As a business owner, one of the most crucial aspects of running a successful operation is creating and maintaining a well-organized budget. A business operating budget template is a powerful tool that can help you keep track of your company’s finances, plan for the future, and make informed decisions about where to allocate resources. Whether you are a small startup or a large corporation, having a clear and detailed budget template in place is essential for financial stability and growth.

What is a Business Operating Budget Template?

A business operating budget template is a document that outlines all of the expenses and revenues associated with running your business. It typically includes categories such as payroll, rent, utilities, supplies, marketing, and more. By inputting your estimated costs and income for each category, you can create a comprehensive overview of your financial situation for a specific period, such as a month, quarter, or year.

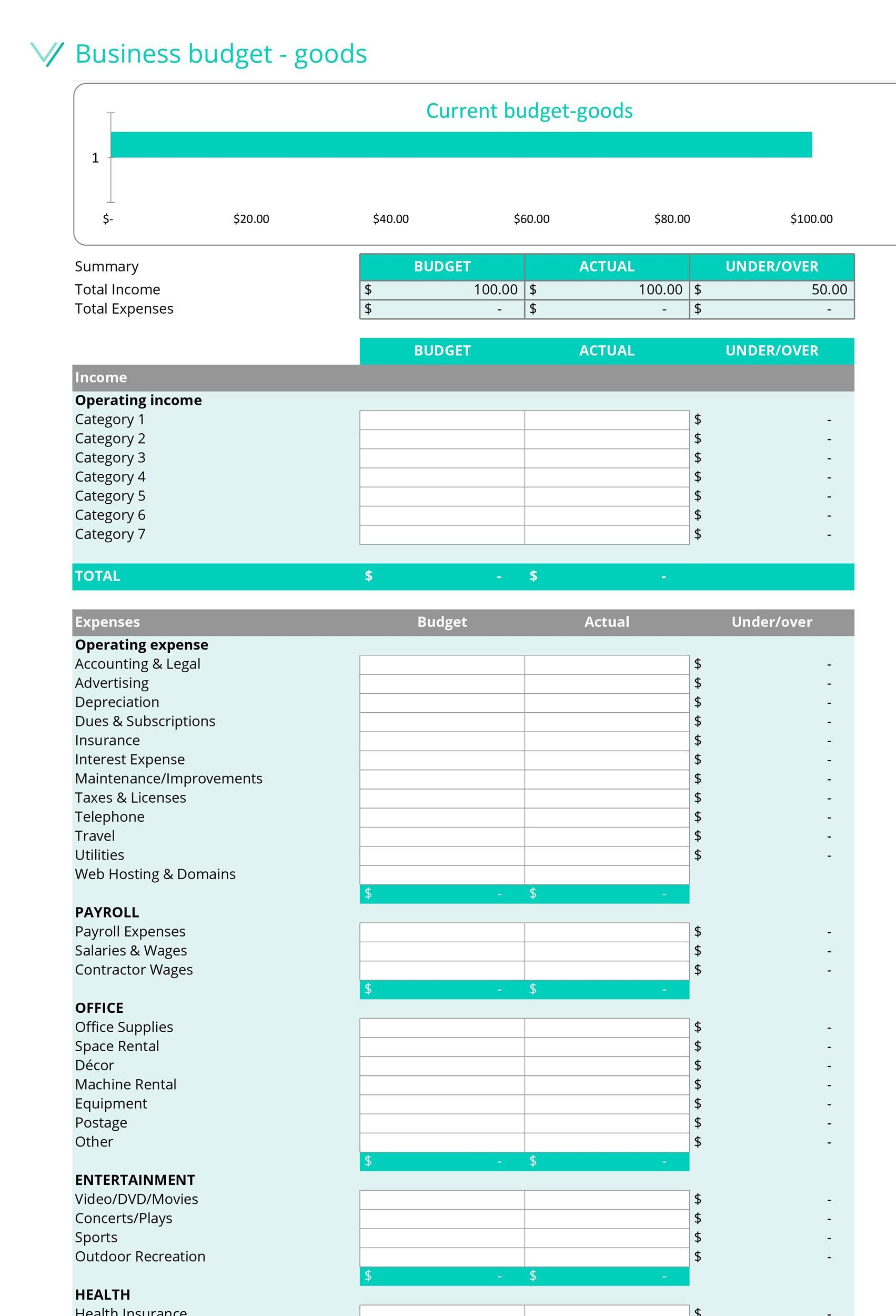

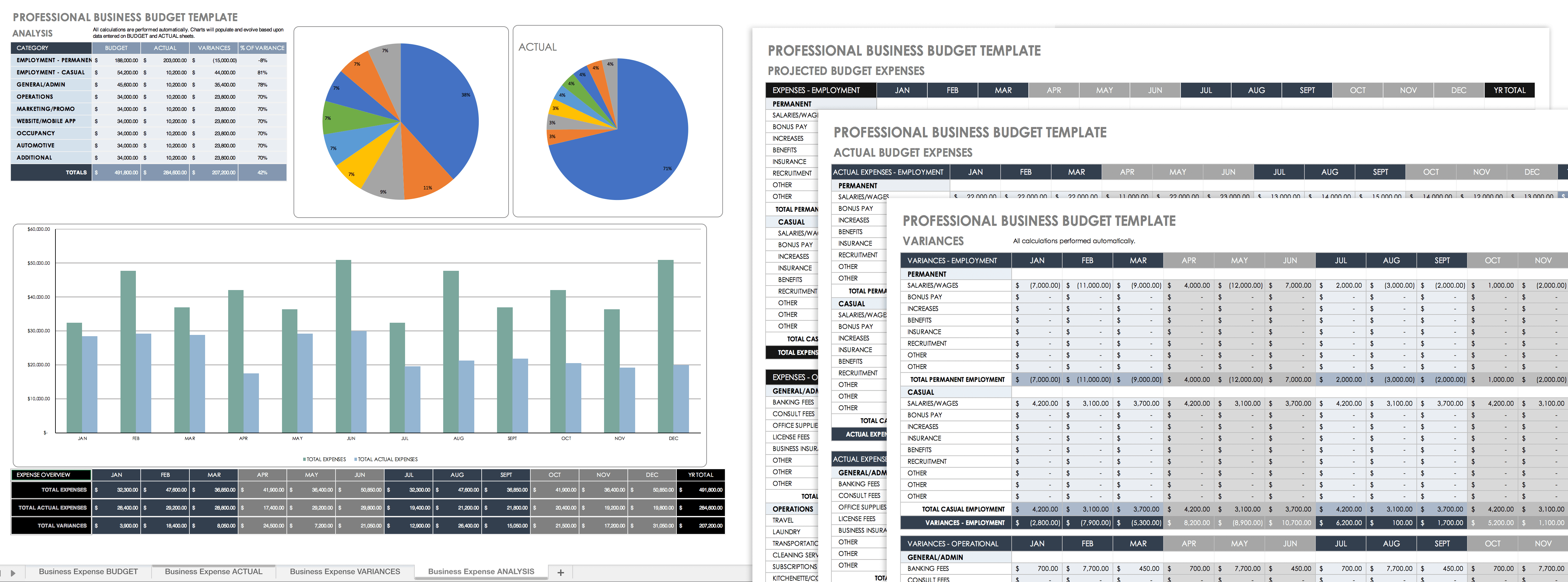

Image Source: gdoc.io

Creating a budget template allows you to track your spending, identify areas where you may be overspending, and make adjustments to ensure that you are operating within your means. It also helps you set financial goals and measure your progress towards achieving them.

The Purpose of a Business Operating Budget Template

The main purpose of a business operating budget template is to provide a framework for managing your company’s finances effectively. By establishing a budget, you can:

