Car lease agreements are a common way for individuals to obtain a vehicle without the commitment of purchasing one outright. These agreements typically involve a fixed-term contract where the lessee pays a monthly fee to use the car for a specified period. At the end of the lease term, the lessee has the option to return the vehicle, purchase it at a predetermined price, or enter into a new lease agreement.

What is a Car Lease Agreement?

A car lease agreement is a contract between a car owner (lessor) and an individual or business (lessee) where the lessee agrees to pay a monthly fee to use the vehicle for a set period. The terms of the lease, including the monthly payment, lease term, mileage restrictions, and any additional fees, are specified in the agreement. Car lease agreements are a popular alternative to purchasing a vehicle outright, as they often require lower monthly payments and provide the lessee with the flexibility to change vehicles more frequently.

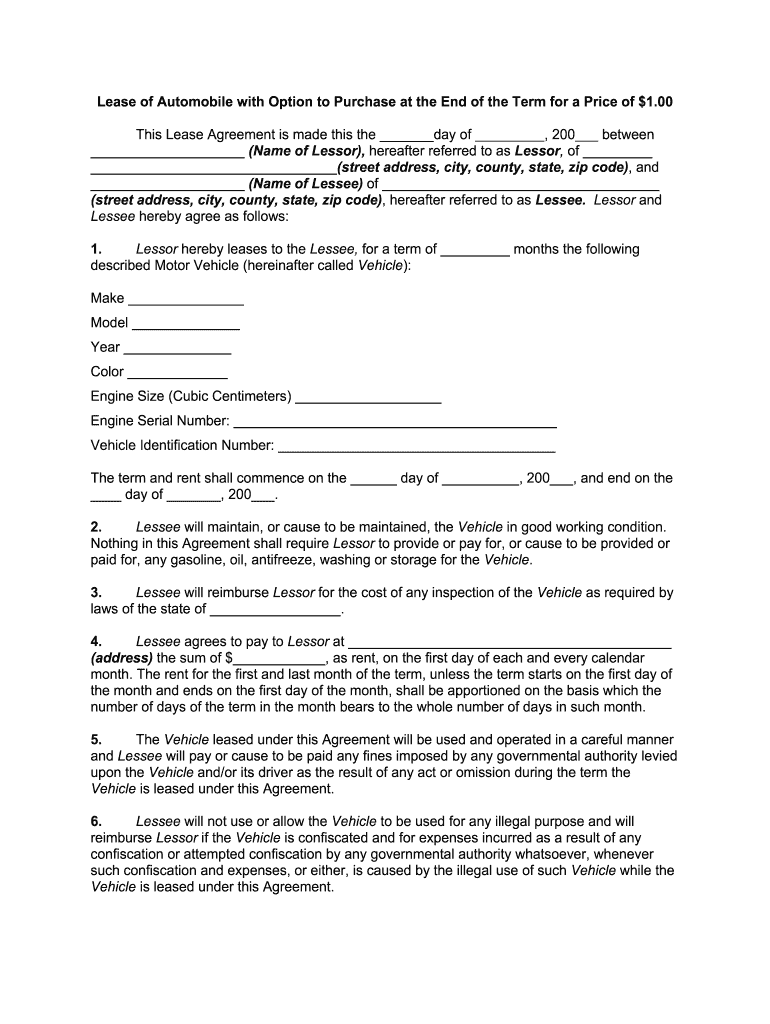

The Purpose of Car Lease Agreements

Image Source: business-in-a-box.com

The primary purpose of a car lease agreement is to provide individuals and businesses with access to a vehicle without the financial commitment of purchasing one. This can be particularly beneficial for individuals who prefer to drive a new car every few years or for businesses that need to maintain a fleet of vehicles. Additionally, car lease agreements often include warranties and maintenance packages, providing the lessee with peace of mind knowing that the vehicle is covered in case of mechanical issues.

Why Choose a Car Lease Agreement?

There are several reasons why individuals and businesses may choose to enter into a car lease agreement rather than purchase a vehicle outright. Some of the advantages of leasing a car include:

