Have you at any time read of direct Deposit? Otherwise, it is fundamentally a simple solution to deposit your money in your bank account, with no obtaining to bother with wasting any time or energy to really go to the bank for these types of transactions. Extra and even more individuals are choosing do have their paychecks, payments and such directly deposited by way of the bank, electronically.

Depositing your cash will be created much much easier and you simply won’t must be concerned about getting to add a bank stop by to your schedule in the working day and even more troublesome, losing your paycheck! The process of direct deposit also takes place to be a whole lot more rapidly which means you will be able to get hold of your resources to the exact same working day since they had been deposited.

For making matters clearer, let us have an case in point. Should you be a small organization owner, you most likely make payments to distinct individuals – say, suppliers and employees. With for those who set-up a direct deposit arrangement with them, you can be capable to send out payments in your suppliers and salaries in your workforce simply, by means of direct deposit with out having to spend time visiting the bank.

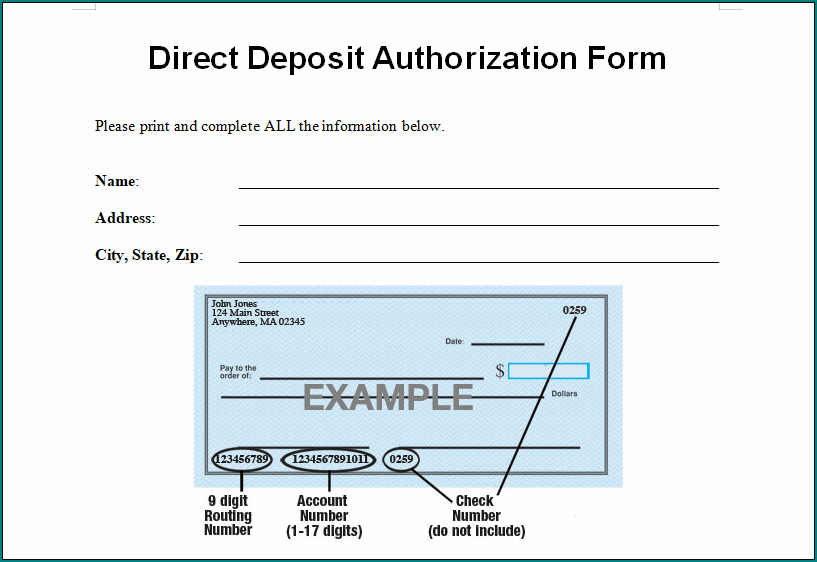

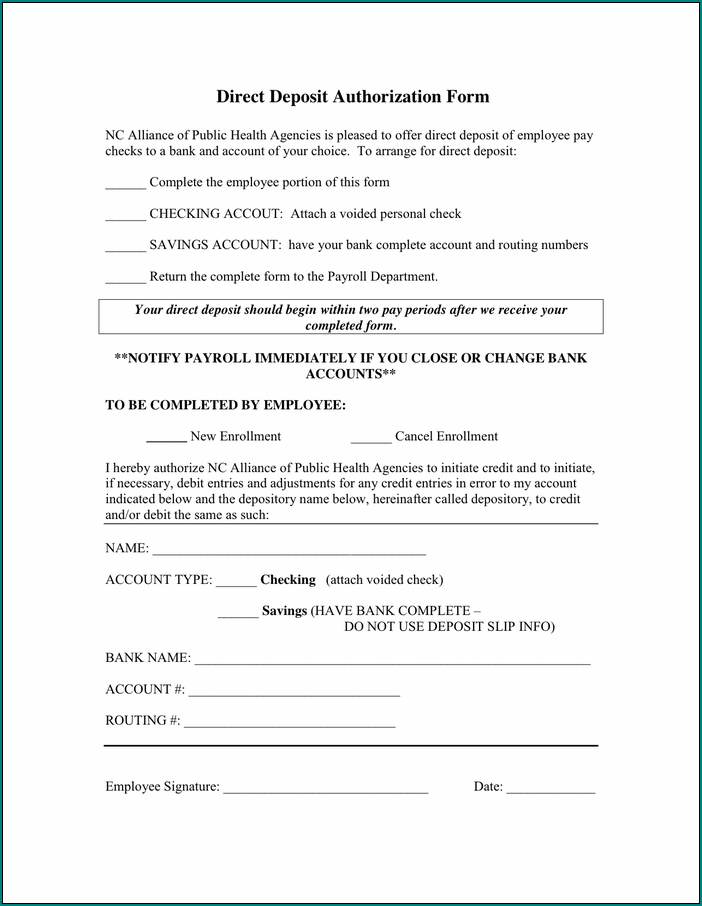

All you have to do is enroll or set-up a approach with the bank to generally be ready to transfer money electronically. For being equipped to perform this, however, you would need to replenish a direct deposit authorization form. This may give your bank the authority to deposit cash both from a account or towards your account electronically.

