Creating a basic monthly budget template is an essential tool for managing your finances effectively. By having a clear understanding of your income and expenses, you can make informed decisions about where to allocate your money each month. Whether you are trying to save for a specific goal, pay off debt, or simply live within your means, a budget template can help you stay on track.

What is a Basic Monthly Budget Template?

A basic monthly budget template is a simple tool that helps you track your income and expenses over a set period, typically one month. It allows you to see where your money is going and identify areas where you can cut back or reallocate funds. The template typically includes categories for income, fixed expenses (such as rent or mortgage payments), variable expenses (like groceries and entertainment), savings, and any debt payments.

The Purpose of a Basic Monthly Budget Template

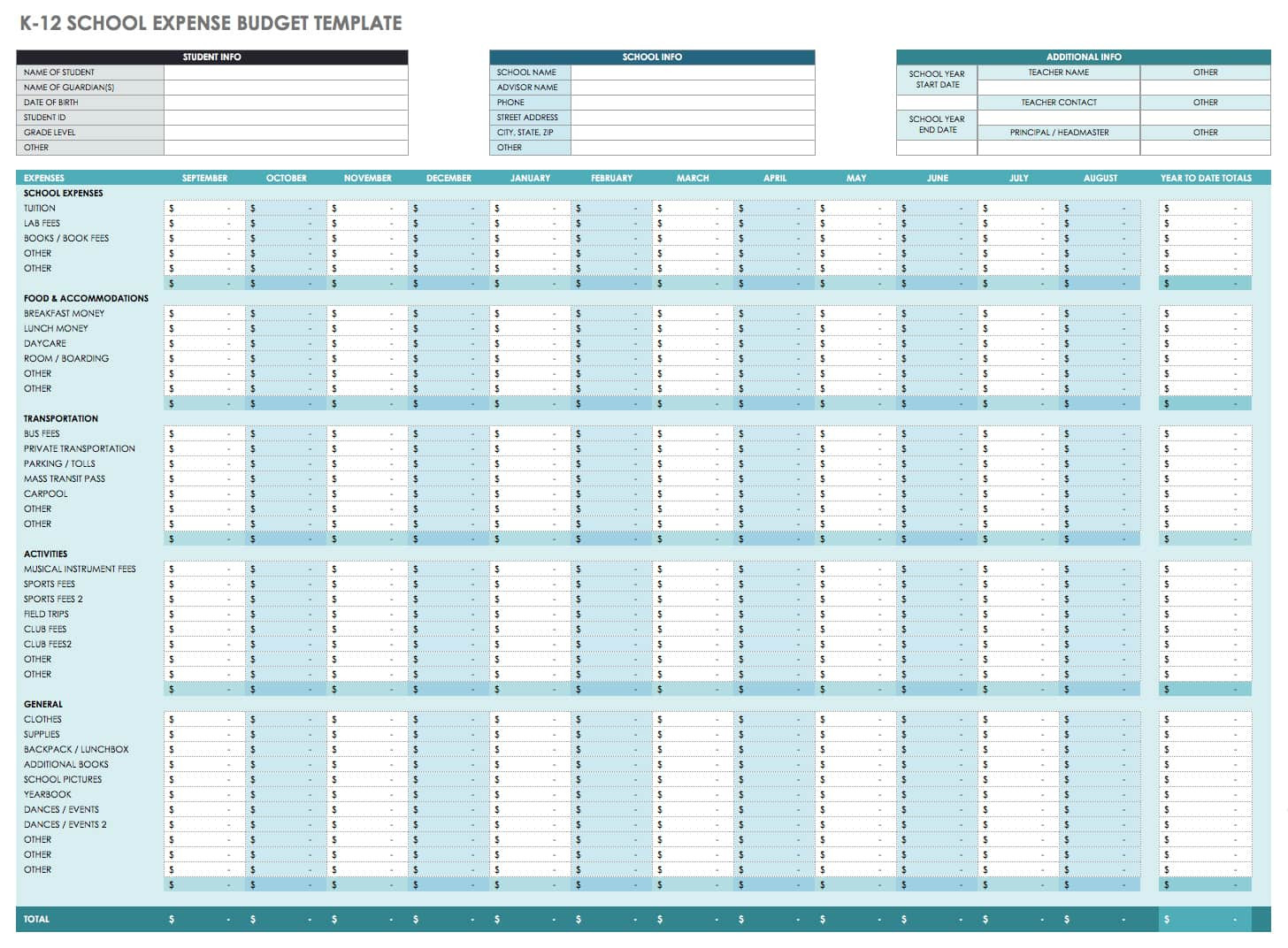

Image Source: smartsheet.com

The main purpose of a basic monthly budget template is to give you a clear overview of your financial situation. By tracking your income and expenses, you can see how much money you have coming in each month and where it is being spent. This can help you identify any areas of overspending, prioritize your expenses, and make adjustments as needed to reach your financial goals.

Why You Should Use a Basic Monthly Budget Template

Using a basic monthly budget template can provide numerous benefits when it comes to managing your finances. Some of the key reasons why you should consider using a budget template include:

Image Source: abbyorganizes.com

1. Financial Awareness: A budget template helps you become more aware of your financial habits and can highlight areas where you may be overspending.

2. Goal Setting: With a budget template, you can set specific financial goals and track your progress towards achieving them.

3. Debt Management: By tracking your expenses, you can allocate funds towards paying off debt more effectively.

4. Emergency Planning: A budget template can help you build an emergency fund by setting aside money for unexpected expenses.

5. Peace of Mind: Knowing exactly where your money is going can give you peace of mind and reduce financial stress.

How to Create a Basic Monthly Budget Template

Creating a basic monthly budget template is a straightforward process that can be customized to fit your individual financial situation. Follow these steps to get started:

Image Source: canva.com

1. Calculate Your Income: Start by calculating your total monthly income, including wages, bonuses, and any other sources of income.

2. List Your Expenses: Create categories for your expenses, such as housing, utilities, groceries, transportation, entertainment, and savings.

3. Track Your Spending: Keep a record of your expenses for a month to get an accurate picture of where your money is going.

4. Adjust as Needed: Review your budget regularly and make adjustments as needed to ensure you are staying on track with your financial goals.

Tips for Successful Budgeting

To make the most of your basic monthly budget template, consider the following tips for successful budgeting:

Image Source: etsystatic.com

1. Be Realistic: Set realistic goals and expectations for your budget to avoid feeling discouraged.

2. Monitor Your Progress: Regularly review your budget to track your progress and make adjustments as needed.

3. Plan for the Unexpected: Include a category for unexpected expenses in your budget to cover any surprises.

4. Celebrate Achievements: Acknowledge and celebrate your financial milestones to stay motivated.

5. Seek Professional Help: If you are struggling with budgeting, consider seeking help from a financial advisor or counselor.

6. Stay Consistent: Consistency is key to successful budgeting, so make it a habit to update and review your budget regularly.

7. Stay Flexible: Life changes, and so should your budget. Be prepared to adjust your budget as your financial situation evolves.

8. Be Patient: Building a solid financial foundation takes time, so be patient with yourself and your progress.

By following these guidelines and utilizing a basic monthly budget template, you can take control of your finances and work towards a more secure financial future. Remember, budgeting is a tool to help you achieve your financial goals, so make it work for you by customizing it to fit your needs and lifestyle.

Image Source: generalblue.com

Image Source: etsystatic.com

Image Source: canva.com

Image Source: squarespace-cdn.com

Image Source: canva.com