A profit and loss statement is one of the major money related records t cap is set up by entrepreneurs or their bookkeepers. Entrepreneurs and bookkeepers use it the same. This is significant on the grounds that it can unmistakably show the money related accomplishment of your business over some stretch of time – and it can likewise show where you’re missing the mark. For instance, numerous online retailers consider the Xmas season to be the most significant season for their exchange, and saving a salary statement for this time span can assist them with checking their own profits against the ebb and flow patterns in their industry. A few months, a retailer will find that they are scarcely equaling the initial investment. In any case, on the off chance that you incorporate a whole quarter of deals, costs, and profits, you may locate that by and large, your business is dominating.

A profit and loss statement is a significant method of working out not just how your business has been acting before, yet for foreseeing how it will act later on. It tends to be significant in helping you make a yearly salary projection, and can be utilized to help show financial specialists and loan bosses why they ought to jump aboard with your business.

Eventually, the motivation behind a P&L statement is to ascertain your net working profit or loss.

On the off chance that you make a profit, fantastic! You can re-contribute it, spare it, or settle on an assortment of different choices. On the off chance that you end up with a loss, it’s an unmistakable sign that your business is on an impractical direction, and you’ll have to figure out how to make something happen.

Yet, on head of that, a P&L can be utilized to assist you with settling on educated choices like:

Would you be able to bear to enlist any new representatives?

Would you be able to stand to move to a greater office?

In what manner will you plan your duties?

Is your present development technique compelling?

The P&L statement can likewise have extra uses relying upon who’s taking a gander at it.

For instance, financial specialists will take a gander at your P&L statements from numerous time spans to perceive how profitable your business is after some time. They can likewise gather data about the productivity of your activities, your intensity, and the sufficiency of your plan of action.

Banks will take a gander at P&L statements to decide if your business is probably going to make a profit later on sufficiently large to take care of credits and premium.

One final significant note about P&L statements is that they don’t speak to your business’ money related wellbeing without anyone else. They may reflect it sometimes, yet they can be slanted (or misdirecting) by charging rehearses or false revealing of exchanges (if deliberate).

That is the reason it’s essential to understand every one of the three significant fiscal reports that I referenced toward the start.

Instructions to break down a profit and loss statement

It’s hard not to be threatened by your P&L statement. Regardless of whether you know the terms, how would you arrange the information to gain any huge statements on business ground?

However, it’s basic to investigate your profit and loss statements.

A nitty gritty investigation of your profit and loss statement can uncover bits of knowledge into your business execution, hailing qualities, and shortcomings. In addition, you can likewise utilize your profit and loss statement to look at your organization against comparative organizations and make industry benchmarks.

Indeed, the US Small Business Administration recommends printing your P&L statement routinely to screen business execution.