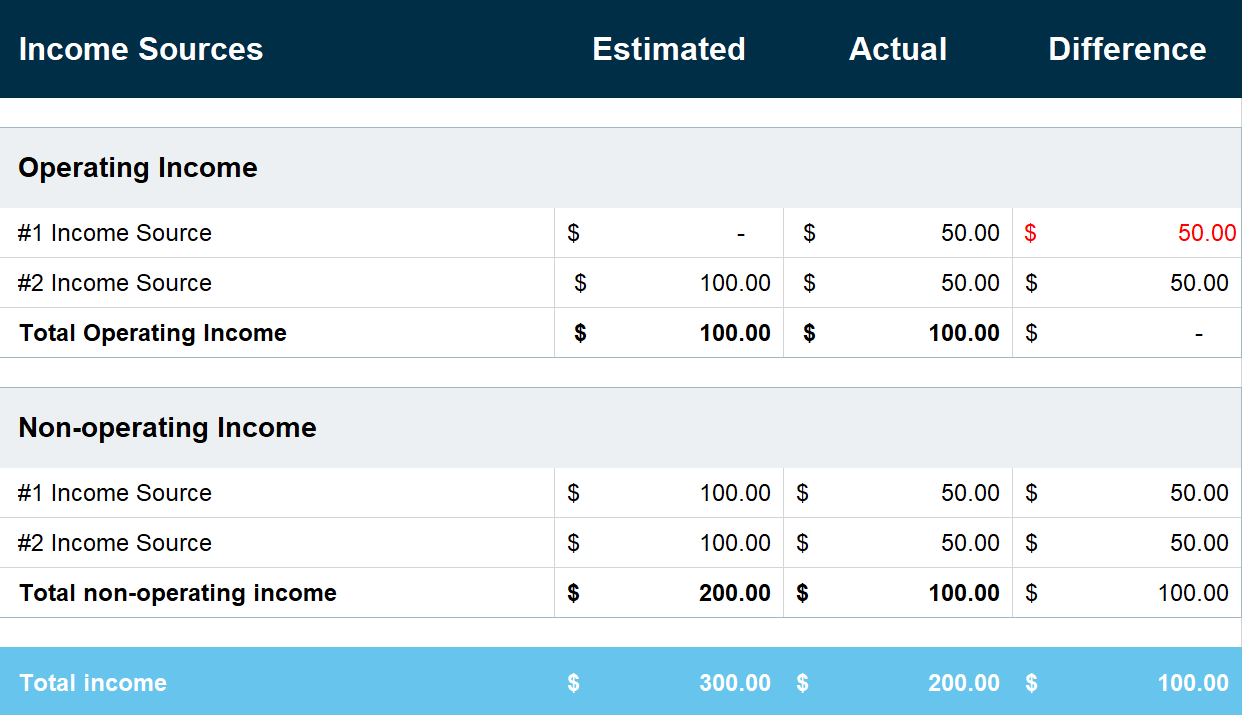

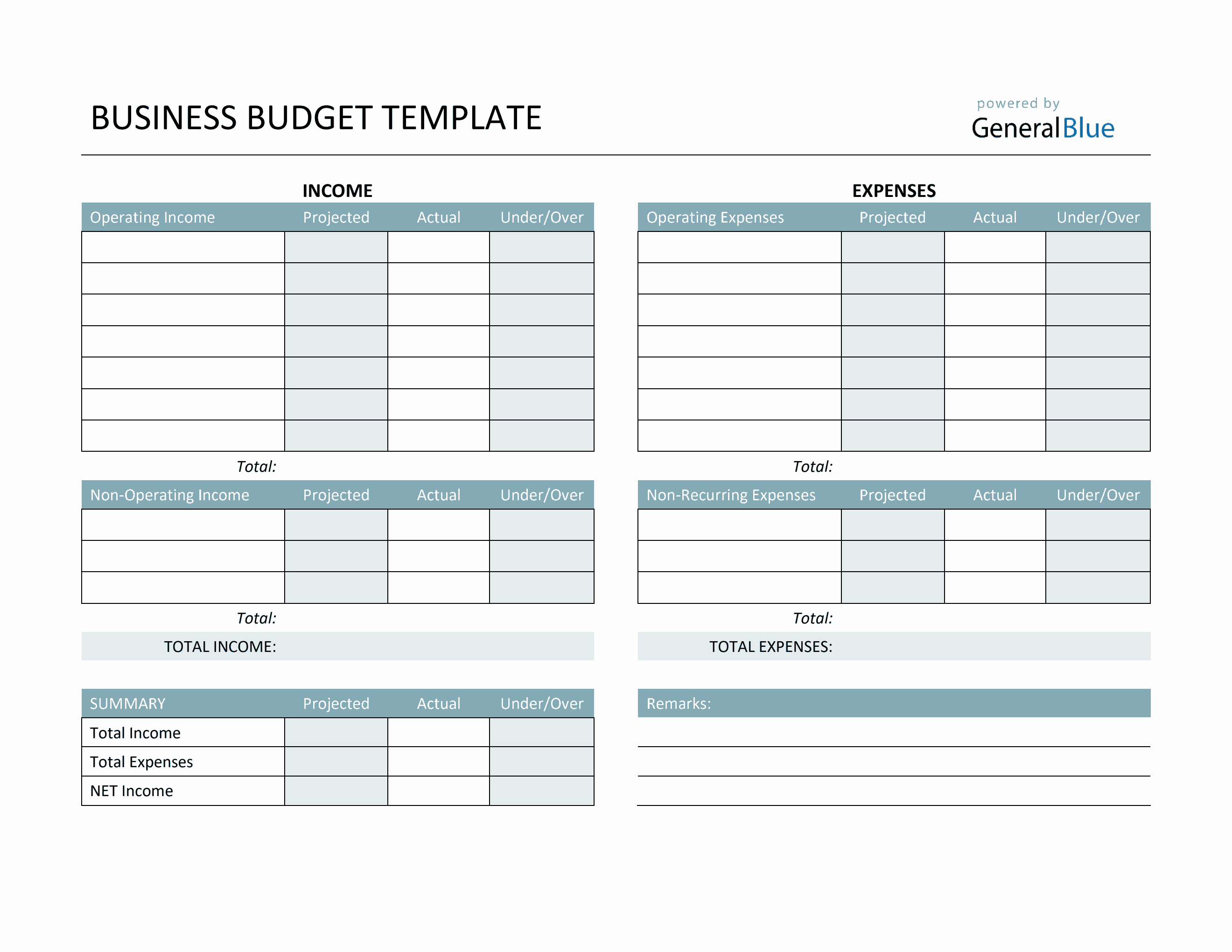

Image Source: templatelab.com

1. Track your expenses and revenues: A budget template allows you to record all of your business expenses and revenues in one place, making it easier to see where your money is going and where it is coming from.

2. Plan for the future: By projecting your income and expenses for the upcoming months or years, you can anticipate any financial challenges or opportunities that may arise and prepare accordingly.

3. Make informed decisions: With a budget template, you can analyze your financial data and make strategic decisions about how to allocate your resources to achieve your business goals.

4. Measure performance: By comparing your actual financial results to your budgeted amounts, you can evaluate your company’s performance and make adjustments as needed to stay on track.

Why You Need a Business Operating Budget Template

Having a business operating budget template is essential for several reasons:

