Are you looking to streamline your capital expenditure budgeting process? One effective way to achieve this is by utilizing a capital expenditure budget template. This tool can help you plan, track, and manage your capital expenditures in a more organized and efficient manner. In this article, we will delve into the specifics of capital expenditure budget templates, their purpose, why they are important, how to use them effectively, and provide some tips for successful budgeting.

What is a Capital Expenditure Budget Template?

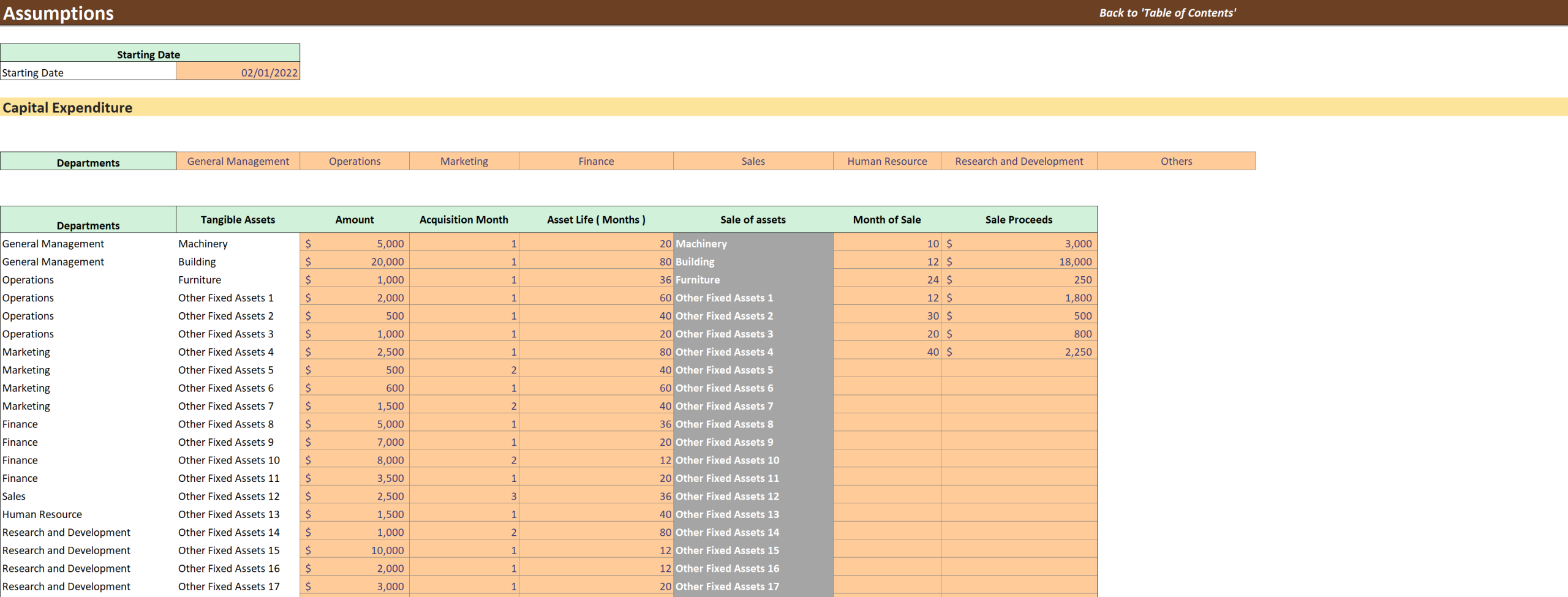

A capital expenditure budget template is a pre-designed spreadsheet or document that helps businesses plan and track their capital expenditures. It typically includes sections for listing all planned capital expenditures, such as equipment purchases, facility upgrades, and infrastructure improvements, along with columns for budgeted amounts, actual costs, and variances.

Image Source: efinancialmodels.com

Capital expenditure budget templates can be customized to suit the specific needs of a business, allowing for the inclusion of additional information such as project timelines, funding sources, and responsible parties. By using a template, businesses can ensure consistency in their budgeting process and easily compare planned versus actual expenditures.

