Are you looking to manage your condo finances more effectively? One way to stay on top of your budget is by utilizing a condo budget template. This tool can help you keep track of your expenses, income, and savings in an organized manner. In this article, we will discuss the purpose of a condo budget template, why it is important, how to create one, and provide tips for successful budgeting.

What is a Condo Budget Template?

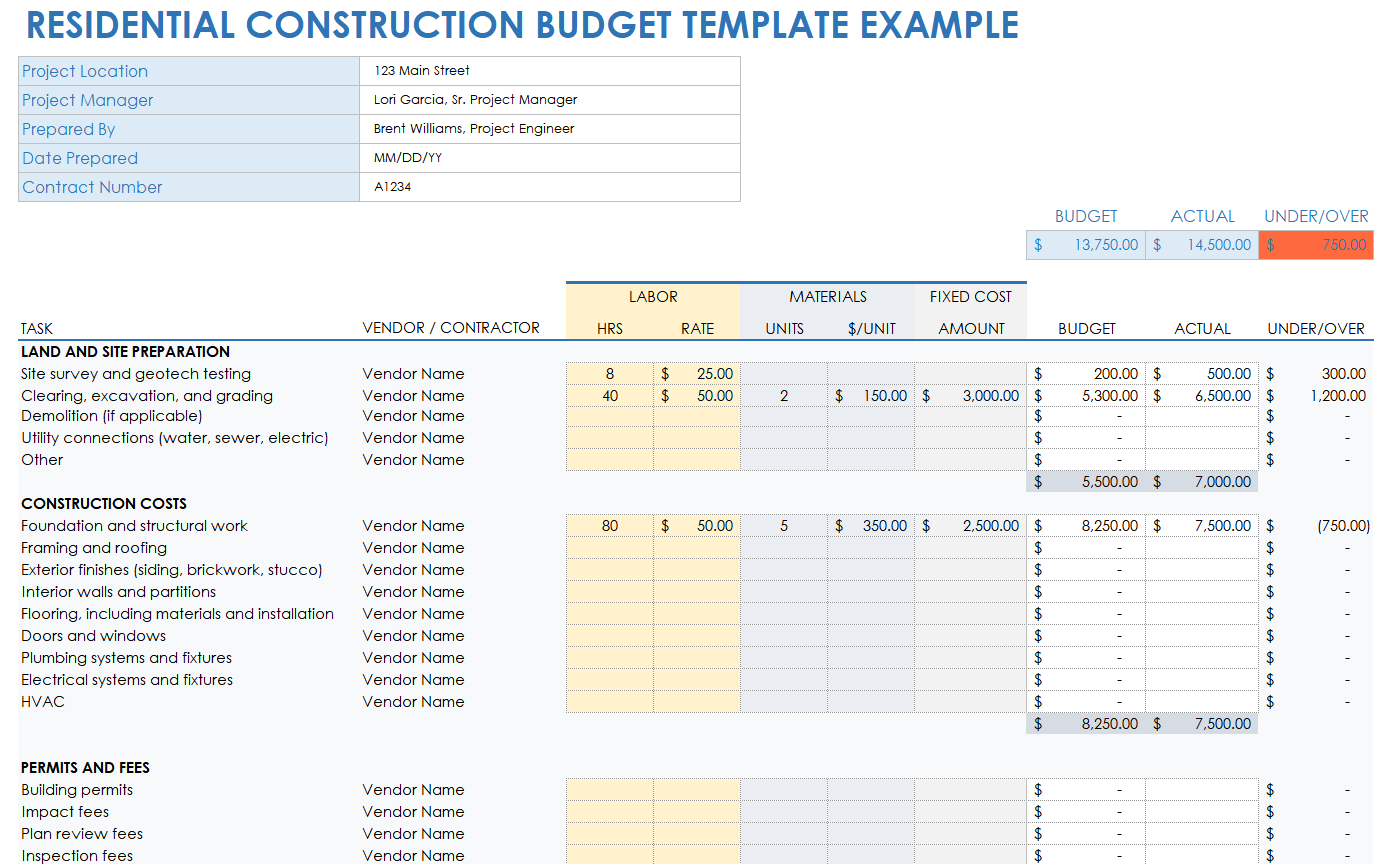

A condo budget template is a spreadsheet or document that helps you plan and track your condo expenses. It typically includes categories such as utilities, maintenance fees, insurance, mortgage or rent, and savings. By using a condo budget template, you can create a clear picture of your financial situation and make informed decisions about your spending.