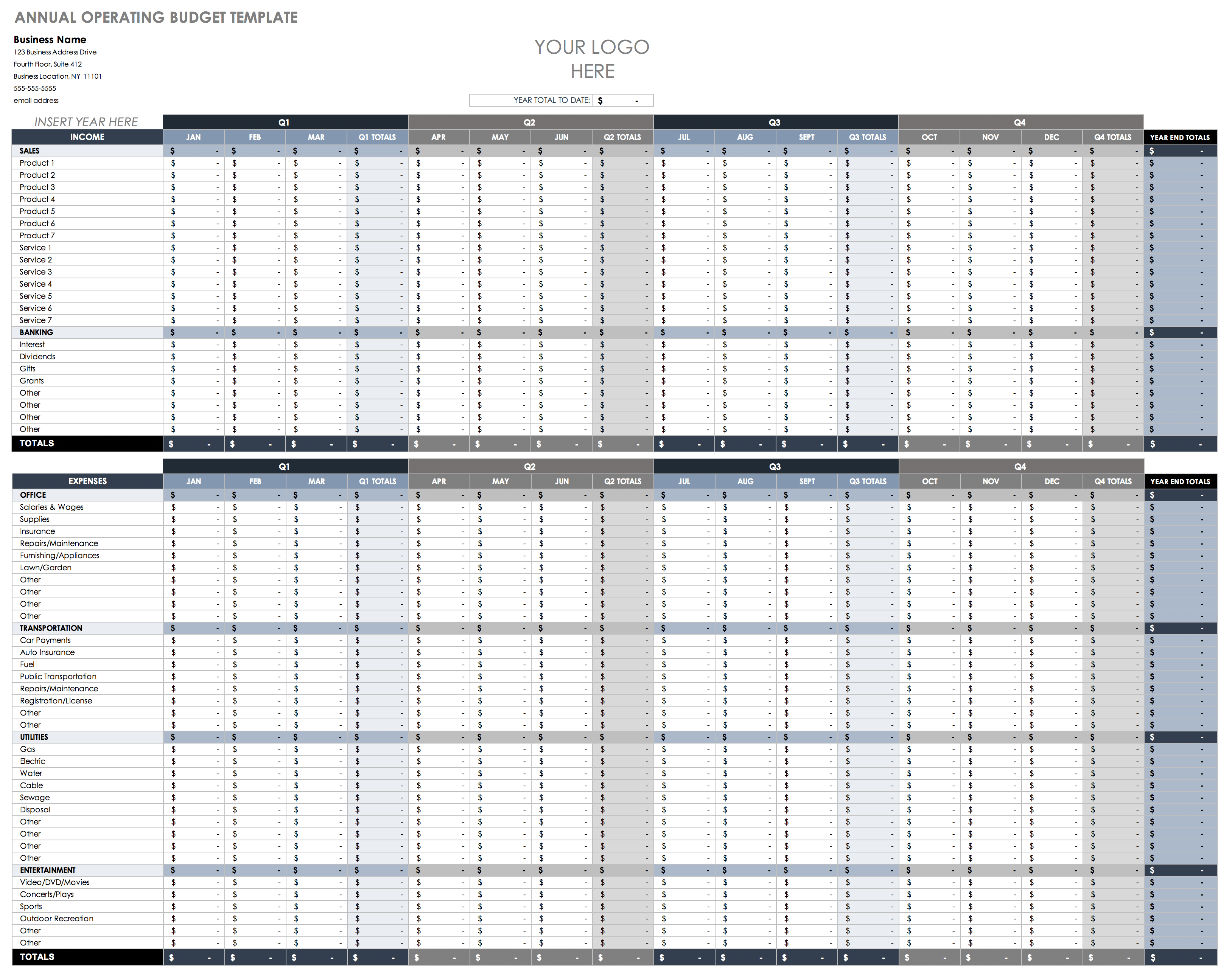

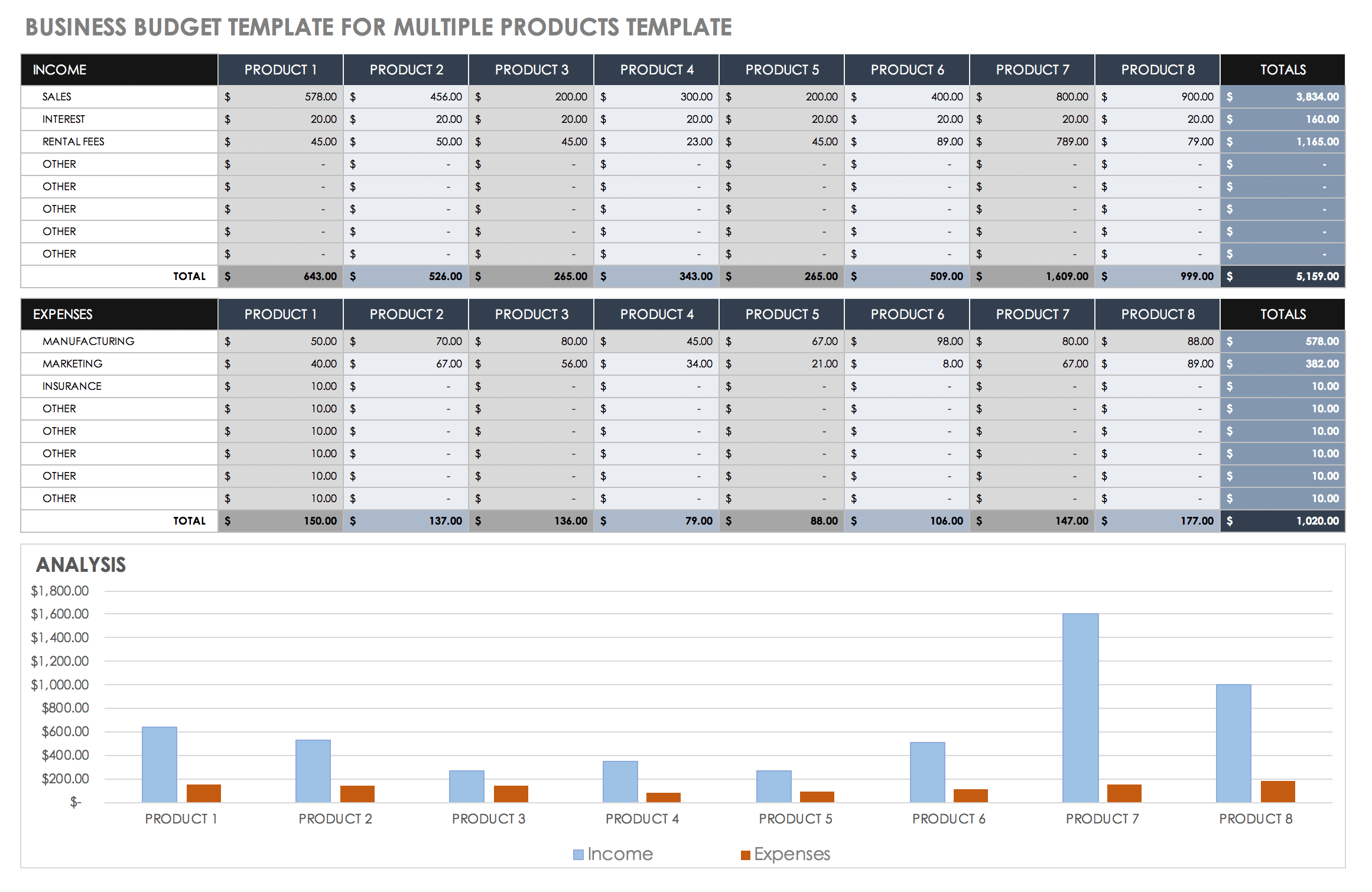

Image Source: ctfassets.net

1. Financial planning: A budget template helps you plan and manage your finances effectively, ensuring that you have enough cash flow to cover your expenses and invest in growth opportunities.

2. Decision-making: With a budget template, you can make informed decisions about how to allocate your resources based on your financial goals and priorities.

3. Strategic goal-setting: By setting financial targets and tracking your progress towards achieving them, you can stay focused on your long-term objectives and make adjustments as needed to stay on track.

4. Financial accountability: A budget template holds you accountable for your financial decisions and helps you avoid overspending or financial mismanagement.

How to Create a Business Operating Budget Template

Creating a business operating budget template can be a straightforward process if you follow these steps:

