Budgeting is a crucial aspect of financial management, helping individuals and families plan and track their expenses to ensure they are living within their means. For many people, creating a budget can be overwhelming and time-consuming, leading them to abandon the process altogether. However, using a bi-weekly budget template can simplify the task and make it more manageable.

What is a Bi-Weekly Budget Template?

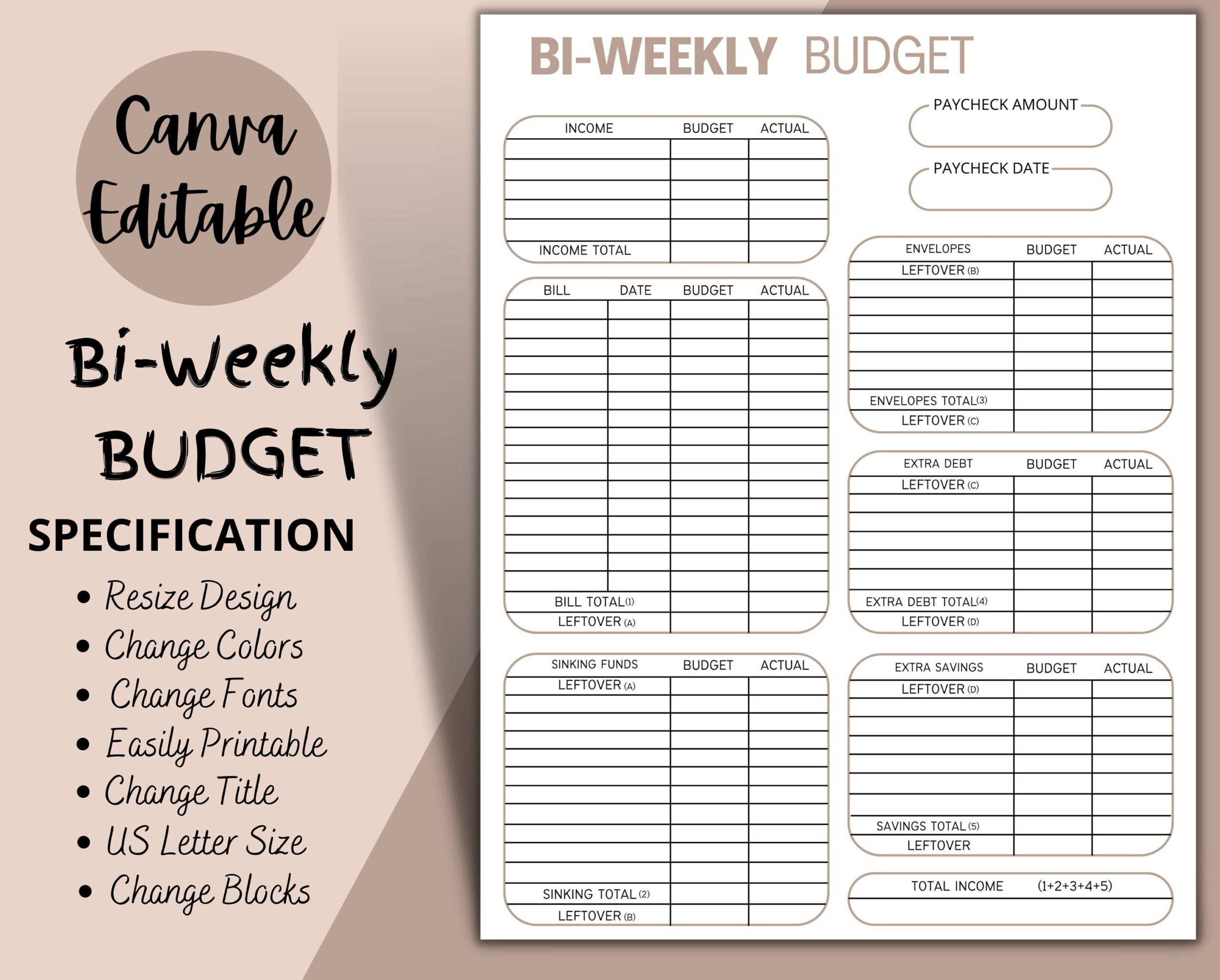

A bi-weekly budget template is a pre-designed spreadsheet or document that helps individuals track and manage their finances on a bi-weekly basis. This template typically includes sections for income, expenses, savings, and debt payments, allowing users to input their financial information and see a clear overview of their budget. By using a bi-weekly budget template, individuals can easily see where their money is going and make adjustments as needed to reach their financial goals.

