Construction projects can be complex and often involve meticulous planning to ensure they are completed on time and within budget. One essential tool for managing the finances of a construction project is a budget template. A budget template for a construction project is a pre-formatted spreadsheet that helps project managers track expenses, allocate resources, and monitor overall project costs. By using a budget template, construction project managers can effectively control costs, make informed decisions, and ultimately achieve project success.

What is a Budget Template for Construction Project?

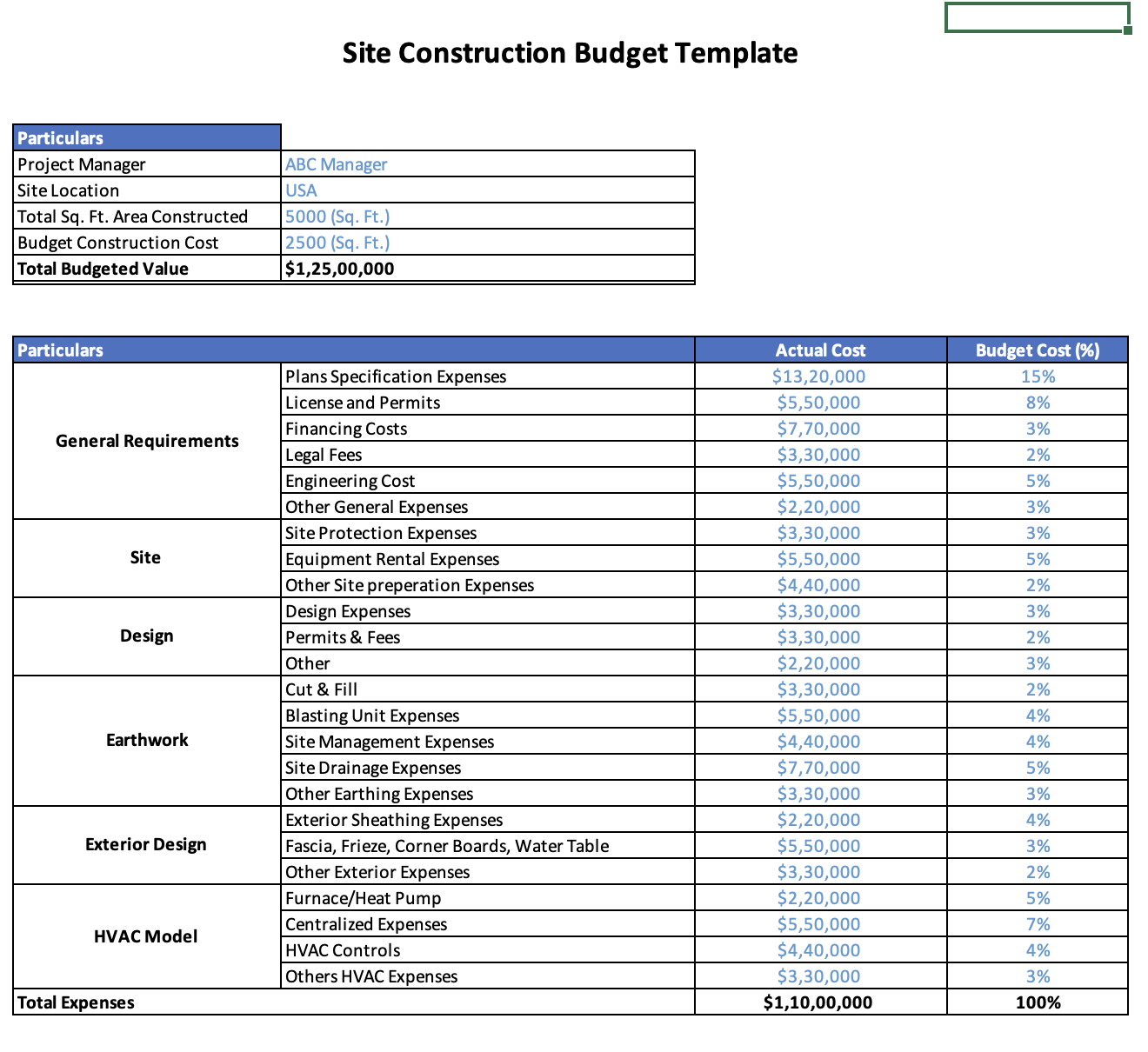

A budget template for a construction project is a detailed spreadsheet that outlines all the expenses associated with the project. It typically includes categories such as labor costs, material costs, equipment rentals, permits, insurance, and other miscellaneous expenses. The template allows project managers to input estimated costs and track actual expenses as the project progresses. By comparing estimated costs to actual expenses, project managers can identify areas where costs are exceeding the budget and take corrective action.