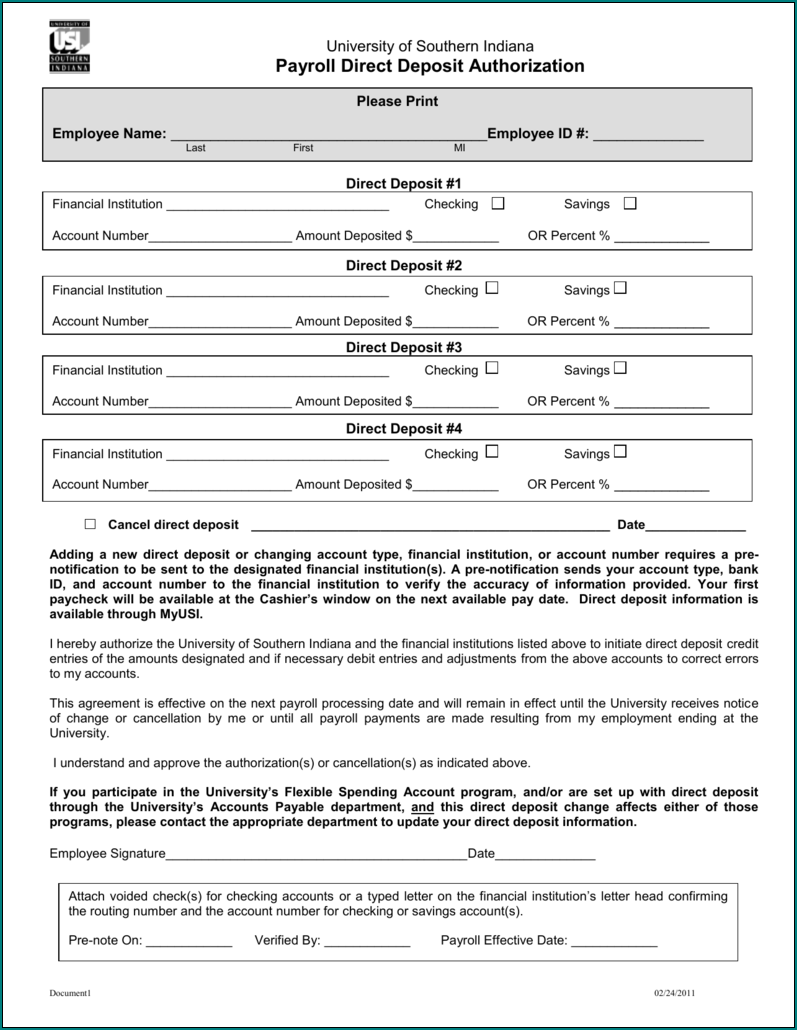

To assist you out, this article will deliver you with significantly needed specifics of some great benefits of direct deposit and every little thing with regards to the forms you’d should refill. There are different forms of direct deposit authorization type templates – payroll direct deposit authorization form, generic direct deposit kind, and employee direct deposit variety, that will be talked over in additional element additional on. So read through on and become guided about this topic.

Samples of Bank Letter For Direct Deposit :

The advantages of a direct Deposit

Ahead of going on into the distinct sorts included in putting together your direct deposit on the bank, let us evaluate the many great things about making use of this process. When you would see, it might be substantially extra convenient so that you can essentially pick out direct deposit about the more traditional method of bodily browsing your bank when you will need to try and do transactions.

Listed here would be the diverse advantages of direct deposit:

Faster Accessibility to Money. When you have your paychecks processed through direct deposit, the test will get cleared right away, which suggests your money goes straight into your account appropriate away. When your fork out continues to be prepared, it goes straight into your account, which implies that you simply can receive your pay out quite a bit earlier than your coworkers who receive paychecks in the course of paydays.

