing details, and the closing date. Be specific about what is included in the sale, such as appliances or fixtures, to avoid any confusion later on.

3. Include Contingencies

Contingencies are conditions that must be met for the sale to proceed. Common contingencies include obtaining financing, a satisfactory home inspection, and the sale of the buyer’s current home. Make sure to include any necessary contingencies in the agreement to protect both parties.

4. Specify the Earnest Money Deposit

Image Source: investopedia.com

The earnest money deposit is a sum of money provided by the buyer to show their commitment to the purchase. Specify the amount of the earnest money deposit in the agreement, as well as the conditions under which it may be forfeited.

5. Disclose any Disclosures

As a seller, you are required to disclose any known defects or issues with the property. Be sure to include all necessary disclosures in the agreement to protect yourself from potential legal issues down the line.

6. Include a Timeline for the Transaction

Image Source: pdffiller.com

Set a timeline for the transaction, including key dates such as the inspection period, mortgage approval deadline, and closing date. Having a clear timeline can help ensure that the transaction proceeds smoothly and efficiently.

7. Review and Revise the Agreement

Before finalizing the home purchase agreement, be sure to review it carefully and make any necessary revisions. It’s essential to ensure that all terms and conditions are accurately reflected in the contract before both parties sign it.

8. Seek Legal Advice

Image Source: etsystatic.com

If you’re unsure about any aspect of the home purchase agreement, don’t hesitate to seek legal advice from a real estate attorney. An attorney can review the agreement and provide guidance to help protect your interests throughout the home buying process.

Tips for a Successful Home Purchase Agreement

Communicate Clearly: Ensure that all terms and conditions are clearly communicated and understood by both parties.

Get Everything in Writing: Document all agreements and negotiations in writing to avoid any misunderstandings.

Work with Professionals: Consider working with a real estate agent or attorney to help draft and review the home purchase agreement.

Review the Agreement Carefully: Take the time to review the agreement carefully before signing to ensure that all terms are accurate and acceptable.

Stay Organized: Keep all documents related to the home purchase agreement organized and easily accessible throughout the transaction.

Be Prepared for Negotiations: Be prepared to negotiate terms and conditions with the other party to reach a mutually agreeable agreement.

Image Source: etsystatic.com

In Conclusion

Understanding the importance of the home purchase agreement is crucial for a successful home buying process. By drafting a comprehensive and legally sound agreement, you can protect your interests and ensure a smooth and efficient transaction. Be sure to follow the tips outlined in this article and seek professional guidance when needed to navigate the complexities of the home purchase agreement with confidence.

Image Source: freeforms.com

Image Source: eforms.com