It’s not fun, glamorous, or maybe enjoyable. Yet creating a budget may be a necessary a part of adulthood, and is actually the primary step towards financial stability. Having a working budget in situ will assist you identify exactly where you stand together with your finances. Here are some tips to making a practical monthly budget to assist you retain your finances in restraint .

Know Your Income

The first thing you will need to urge a grasp of is what proportion money you’re actually bringing in monthly . This number isn’t just your annual salary divided by 12 months. You’ll even have to deduct factors like tax , pension account contributions, and other things that might be docked from your pay. Not including these deductions will cause you to possess an inflated idea of what your take-home income is, which can put you within the red.

Document Your Expenses, Both Fixed and Variable

Your fixed expenses would come with things like your mortgage, car payments, student loans, then forth. These expenses remain relatively constant month after month. Variable expenses, on the opposite hand, are people who either only crop up every few months, or fluctuate in cost month to month. These may include land tax payments, entertainment, groceries, and so on.

Focus on Your Savings

It’s a good idea to place some money aside monthly – regardless of how little – towards your bank account . Financial experts typically recommend setting about 10 percent of your post-tax income aside for your savings, although the more you’ll put away the higher . you would possibly prefer to have some of your money transferred out of your bank account and into your bank account automatically monthly so you do not have the excuse of ‘forgetting’ to place that portion aside.

Keeping a monthly budget can assist you keep tabs on your finances

Analyze Your Spending Habits – Keep all of your Receipts

Retaining all of your receipts for all of your expenditures will assist you determine what proportion you’re actually spending monthly . After two or three months of adding these totals up, you will have an honest idea of the typical amount of cash that’s going towards expenses, and determine whether you would like to chop back on spending or not.