The Purpose of a Budget Template for Construction Project

Image Source: smartsheet.com

The primary purpose of a budget template for a construction project is to provide a roadmap for managing project finances. By creating a budget template at the beginning of a project, project managers can establish cost controls, set spending limits, and allocate resources effectively. The budget template serves as a tool for tracking expenses, monitoring cash flow, and ensuring that the project remains within budget. Additionally, the budget template can help project managers identify cost savings opportunities, prioritize spending, and make informed decisions to keep the project on track.

Why Use a Budget Template for Construction Project?

Using a budget template for a construction project offers several benefits. First and foremost, a budget template provides a systematic approach to managing project finances, which is crucial for the success of any construction project. By documenting all expenses in a structured format, project managers can easily track costs, analyze spending patterns, and make adjustments as needed. Furthermore, a budget template helps project managers communicate financial information to stakeholders, such as investors, clients, and team members, to ensure transparency and accountability throughout the project.

How to Create a Budget Template for Construction Project

Image Source: slideteam.net

Creating a budget template for a construction project involves several key steps. First, project managers should identify all the potential expenses associated with the project, including labor, materials, equipment, permits, and other costs. Next, they should create a spreadsheet with categories for each expense type and input estimated costs based on market rates, historical data, or vendor quotes. As the project progresses, project managers should update the budget template with actual expenses and compare them to the estimates to identify any discrepancies. By regularly reviewing and adjusting the budget template, project managers can proactively manage project finances and ensure that the project stays on budget.

1. Define Expense Categories:

To create a comprehensive budget template, define specific expense categories such as labor, materials, equipment, permits, insurance, and contingency funds. This will help organize expenses and ensure that all costs are accounted for in the budget.

2. Input Estimated Costs:

Image Source: archdesk.com

Based on historical data, market rates, vendor quotes, and project requirements, input estimated costs for each expense category in the budget template. Be sure to consider any potential cost variations and include a buffer for unexpected expenses.

3. Update Actual Expenses:

Regularly update the budget template with actual expenses as the project progresses. Compare actual expenses to estimated costs to identify any discrepancies and make necessary adjustments to keep the project on track.

4. Monitor Cash Flow:

Image Source: website-files.com

Monitor cash flow by tracking income and expenditures in the budget template. This will help project managers ensure that there is enough funding to cover expenses and identify any cash flow issues that may arise during the project.

5. Review and Adjust Budget:

Regularly review the budget template and make adjustments as needed based on actual expenses, project progress, and changing circumstances. By staying proactive and flexible, project managers can adapt to unforeseen challenges and keep the project within budget.

6. Communicate Financial Information:

Image Source: smartsheet.com

Use the budget template to communicate financial information to stakeholders, such as investors, clients, and team members. Provide regular updates on project finances, budget status, and any cost-saving opportunities to ensure transparency and accountability.

7. Track Cost Savings Opportunities:

Identify cost savings opportunities by analyzing expenses in the budget template. Look for areas where costs can be reduced, resources can be reallocated, or processes can be optimized to maximize efficiency and minimize expenses.

8. Stay Proactive and Flexible:

Image Source: smartsheet.com

Stay proactive and flexible when managing project finances with the budget template. Anticipate potential challenges, adapt to changing circumstances, and make informed decisions to keep the project on track and within budget.

Tips for Successful Budget Management in Construction Projects

Successfully managing a budget for a construction project requires careful planning, diligent monitoring, and strategic decision-making. Here are some tips for effective budget management in construction projects:

Image Source: website-files.com

Track Expenses: Monitor expenses closely and update the budget template regularly with actual costs.

Allocate Resources Wisely: Prioritize spending and allocate resources to critical areas of the project to maximize efficiency.

Anticipate Contingencies: Include a contingency fund in the budget template to cover unexpected expenses or emergencies.

Communicate Effectively: Keep stakeholders informed about project finances, budget status, and any changes that may impact costs.

Review and Adjust: Regularly review the budget template, analyze spending patterns, and make adjustments to keep the project on budget.

Seek Cost Savings: Look for cost-saving opportunities, negotiate with vendors, and optimize processes to reduce expenses and increase profitability.

Image Source: archdesk.com