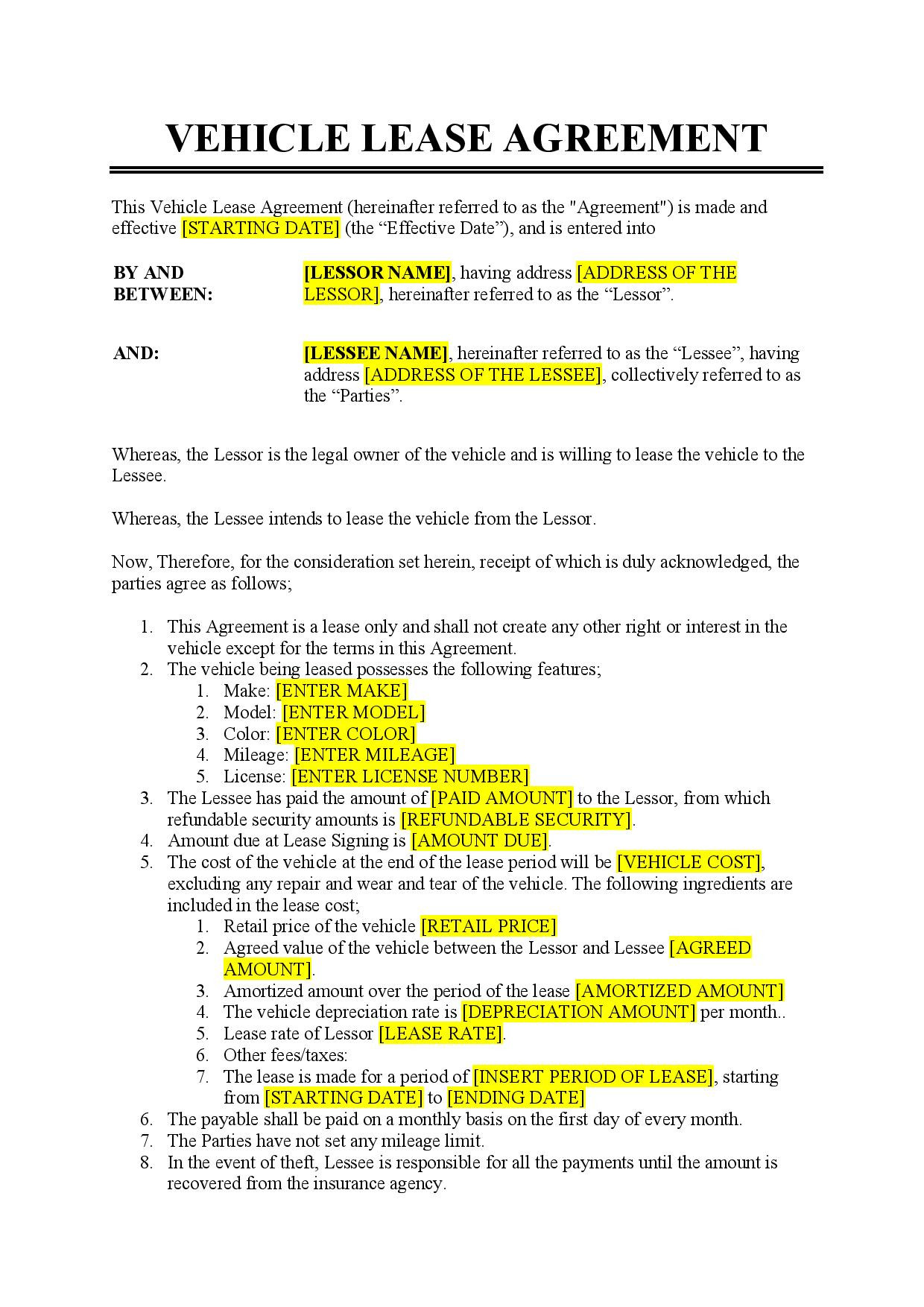

1. Lower Monthly Payments

Image Source: pdffiller.com

Leasing a car typically results in lower monthly payments compared to financing a purchase, making it a more affordable option for those on a budget.

2. Access to Newer Vehicles

Leasing allows individuals to drive newer vehicles with the latest features and technology, without the long-term commitment of ownership.

3. Limited Maintenance Costs

Image Source: signnow.com

Many car lease agreements include maintenance packages, reducing the lessee’s out-of-pocket expenses for routine maintenance and repairs.

4. Flexibility to Upgrade

Leasing provides the flexibility to upgrade to a new vehicle at the end of the lease term, allowing individuals to drive a different car more frequently.

5. No Resale Hassles

Image Source: cocosign.com

At the end of the lease term, the lessee can simply return the vehicle to the lessor without the hassle of selling or trading in a used car.

6. Tax Benefits for Businesses

Businesses may be able to deduct lease payments as a business expense, providing potential tax benefits for leasing a vehicle.

7. Warranty Coverage

Image Source: etsystatic.com

Many car lease agreements include manufacturer warranties, protecting the lessee from unexpected repair costs.

8. Avoid Depreciation

With a lease agreement, the lessee does not have to worry about the depreciation of the vehicle, as they do not own the car outright.

How to Negotiate a Car Lease Agreement

Image Source: usesignhouse.com

When entering into a car lease agreement, it is important to negotiate the terms to ensure you are getting the best deal possible. Some tips for negotiating a car lease agreement include:

Research the Market. Before entering into a lease agreement, research the market value of the car you are interested in leasing to ensure you are getting a fair deal.

Compare Offers. Obtain quotes from multiple dealerships and leasing companies to compare lease terms, monthly payments, and any additional fees.

Understand Lease Terms. Read the lease agreement carefully and make sure you understand the terms, including mileage restrictions, maintenance responsibilities, and any penalties for early termination.

Negotiate Monthly Payments. Work with the lessor to negotiate lower monthly payments, a longer lease term, or additional perks such as free maintenance or upgrades.

Consider Residual Value. The residual value of the vehicle at the end of the lease term can impact your monthly payments, so negotiate this value to ensure you are getting a good deal.

Avoid Excessive Fees. Be wary of any hidden fees or unnecessary add-ons in the lease agreement, and negotiate to have them removed to keep your costs down.

Image Source: easylegaldocs.com

Tips for Successful Car Lease Agreements

To ensure a successful car lease agreement, follow these tips:

Image Source: signaturely.com

Understand Your Budget. Determine how much you can afford to spend on a monthly lease payment, taking into account your other financial obligations.

Shop Around. Compare lease offers from different dealerships and leasing companies to find the best deal for your needs.

Read the Fine Print. Carefully review the lease agreement and ask questions about anything you do not understand before signing.

Maintain the Vehicle. Follow the manufacturer’s recommended maintenance schedule and take care of the vehicle to avoid additional charges at the end of the lease term.

Plan for the Future. Consider your long-term needs and goals when entering into a lease agreement to ensure it aligns with your lifestyle and budget.

Seek Professional Advice. If you are unsure about any aspect of the lease agreement, consult with a legal or financial advisor to help you make an informed decision.

In conclusion, car lease agreements can be a convenient and cost-effective way to drive a vehicle without the commitment of ownership. By understanding the terms of the agreement, negotiating the best deal, and following these tips for success, you can enjoy the benefits of leasing a car while avoiding common pitfalls.

Image Source: rocketlawyer.com

Image Source: signaturely.com