What is a profit and loss articulation?

A profit and loss proclamation (P&L) sets out your organization pay versus costs, to help ascertain profit. You’ll at times see profit and loss explanations called a pay articulation, proclamation of tasks, or proclamation of income.

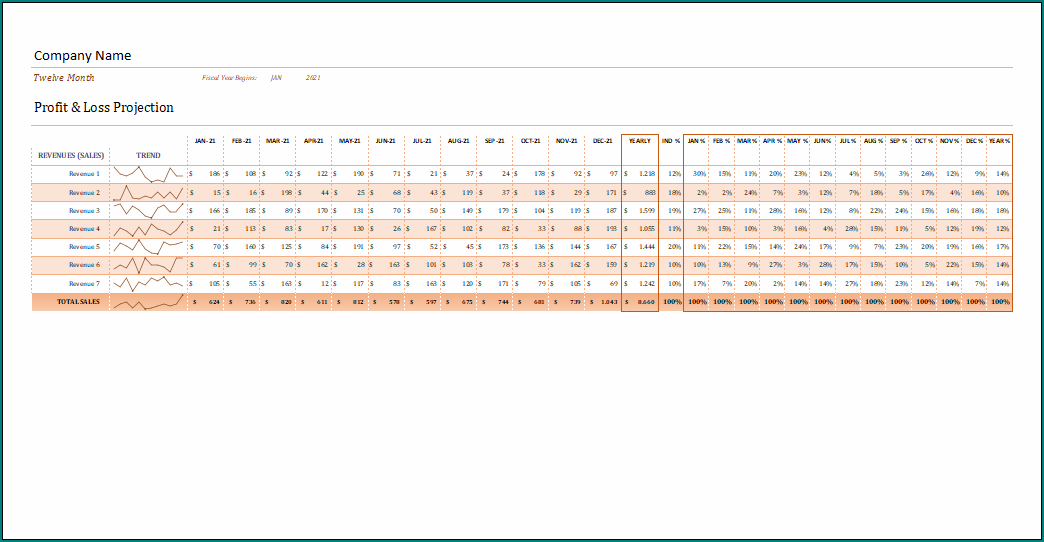

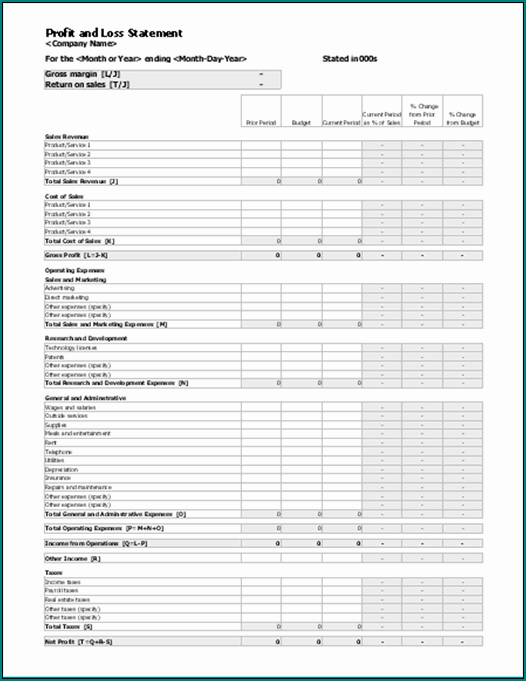

P&L proclamations can be made to dissect and look at business execution longer than a month, a quarter or a year, and are a successful instrument to survey income and anticipate future business execution.

Shrewd entrepreneurs use profit and loss articulations close by other key monetary records, similar to the asset report and income proclamation, to investigate and improve the strength of their organizations.

What is Included in the Profit and Loss Statement

The profit and loss articulation will show the business name and the time frame that the assertion is for, this can be seven days, month, quarter, year or any period that you require.

The figures presented on the profit and loss record may not be equivalent to the exchanges in your financial balance. All things considered, they are the figures that identify with the time frame regarding the deal or cost.

An illustration of this: during a month a business made deals of £1000, yet no products were bought; rather existing load of £500 was sold. Post the figure of £500 as an expense of offer on the profit and loss account.

There are a few different contrasts between the ledger and the profit and loss account:

Deals – Include the deals when they happen; this may not be that very month as when installment is gotten.

Cost of Sales – Include every one of the costs that identify with the business which have occurred.

Gatherings – Include any cost which identifies with the month for which no receipt is gotten.

Prepayments – You may get a receipt for a while, similar to a year or a future date, post the right sum in the correct month it relates.

Devaluation – If you own fixed resources, they are deteriorated over a period, incorporate a month to month figure to your records.

