Regardless of whether you deal with the accounts at your work or at home, having a budget set up is a basic initial step. A budget is important to realize where you’re right now spending, choose where you can spare, and figure out where you might want to apply your cash.

Why set up a budget?

Having a budget that subtleties your pay and use will assist you with keeping up control of your funds and, if essential, help to delineate the issues you might be having with your leasers. The facts confirm that your obligation issues won’t be unraveled by the way that you have a budget alone. However, starting with this fundamental data about the truth of your present circumstance is basic.

While evaluating how long you have before your money holds run out, accept you’ll have no pay for the initial hardly any weeks.

In the event that you have lost your employment and have next to no money available and didn’t get an excess or end installment you may need to get crisis help quickly to guarantee you have some money for nuts and bolts like food and haven.

Making an individual budget isn’t just significant for your monetary prosperity and genuine feelings of serenity, yet in addition for your short and long haul objectives. Assuming responsibility for your accounts with an individual budget template will assist you with making progress on these objectives.

To begin, you need to consider the accompanying strides to assist you with building up your own budget:

Set your objectives. Set aside some effort to make a rundown of your short and long haul objectives. Decide why every objective is a need, how you intend to accomplish them, and the time span in which you might want to achieve them. Momentary objectives should just take a year to achieve and would incorporate things like taking care of a Mastercard. Your drawn out objectives could take numerous years to achieve, with instances of long haul objectives including putting something aside for your kid’s schooling or your own retirement.

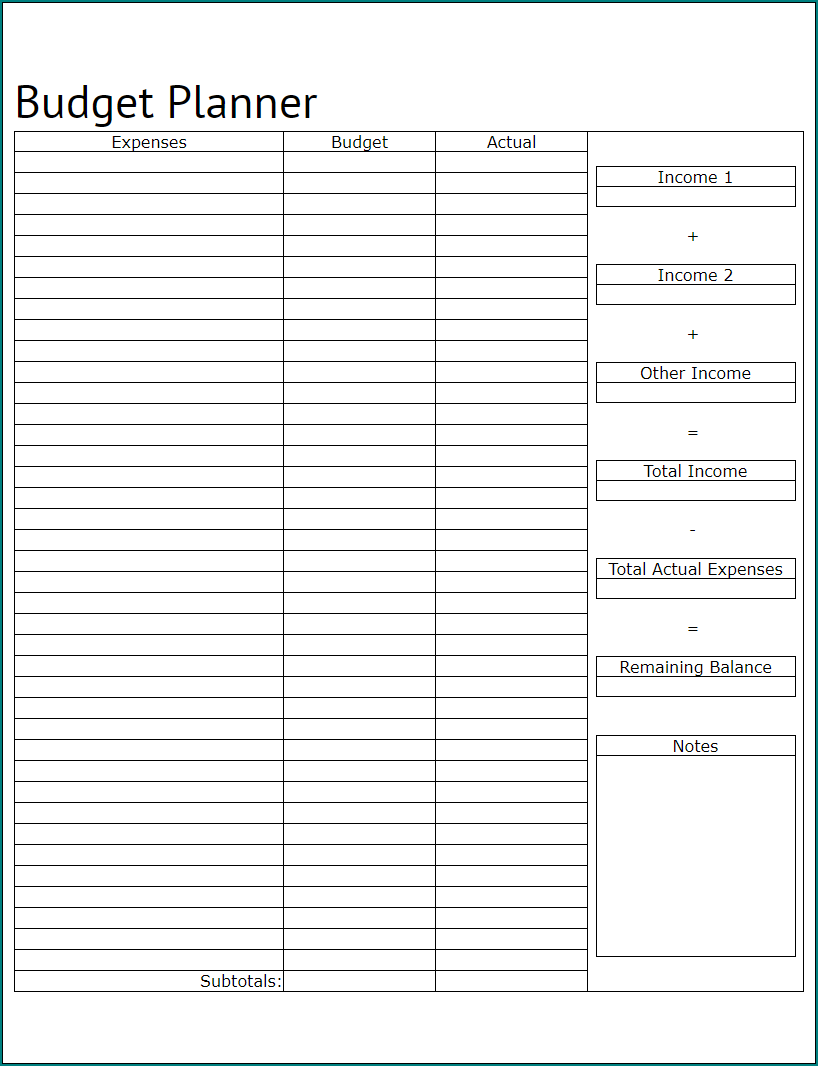

Samples of Budget Planner Template :

Track your spending. To make exact appraisals of the amount you ought to allot to each expense inside your own budget, you will require a feeling of the amount you are right now spending in every territory. Survey your bank explanations for the last three to four months to get a thought of your spending. Obviously, you may choose to change the sum you budget for every thing, except this will at any rate give a benchmark to go off of.

Customize your budget. Utilizing an individual budget template is useful to kick your budget off, however you can generally customize your budget to coordinate your particular necessities. Also, in light of the fact that you make a budget one month, doesn’t mean your costs and objectives will be the equivalent for the following. Make certain to have month to month registration on your budget and don’t spare a moment to refresh it as your conditions change.

Budget Planner Template | Excel download