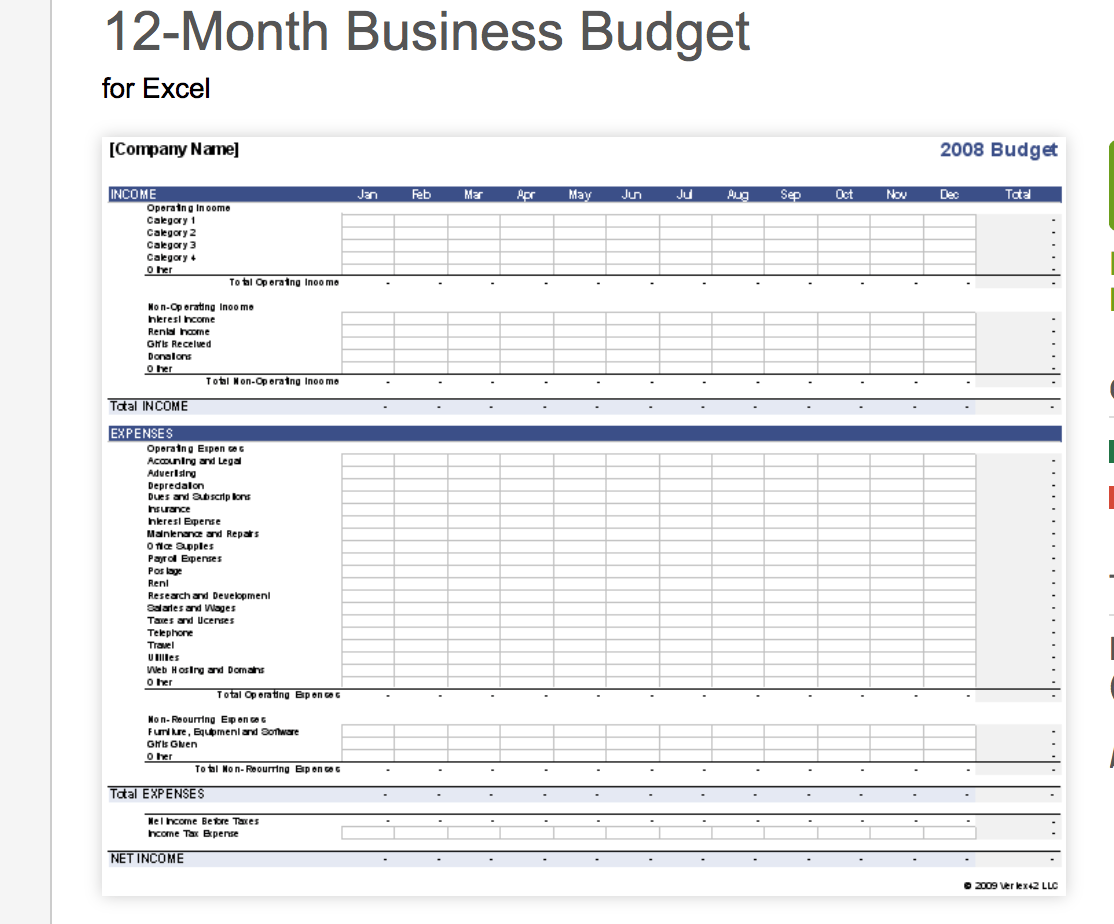

Image Source: workfeed.io

1. Identify your revenue streams: Start by listing all of the sources of income for your business, such as sales, services, and investments.

2. List your expenses: Next, categorize your expenses into fixed costs (e.g., rent, utilities) and variable costs (e.g., supplies, marketing).

3. Estimate your costs: For each expense category, estimate the amount you expect to spend based on past data, market trends, and future projections.

4. Calculate your net income: Subtract your total expenses from your total revenues to determine your projected net income for the period.

5. Monitor and adjust: Regularly review your budget template, compare your actual results to your projections, and make adjustments as needed to stay on track.

Tips for Successful Budgeting

Creating and maintaining an effective business operating budget template requires attention to detail and a strategic mindset. Here are some tips to help you succeed:

Image Source: smartsheet.com

Be realistic: When estimating your expenses and revenues, be conservative and account for potential fluctuations or unexpected costs.

Review regularly: Schedule regular reviews of your budget template to track your progress, identify areas for improvement, and make adjustments as needed.

Communicate with your team: Involve your employees in the budgeting process to gain their insights, set clear financial goals, and foster a culture of financial responsibility.

Seek professional advice: If you are unsure about creating or managing a budget template, consider consulting with a financial advisor or accountant for expert guidance.

Plan for contingencies: Include a contingency fund in your budget template to account for unexpected expenses or revenue shortfalls that may arise.

Stay flexible: Be prepared to adapt your budget template as your business evolves, market conditions change, or new opportunities arise.

By following these guidelines and utilizing a well-structured business operating budget template, you can effectively manage your company’s finances, make informed decisions, and achieve your financial goals. Remember that a budget is not just a financial document – it is a strategic tool that can help you build a strong foundation for long-term success.

Image Source: storyblok.com

Image Source: smartsheet.com

Image Source: generalblue.com

Image Source: corporatefinanceinstitute.com

Image Source: smartsheet.com