Auto insurance verification letters are essential documents that serve as proof of insurance coverage for your vehicle. Whether you are buying a new car, renewing your policy, or dealing with a traffic violation, having a verification letter can save you time and hassle.

In this article, we will delve into the details of auto insurance verification letters, their purpose, why they are important, how to obtain one, and provide tips for successful verification.

What is an Auto Insurance Verification Letter?

Image Source: legaltemplates.net

An auto insurance verification letter is a document your insurance company provides that confirms your coverage and policy details. State departments often request this letter of motor vehicles (DMV), law enforcement agencies, and other entities to verify that you have valid auto insurance. It typically includes information such as your policy number, coverage limits, effective dates, and the name of the insured driver.

The Purpose of Auto Insurance Verification Letters

The primary purpose of an auto insurance verification letter is to demonstrate that you meet the minimum insurance requirements set by your state. These letters are used to prove financial responsibility in case of an accident or traffic violation. You may face fines, license suspension, or other penalties without a verification letter. Additionally, verification letters are often required when registering a vehicle or obtaining a driver’s license.

Why Are Auto Insurance Verification Letters Important?

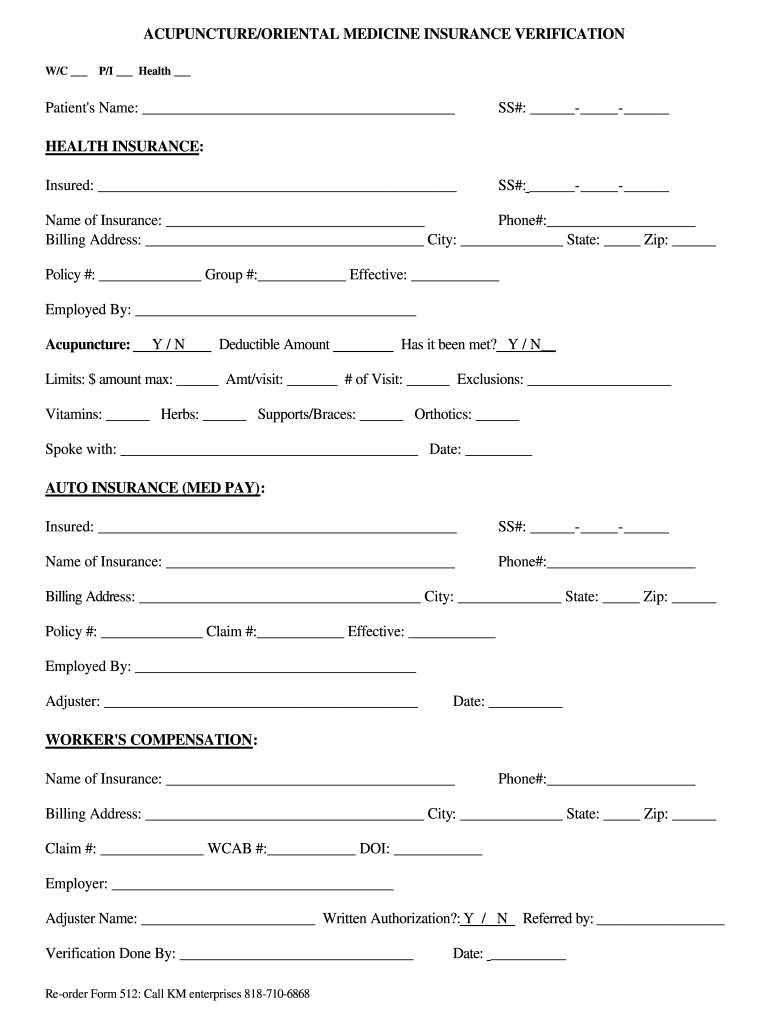

Image Source: pdffiller.com

Auto insurance verification letters play a crucial role in ensuring that drivers are compliant with state laws and regulations. By providing proof of insurance coverage, you can avoid legal issues and financial consequences. In the event of an accident, having a verification letter can expedite the claims process and protect you from liability. It also gives peace of mind knowing that you are adequately covered in case of unforeseen circumstances.

How to Obtain an Auto Insurance Verification Letter

Obtaining an auto insurance verification letter is a straightforward process. Simply contact your insurance provider and request a copy of the letter. You can usually receive it via email, fax, or regular mail, depending on your preference. Make sure to provide accurate information, such as your policy number and vehicle details, to ensure that the letter is valid. Keep a copy of the verification letter in your vehicle at all times for easy access when needed.

Tips for Successful Auto Insurance Verification

Image Source: insure-rite.com

- Double-check the information: Before requesting a verification letter, review your policy details to ensure accuracy.

- Keep it up to date: Update your verification letter whenever there are changes to your policy, such as coverage limits or vehicle additions.

- Know the requirements: Familiarize yourself with your state’s insurance laws and regulations to avoid any issues with verification.

- Be proactive: Request a verification letter in advance if you anticipate needing it for vehicle registration or license renewal.

- Store it safely: Keep a digital and physical copy of your verification letter in a secure location for easy retrieval.

Conclusion

Auto insurance verification letters are essential documents that provide proof of insurance coverage and financial responsibility. By understanding their purpose, importance, and how to obtain one, you can ensure compliance with state laws and protect yourself from legal consequences. Follow the tips outlined in this article for successful verification and peace of mind on the road. Remember, having a verification letter on hand can save you time and hassle in various situations related to your vehicle and insurance coverage.

Image Source: pdffiller.com

Image Source: ytimg.com

Image Source: pdffiller.com

Image Source: pdffiller.com

Image Source: i0.wp.com

Image Source: etsystatic.com

Image Source: eforms.com