Construction Loan Budget Template: A Comprehensive Guide for Successful Project Planning

Embarking on a construction project can be an exciting yet daunting task. From securing financing to selecting contractors and managing timelines, there are numerous factors to consider. One crucial aspect of project planning is creating a detailed budget to ensure that costs are monitored and controlled throughout the construction process. A construction loan budget template can be a valuable tool in this regard, providing a structured framework for estimating expenses, tracking expenditures, and staying on track with financial goals.

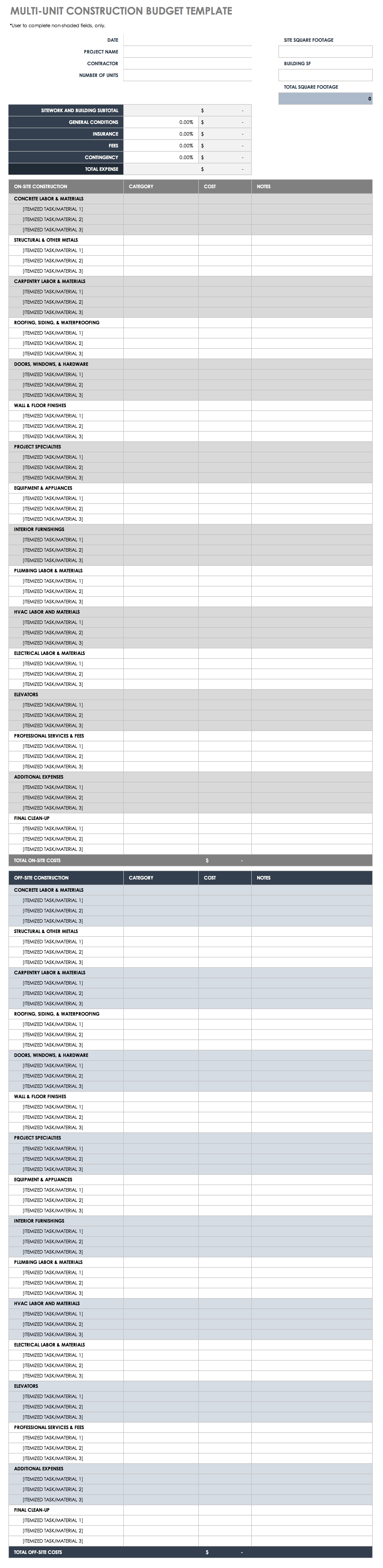

What is a Construction Loan Budget Template?

Image Source: smartsheet.com

A construction loan budget template is a pre-designed spreadsheet or document that outlines the estimated costs associated with a construction project. It typically includes categories such as materials, labor, permits, equipment rental, subcontractors, and contingencies. The template serves as a roadmap for managing expenses, allocating funds, and ensuring that the project stays within budget constraints. By inputting estimated and actual costs into the template, project managers and contractors can easily track progress, identify potential cost overruns, and make informed decisions to mitigate financial risks.

The Purpose of Using a Construction Loan Budget Template

The primary purpose of using a construction loan budget template is to establish a clear and realistic financial plan for the construction project. By breaking down costs into specific categories and line items, the template helps project stakeholders understand where money will be allocated and how expenses will be managed. Additionally, the template serves as a communication tool, enabling project managers to share budget information with lenders, investors, clients, and other stakeholders. By creating a structured budget framework, project teams can ensure that resources are utilized efficiently, risks are minimized, and financial objectives are met.

Why You Should Use a Construction Loan Budget Template

Image Source: website-files.com

Using a construction loan budget template offers several benefits for project planning and management. Firstly, the template provides a systematic approach to budgeting, allowing project teams to forecast costs, track expenses, and identify variances in real-time. This proactive approach helps prevent cost overruns, delays, and financial surprises during the construction process. Secondly, the template promotes transparency and accountability among project stakeholders by outlining financial responsibilities and expectations. By following a standardized budgeting process, project teams can foster trust, collaboration, and alignment towards common financial goals.