The Purpose of a Capital Expenditure Budget Template

The primary purpose of a capital expenditure budget template is to help businesses effectively plan and manage their capital expenditures. By providing a structured format for documenting and tracking expenditures, the template enables businesses to:

Image Source: oakbusinessconsultant.com

1. Establish clear financial goals and objectives for capital expenditures

2. Monitor spending and ensure that projects stay within budget

3. Identify variances between budgeted and actual expenses

4. Make informed decisions about resource allocation and investment priorities

5. Improve accountability and transparency in the budgeting process

Overall, a capital expenditure budget template serves as a valuable tool for financial planning and control, helping businesses make strategic decisions to support their long-term growth and profitability.

Why Use a Capital Expenditure Budget Template?

Image Source: eloquens.com

The use of a capital expenditure budget template offers several key benefits for businesses, including:

1. Improved Organization: The template provides a structured framework for documenting and organizing capital expenditures, making it easier to track and manage expenses.

2. Enhanced Visibility: By centralizing all capital expenditure information in one document, businesses can gain a comprehensive view of their investment portfolio and identify opportunities for cost savings or efficiency improvements.

3. Increased Accuracy: With predefined categories and formats, the template helps minimize errors and discrepancies in budget calculations, ensuring that financial data is accurate and reliable.

4. Time Savings: Using a template streamlines the budgeting process, saving time and effort for finance teams and allowing them to focus on more strategic tasks.

5. Better Decision-Making: The template provides a clear overview of planned expenditures and their impact on the overall financial health of the business, enabling informed decision-making and resource allocation.

6. Compliance and Reporting: A well-designed template can facilitate compliance with financial regulations and reporting requirements, helping businesses maintain transparency and accountability in their budgeting practices.

Image Source: ytimg.com

In summary, the use of a capital expenditure budget template can help businesses optimize their budgeting process, improve financial management, and drive long-term success.

How to Use a Capital Expenditure Budget Template

Using a capital expenditure budget template effectively involves several key steps:

Image Source: template.net

1. Customize the Template: Tailor the template to fit the specific needs and requirements of your business, including adding or removing sections, adjusting formulas, and formatting data as needed.

2. Populate the Template: Enter all relevant information about planned capital expenditures, including project details, budgeted amounts, expected timelines, and funding sources.

3. Track Actual Expenses: Regularly update the template with actual expenditure data, comparing it to the budgeted amounts and identifying any variances.

4. Analyze and Review: Periodically review the budget template to analyze spending patterns, identify trends, and make adjustments as needed to stay on track with financial goals.

5. Communicate and Collaborate: Share the budget template with relevant stakeholders, such as department heads, finance teams, and senior management, to ensure alignment and transparency in budgeting decisions.

6. Monitor Performance: Use the template to monitor the performance of capital expenditure projects, evaluating their impact on business objectives and adjusting future budgets accordingly.

By following these steps, businesses can leverage a capital expenditure budget template to effectively plan, track, and manage their capital expenditures, leading to improved financial performance and strategic decision-making.

Tips for Successful Capital Expenditure Budgeting

Image Source: 10xsheets.com

To make the most of your capital expenditure budget template, consider the following tips for successful budgeting:

Set Clear Goals: Define specific financial objectives and targets for capital expenditures to guide your budgeting process.

Regularly Update Data: Keep the template up-to-date with accurate and timely information to ensure the reliability of financial reporting.

Monitor Variances: Analyze discrepancies between budgeted and actual expenses, investigating the root causes and taking corrective actions as needed.

Engage Stakeholders: Involve key stakeholders in the budgeting process, seeking their input and collaboration to enhance decision-making and accountability.

Review and Adjust: Periodically review the budget template to evaluate performance, identify opportunities for improvement, and make adjustments for future budget cycles.

Seek Continuous Improvement: Look for ways to streamline and optimize your budgeting process, leveraging technology and best practices to enhance efficiency and effectiveness.

Image Source: zebrabi.com

By following these tips, businesses can maximize the benefits of using a capital expenditure budget template, driving financial success and sustainable growth for their organization.

Image Source: templarket.com

Image Source: oakbusinessconsultant.com

Image Source: solverglobal.com