Get Payments Just before Holidays. Direct deposit procedures are often made sooner than your paydays, which signify that whether or not your payday falls over a getaway, you may continue to obtain your pay since it goes straight on your account suitable soon after it is processed.

Receive a Chance to Earn Benefits. Several banks truly offer you promotions or reward factors for their clients should they insert the direct deposit characteristic to their accounts. It is possible to reap the benefits of this perk and earn reward points anytime you make transactions, which could possibly be effective for yourself from the extended run.

No Routine maintenance Service fees. direct deposit takes out the need to manage checks, which suggests you will not need to pay costs for examine handling. What’s more, it augments the money movement of banks so that they won’t be charging you for individual banking charges. Monthly servicing fees might be waived in certain situations in the event you agree to have your paychecks be directly deposited on your account and you simply might even be qualified for enhanced fascination costs.

Be Additional Aware About your Price savings. You can be capable of manage your money a lot much better by means of direct deposit. For those who create your direct deposit to put dollars into unique accounts – the ones you utilize for expending, the just one you utilize for savings and this kind of, your money are going to be mechanically deposited in them and you also should be able to boost your discounts very quickly.

Make Payments in time. Very similar with saving, it is possible to set-up your direct deposit so that your payments are deposited out of your account at the right moments. This could offer you a great standing with regards to payments therefore you won’t really need to be concerned about delays.

Be Improved at Budgeting. Preparing to save lots of up for a thing special, just like a trip, an auto or perhaps a residence? It might be less difficult to do that with direct deposit. All it’s important to do is open up an account and set it up making sure that a part of your paycheck goes specifically into that account each and every payday. In undertaking this, you can even be ready to specify the amount which fits into your investing account and given that you keep on with that, you’d be less likely to overspend on issues you never essentially require.

It’s No cost and straightforward. Obtaining direct deposit set-up within your account is completely free and without the need of any concealed fees. The identical quantity of money you get each individual payday could well be exactly the same as being the amount of money which would be on the look at. It is also pretty uncomplicated to established it up, all you require is to fill out a direct deposit authorization sort and submit it on your bank.

It Will save Time and cash and It’s Environment-Friendly. direct deposit truly can make payment and bookkeeping processes a lot easier for employers. Acquiring to organize and give out checks can be very monotonous particularly if your workplace provides a large amount of employees. Also, picking out direct deposit gets rid of the necessity for checks, conserving a lot of paper and ink, which contributes to saving the natural environment.

Under no circumstances Reduce Your Checks. If you pick digital transactions, you will not must stress about dealing with – or more importantly, dropping your checks. Checks can possibly get lost during the mail or else you can even misplace your checks effortlessly.

Prevent Delays and Enhance Productivity. In some cases paychecks are specified at the end of the working day, resulting in workers to obtain to remain with the business afterwards than they’ve got to only to obtain paid. This can be equally frustrating and inconvenient. Also, staff won’t must pay a visit to their financial institutions in order to deposit their checks in the course of breaks or perhaps remaining absent in order to set a go to for the bank. If staff are compensated by direct deposit, then they may be assured that their shell out goes for their account on time.

Transforming Banks Can be Less difficult. With direct deposit, modifying banking companies might be a simple course of action. All you’d need to do is acquire a payroll direct deposit authorization sort or an worker direct deposit authorization kind, fill it up with your new bank’s information and also have your employer reroute your paychecks towards your new financial institution.

Take pleasure in Safety and flexibility. You won’t really need to question your employer to problem you a new paycheck in case you dropped yours or it bought lost from the mail. You’d know in which your money goes in any way instances, regardless of whether you have selected to acquire your shell out split into diverse accounts. Also, it doesn’t just have to be to your paychecks; you should utilize direct deposit for different applications.

Effortless Access for your Funds. Through on-line or cell banking, you may right away assessment all of the payments which go into your accounts, all you will need to do is indicator in. This implies you won’t really have to pour through paper spend slips when you will need to critique your finances.

Your Privateness is Ensured. There may be no way everyone at function may have obtain in your financial data because your pay back goes straight from the employer on your have private account.

Bank Letter For Direct Deposit | Word download