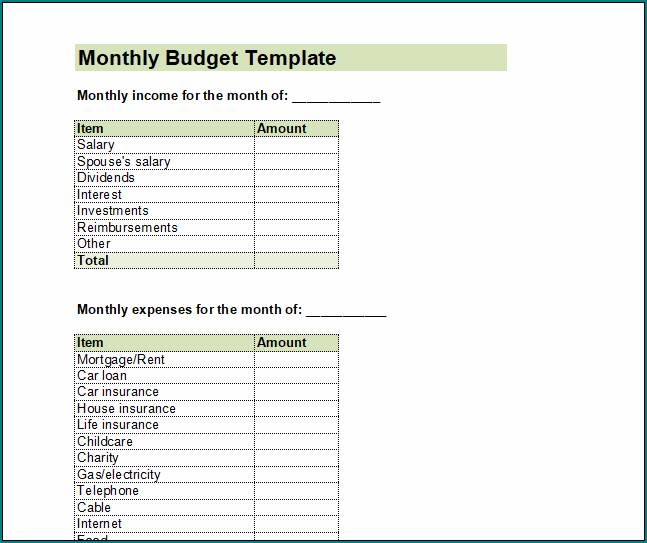

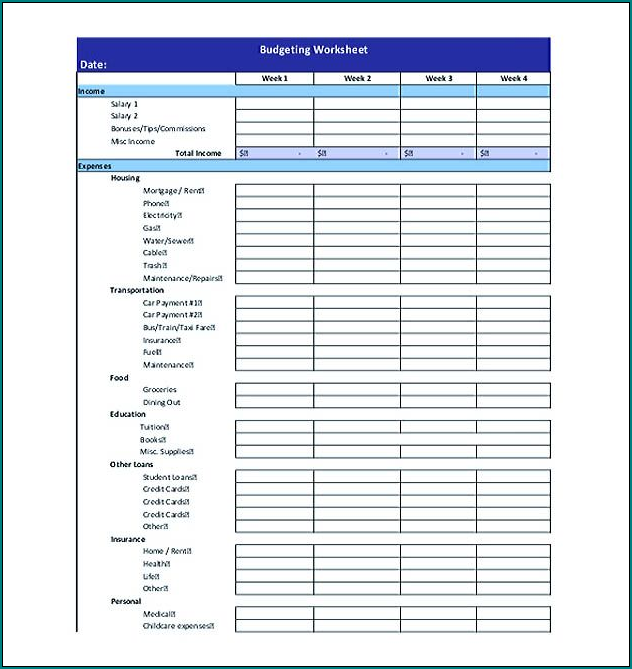

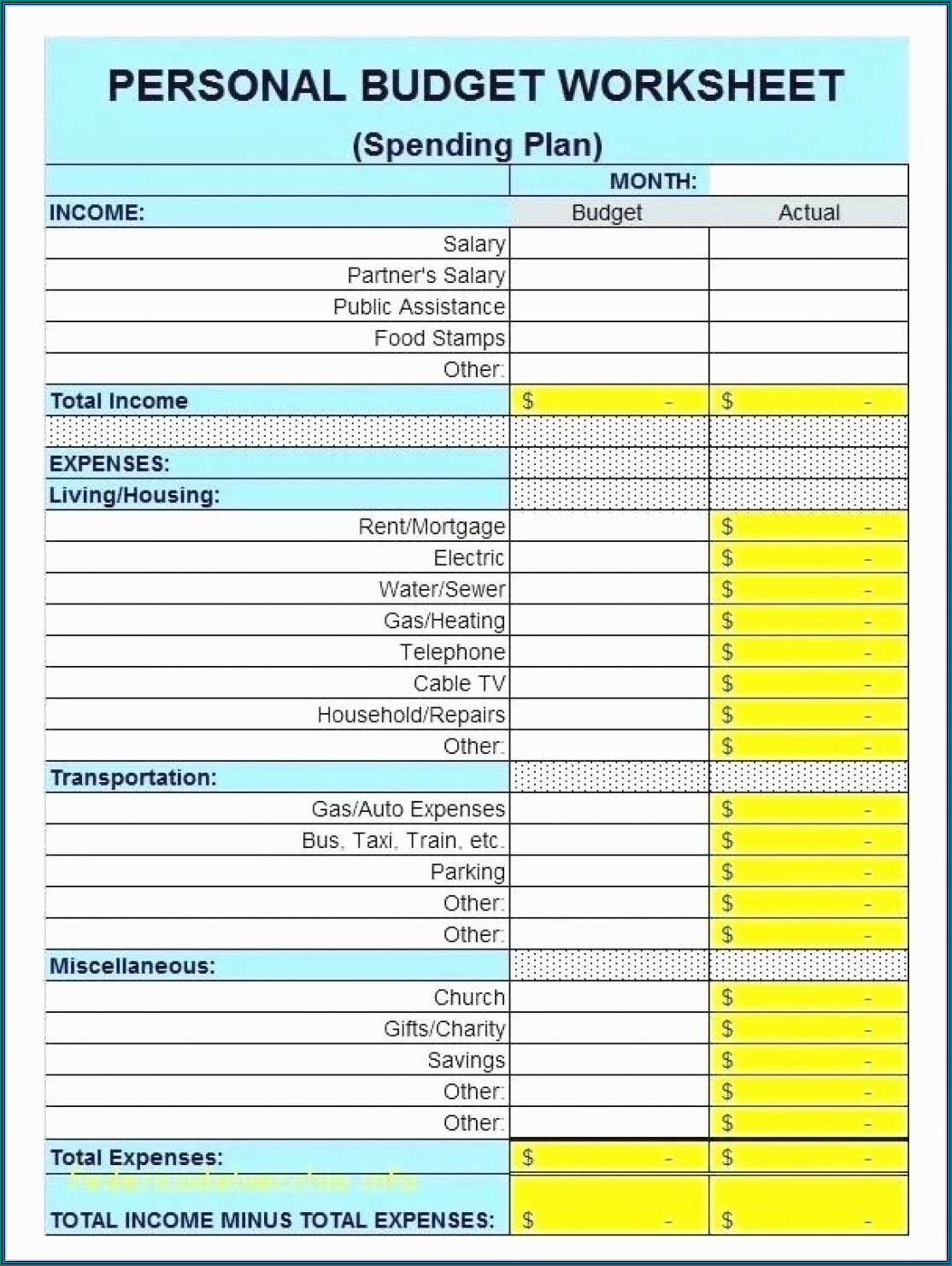

Samples of Financial Budget Template :

Set Goals, Both Short- and Long-Term

Setting specific goals can assist you pay off any outstanding debt that you simply may have, which may eventually release your finances at some point down the road . Short-term goals can include things like paying down credit cards, while long-term goals may include paying off your mortgage.

Financial Budget Template | Excel download