How to Create and Implement a Construction Loan Budget Template

Creating a construction loan budget template involves several key steps to ensure its effectiveness and usability. Start by defining the scope of the project and identifying all potential cost categories and line items. Consult with contractors, suppliers, and other relevant parties to gather accurate cost estimates for each item. Next, organize the budget template into a logical structure, with clear headings, subheadings, and formulas for calculating totals and variances. Input the estimated costs for each category, considering factors such as inflation, market trends, and unforeseen expenses. Regularly update the budget template with actual costs and compare them against the estimates to monitor progress and make adjustments as needed.

1. Define the scope of the project

Image Source: smartsheet.com

Before creating a construction loan budget template, it is essential to define the scope of the project, including the size, complexity, and timeline. By understanding the project requirements and objectives, project teams can accurately estimate costs and allocate resources accordingly.

2. Gather accurate cost estimates

To create a realistic budget, it is crucial to gather accurate cost estimates from reliable sources such as contractors, suppliers, and industry experts. Consider factors such as material prices, labor rates, permits, and equipment rental costs when estimating expenses.

3. Organize the budget template

Image Source: archdesk.com

Organize the construction loan budget template into a logical and user-friendly format, with categories, subcategories, and line items clearly defined. Use color-coding, numbering, and formatting techniques to make the template easy to read and navigate.

4. Input estimated costs

Input the estimated costs for each category and line item in the budget template, taking into account all relevant factors that may impact expenses. Be thorough and detailed in your estimations to ensure accuracy and completeness.

5. Update the budget template regularly

Image Source: levelset.com

To effectively monitor project costs and track progress, update the budget template regularly with actual expenses and compare them against the estimates. This will help project teams identify variances, make adjustments, and stay on track with financial goals.

6. Make adjustments as needed

As the construction project progresses, be prepared to make adjustments to the budget template based on changing circumstances, unforeseen expenses, and market fluctuations. By staying flexible and proactive, project teams can adapt to challenges and ensure financial sustainability.

7. Communicate budget updates

Image Source: smartsheet.com

Regularly communicate budget updates and variances to project stakeholders, including lenders, investors, clients, and contractors. Transparency and accountability are key to successful budget management, fostering trust and collaboration among all parties involved.

8. Review and evaluate the budget

After the construction project is completed, review and evaluate the budget template to assess its effectiveness, identify lessons learned, and make improvements for future projects. By reflecting on the budgeting process, project teams can enhance their financial management practices and achieve better outcomes in the long run.

Tips for Successful Construction Loan Budgeting

Image Source: smartsheet.com

Creating and managing a construction loan budget can be challenging, but with the right strategies and tools, it can also be rewarding. Here are some tips for successful budgeting:

Plan for contingencies: Include a contingency fund in your budget template to account for unexpected expenses and emergencies.

Track expenses diligently: Keep detailed records of all project expenses and update the budget template regularly to monitor progress.

Consult with experts: Seek advice from financial advisors, contractors, and industry professionals to ensure accuracy and reliability in your budget estimates.

Stay proactive: Anticipate potential cost overruns and take proactive measures to address them before they escalate into larger financial issues.

Communicate openly: Foster open communication and collaboration among project stakeholders to ensure everyone is aligned with budget goals and objectives.

Learn from experience: Reflect on past projects, analyze budget variances, and apply lessons learned to improve your budgeting practices for future projects.

Image Source: smartsheet.com

Conclusion

In conclusion, a construction loan budget template is a valuable tool for project planning, management, and financial control. By creating a detailed and structured budget framework, project teams can effectively estimate costs, track expenses, and make informed decisions to ensure the success of their construction projects. By following the guidelines and tips outlined in this article, project stakeholders can enhance their budgeting practices, foster transparency and accountability, and achieve better outcomes in their construction endeavors. Remember, successful budgeting is not just about numbers—it’s about creating a roadmap for success and building a solid foundation for your construction projects.

Image Source: smartsheet.com