Exactly what is a Financial debt Schedule?

A personal debt schedule lays out all the credit card debt a company has inside of a schedule primarily based on its maturity, It is ordinarily utilised by corporations to construct a funds stream analysis. As demonstrated within the graphic under, curiosity expenditure in the personal debt timetable flows to the money statement, the closing credit card debt equilibrium flows on to the stability sheet, and principal repayments move through the hard cash move statement (funding schedules).

Components to consider within the Construction of the Credit card debt Timetable

Before committing to borrow revenue, a business demands to very carefully contemplate its capacity to repay financial debt as well as real price tag with the credit card debt. Here is a listing with the aspects a business needs to take into consideration: –

Credit card debt maturity – Most credit card debt is amortized and paid regular monthly. The for a longer time the maturity in the debt, the decrease the amount due every month, however the higher the total sum in the debt and fascination accrued.

Interest charge – The reduced the desire charge, the better, although not normally. A minimal desire rate for just a long-term financial debt ordinarily ends in better full desire because of than short-term credit card debt which has a high interest price.

Floating or preset desire – A floating desire price will transform the general credit card debt amount of money every single calendar year, whilst a hard and fast fascination level offers dependability inside the calculation. Dependant upon the future assumptions, a floating fascination rate would be the better choice inside a reduced or declining fascination price atmosphere.

Means to create get – No reason to take on new debt should the debtor can not make use of the cash to produce a gentle stream of earnings to pay the financial debt off. Failure to pay a credit card debt could result in a drop in credit score or simply forced liquidation.

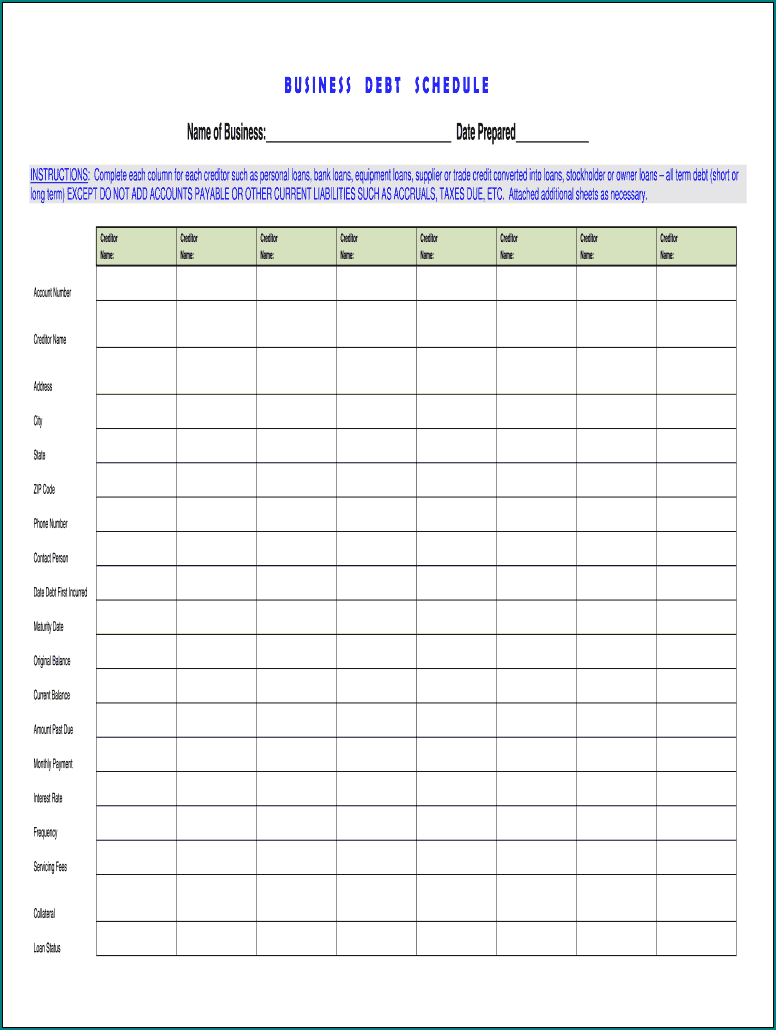

Samples of Debt Schedule Template :

Why is actually a Debt schedule Essential?

The power to estimate the full sum a corporation needs to pay as soon as a debt matures is the primary reason a financial debt timetable is built. Another excuse for using a personal debt schedule consists of the company’s capability to observe the maturity from the personal debt and make selections dependent on it, like the possibility of refinancing the credit card debt through a special institution/ supply when the desire level declines.

Debt Schedule Template | Excel download