The Purpose of Using a Condo Budget Template

Image Source: communityfinancials.com

The main purpose of a condo budget template is to help you manage your finances effectively. By tracking your expenses and income, you can identify areas where you may be overspending and make adjustments accordingly. A condo budget template can also help you set financial goals, such as saving for a major purchase or paying off debt. Ultimately, the goal is to achieve financial stability and peace of mind.

Why You Should Use a Condo Budget Template

Using a condo budget template can provide numerous benefits. It can help you avoid overspending, track your progress towards financial goals, and reduce financial stress. By having a clear overview of your finances, you can make more informed decisions about your spending and saving habits. Additionally, a condo budget template can help you plan for unexpected expenses and emergencies.

How to Create a Condo Budget Template

Image Source: communityfinancials.com

Creating a condo budget template is relatively simple. Start by listing all of your monthly expenses, such as utilities, maintenance fees, insurance, and mortgage or rent. Next, list your sources of income, including salaries, bonuses, and other sources of revenue. Calculate your total expenses and income, and subtract your expenses from your income to determine your monthly savings or deficit. Adjust your budget as needed to ensure that you are living within your means.

1. List all of your monthly expenses, including fixed and variable costs.

When creating a condo budget template, it is important to include all of your monthly expenses, both fixed and variable. Fixed costs are expenses that remain constant each month, such as mortgage or rent payments, insurance premiums, and maintenance fees. Variable costs are expenses that can fluctuate, such as utilities, groceries, and entertainment.

2. Calculate your total monthly income.

Image Source: smartsheet.com

In addition to listing your expenses, you should also calculate your total monthly income. This includes your salary, bonuses, rental income, and any other sources of revenue. By comparing your income to your expenses, you can determine how much money you have left over for savings or discretionary spending.

3. Track your spending and adjust your budget as needed.

Once you have created your condo budget template, it is important to track your spending and make adjustments as needed. If you find that you are overspending in certain areas, look for ways to cut back or find alternative solutions. By regularly reviewing your budget and making adjustments, you can stay on track towards your financial goals.

4. Set financial goals and prioritize your spending.

Image Source: bysophialee.com

Another important aspect of using a condo budget template is setting financial goals and prioritizing your spending. Whether you are saving for a down payment on a new home, planning a vacation, or paying off debt, having clear goals can help you stay motivated and focused on your finances. Prioritize your spending to align with your goals and make adjustments as needed.

5. Build an emergency fund for unexpected expenses.

One key component of a successful condo budget template is building an emergency fund. An emergency fund can provide a safety net for unexpected expenses, such as car repairs, medical bills, or home maintenance. Aim to save at least three to six months’ worth of living expenses in your emergency fund to ensure that you are prepared for any financial setbacks.

6. Review your budget regularly and make adjustments as needed.

Image Source: smartsheet.com

To ensure that your condo budget template remains effective, it is important to review it regularly and make adjustments as needed. Life circumstances can change, and your budget should reflect those changes. Whether you experience a change in income, expenses, or financial goals, be proactive in updating your budget to stay on track towards financial stability.

7. Seek professional advice if needed.

If you are struggling to create or maintain a condo budget template, don’t be afraid to seek professional advice. Financial advisors and accountants can provide valuable insight and guidance to help you manage your finances more effectively. They can help you create a personalized budget, set financial goals, and develop a plan for achieving them.

8. Stay motivated and disciplined in your budgeting efforts.

Image Source: smartsheet.com

Budgeting can be challenging, but staying motivated and disciplined is key to success. Celebrate your financial milestones, no matter how small, and stay focused on your long-term financial goals. By consistently tracking your spending, adjusting your budget as needed, and seeking support when necessary, you can achieve financial stability and peace of mind.

Tips for Successful Condo Budgeting

Track your expenses: Keep a record of all your expenses to identify spending patterns and areas where you can cut back.

Automate your savings: Set up automatic transfers to your savings account to ensure you are consistently saving money each month.

Use budgeting apps: Consider using budgeting apps or software to help streamline the budgeting process and track your finances more efficiently.

Communicate with your household: If you share expenses with roommates or family members, communicate openly about budgeting goals and priorities.

Stay flexible: Life can be unpredictable, so be prepared to adjust your budget as needed to accommodate changes in income or expenses.

Celebrate milestones: Recognize and celebrate your financial achievements along the way to stay motivated and focused on your long-term goals.

Image Source: pinimg.com

By using a condo budget template, you can take control of your finances and work towards achieving your financial goals. Remember to stay proactive, track your spending, and make adjustments as needed to ensure that you are living within your means. With dedication and discipline, you can achieve financial stability and peace of mind.

Image Source: pinimg.com

Image Source: pinimg.com