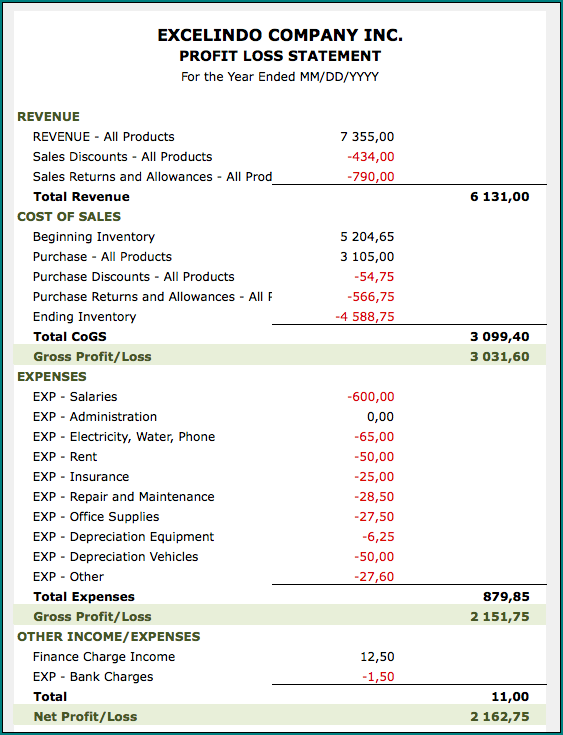

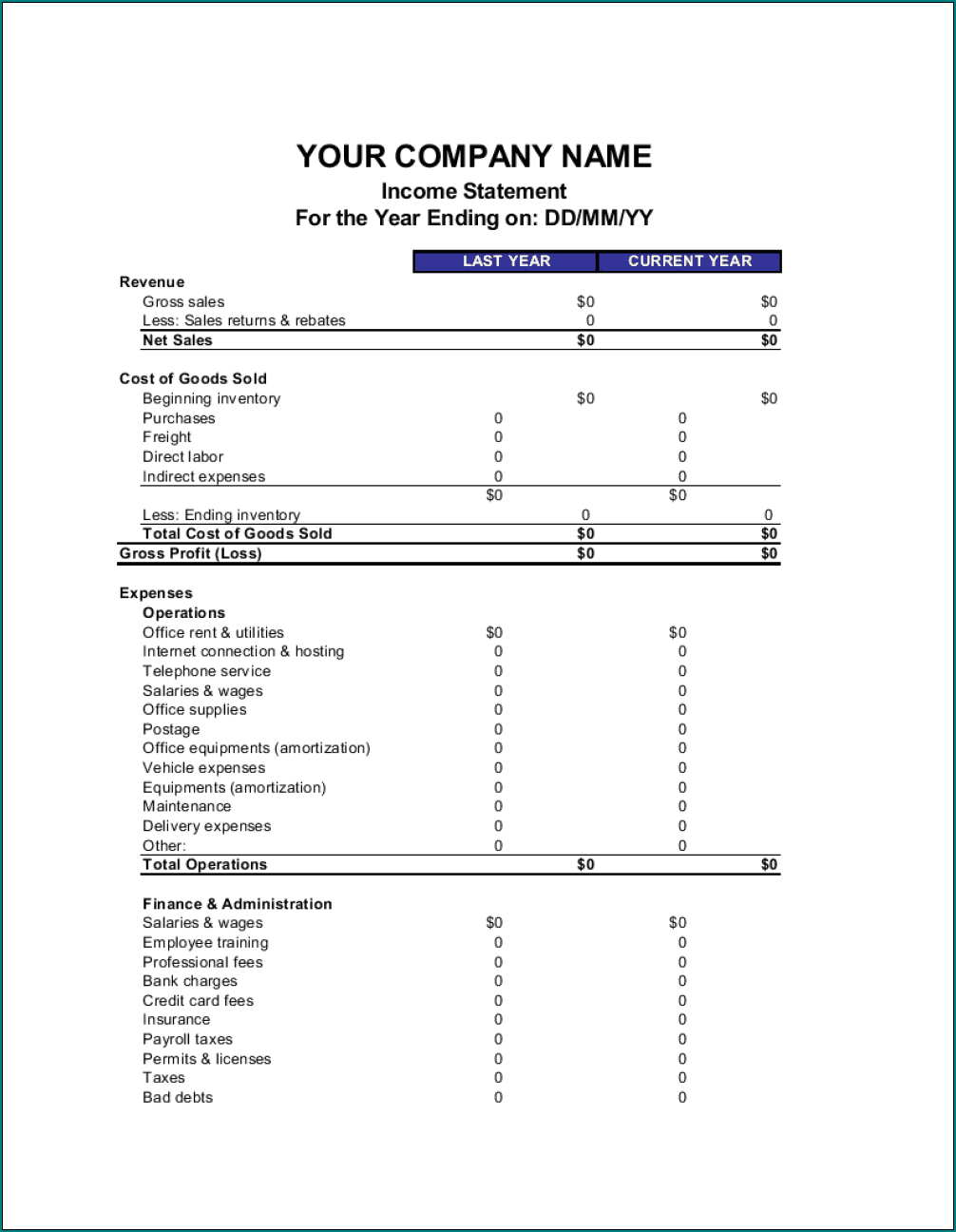

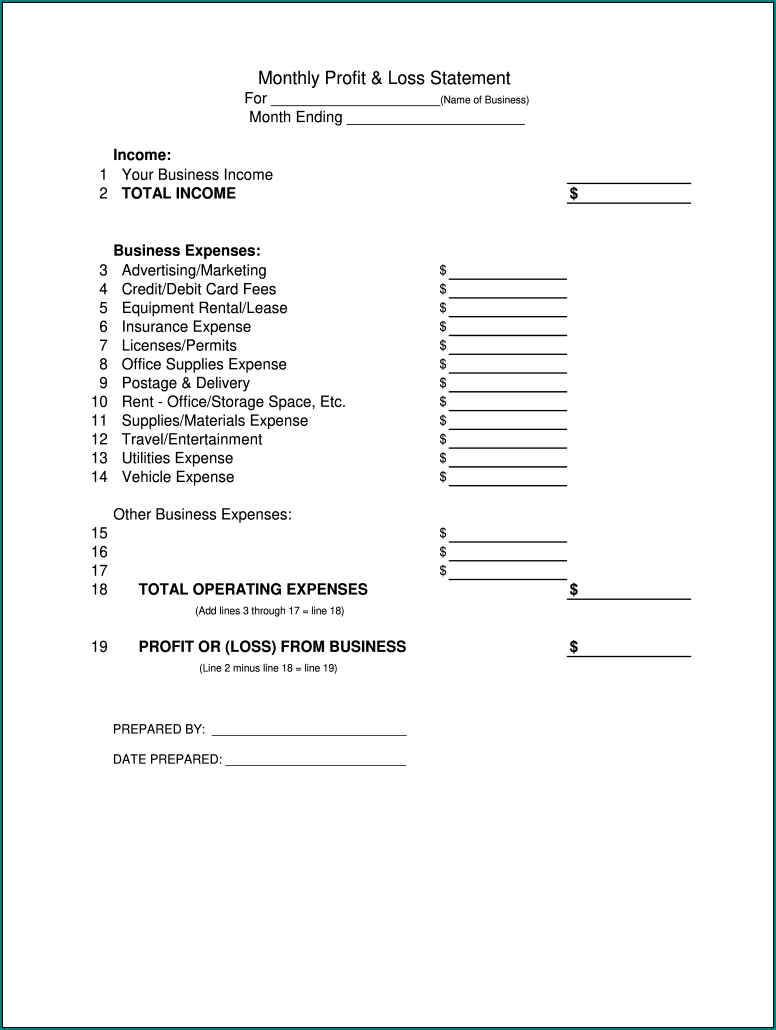

Samples of Basic Profit And Loss Statement Template :

Playing out a P&L analyisis

We’ve assembled probably the best approaches to play out a P&L statement examination:

Year-on-year correlations. Investigate exceptional changes, e.g., drop in deals

Contemplating patterns. What’s the direction of your business? Are your methodologies paying off? Contrasting yearly execution will assist you with deciding if income is becoming quicker than costs, for example.

Projections. Consider utilizing your P&L statement to help venture future incomes.

Assessing edges, e.g., net profit edge

Deals: study your standout months. Are there a specific drivers of achievement? For example, did you twofold down on promoting, causing a knock in deals?

Costs. Are there approaches to diminish costs? What are the greatest costs? Does this bode well for your business?

Pay. Are your salary sources practical?

Analyzing these numbers can give you a smart thought about the monetary strength of your business.

Basic Profit And Loss Statement Template | Excel download