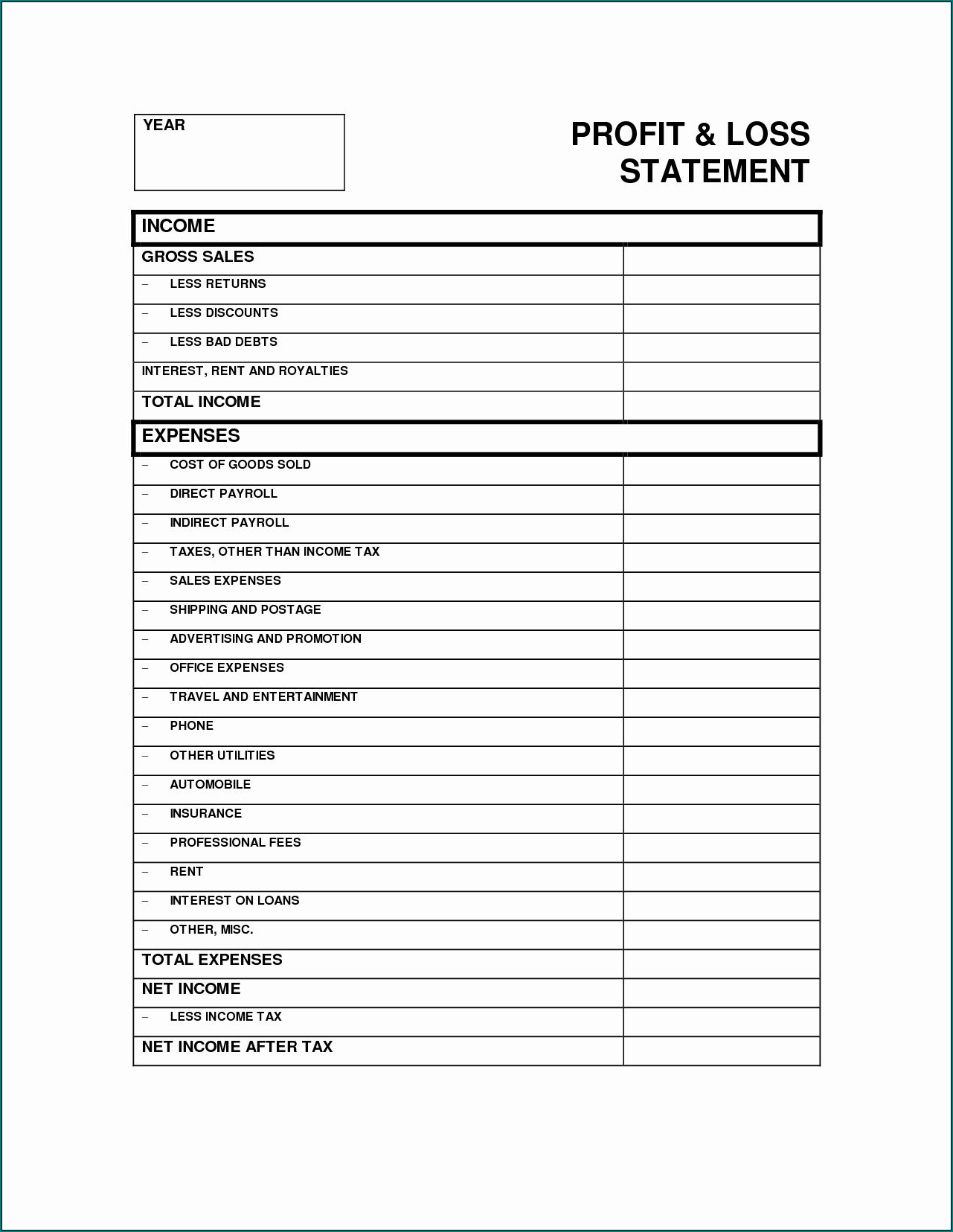

The record incorporates deals or turnover, less expense of deals, which will give you a gross profit figure. You at that point deduct every one of the overhead costs and profit installments to furnish you with either a Profit or Loss figure.

Prior to You Fill Out Your Profit and Loss Template, Some Questions to Consider:

How would you as of now handle stock? Does your stock technique permit you to figure/or precisely gauge the amount of merchandise sold?

It is safe to say that you are ready to compute precisely what number of merchandise or administrations were sold during the time-frame you’re utilizing?

Do you have records of general costs, like gear rental, office space rental and regularly scheduled installments you make consistently?

Do you have receipts and data on the entirety of your office’s managerial costs – like paper, staplers, and different supplies?

Do you think enough about these exchanges that you can without much of a stretch separate selling-related costs from outside costs?

What sorts of losses have you encountered? On the off chance that you own a retail store, did you incorporate things that have been harmed and/or taken? In case you’re an online dealer, what sorts of chargeback expenses would you say you are paying? These are each of the a piece of working together, so don’t forget about them.

Samples of Basic Profit And Loss Template :

Try not to allow little costs to drop off the radar, by the same token. Without a doubt, a hurry to the workplace supply store for paper or elastic bands may appear to be an inconsequential cost, yet these costs consistently add up. Keep your receipts, including what you’ve bought using a loan, and try to incorporate credit installments in your rundown of costs.

Basic Profit And Loss Template | Excel download