The Purpose of Using a Bi-Weekly Budget Template

Image Source: etsystatic.com

The primary purpose of using a bi-weekly budget template is to help individuals take control of their finances and make informed decisions about their money. By tracking income and expenses on a bi-weekly basis, individuals can better understand their spending habits, identify areas where they can cut back, and prioritize their financial goals. Additionally, using a budget template can help individuals avoid overspending, build an emergency fund, and save for long-term financial goals such as retirement or buying a home.

Why You Should Use a Bi-Weekly Budget Template

There are several reasons why using a bi-weekly budget template can benefit you in managing your finances effectively. Firstly, a budget template provides a structured framework for tracking your income and expenses, making it easier to see where your money is going. This visibility can help you make informed decisions about spending and saving, ultimately leading to a more secure financial future. Additionally, using a budget template can help you avoid financial stress, prevent overspending, and stay on track with your financial goals.

How to Create and Use a Bi-Weekly Budget Template

Image Source: gdoc.io

Creating a bi-weekly budget template is relatively simple and can be done using a spreadsheet program like Microsoft Excel or Google Sheets. Start by listing all sources of income for the two-week period, including paychecks, bonuses, and any other sources of income. Next, list all expenses such as rent, utilities, groceries, entertainment, and debt payments. Subtract your total expenses from your total income to determine if you have a surplus or a deficit. Make adjustments as needed to ensure that your expenses do not exceed your income.

1. Determine Your Financial Goals

Before creating your bi-weekly budget template, take some time to identify your financial goals. Whether you want to pay off debt, save for a vacation, or build an emergency fund, having clear goals in mind will help you prioritize your spending and stay motivated to stick to your budget.

2. Track Your Spending

Image Source: myminimalplanner.com

To create an accurate bi-weekly budget, track your spending for a few weeks to see where your money is going. This will help you identify areas where you can cut back and make adjustments to your budget accordingly.

3. Be Realistic

When creating your bi-weekly budget template, be realistic about your income and expenses. Avoid underestimating expenses or overestimating income, as this can lead to a budget that is not sustainable in the long run.

4. Review and Adjust Regularly

Image Source: i2.wp.com

Review your bi-weekly budget regularly to ensure you are staying on track with your financial goals. Make adjustments as needed to accommodate any changes in your income or expenses.

5. Use Envelopes or Apps for Cash Management

Consider using the envelope system or budgeting apps to help you manage cash flow effectively. By allocating cash to specific categories such as groceries or entertainment, you can prevent overspending and stay within your budget.

6. Set Aside Money for Savings

Image Source: notability.com

Make savings a priority in your bi-weekly budget by setting aside a portion of your income for savings or investments. This will help you build an emergency fund and work towards achieving long-term financial goals.

7. Avoid Impulse Purchases

Stick to your budget by avoiding impulse purchases and unnecessary expenses. Before making a purchase, ask yourself if it aligns with your financial goals and if it is worth sacrificing other priorities.

8. Seek Professional Advice if Needed

Image Source: mrsneat.net

If you are struggling to create or stick to a bi-weekly budget, consider seeking advice from a financial advisor or counselor. They can provide personalized guidance and support to help you achieve your financial goals.

Tips for Successful Budgeting with a Bi-Weekly Budget Template

Track Your Expenses. Keep a record of all your expenses to determine where your money is going.

Set Realistic Goals. Establish achievable financial goals that align with your income and expenses.

Monitor Your Progress. Regularly review your budget and make adjustments to ensure you are on track with your goals.

Stay Motivated. Remind yourself of the benefits of budgeting and stay motivated to stick to your financial plan.

Celebrate Your Achievements. Celebrate small victories along the way to keep yourself motivated and engaged in the budgeting process.

Seek Support. Don’t be afraid to ask for help or seek advice from financial professionals if you need assistance with budgeting.

Image Source: generalblue.com

In conclusion, using a bi-weekly budget template can help you take control of your finances, track your income and expenses, and work towards achieving your financial goals. By following the tips outlined in this article and staying committed to your budget, you can build a solid financial foundation and secure your future. Start using a bi-weekly budget template today and see the positive impact it can have on your financial well-being.

Image Source: etsystatic.com

Image Source: etsystatic.com

Image Source: etsystatic.com