Creating a budget is essential for any business to track its expenses, revenue, and overall financial health. A company budget template is a valuable tool that can help streamline the budgeting process and ensure accurate financial planning. Whether you are a small startup or a large corporation, having a well-designed budget template can make a significant difference in managing your finances effectively.

What is a Company Budget Template?

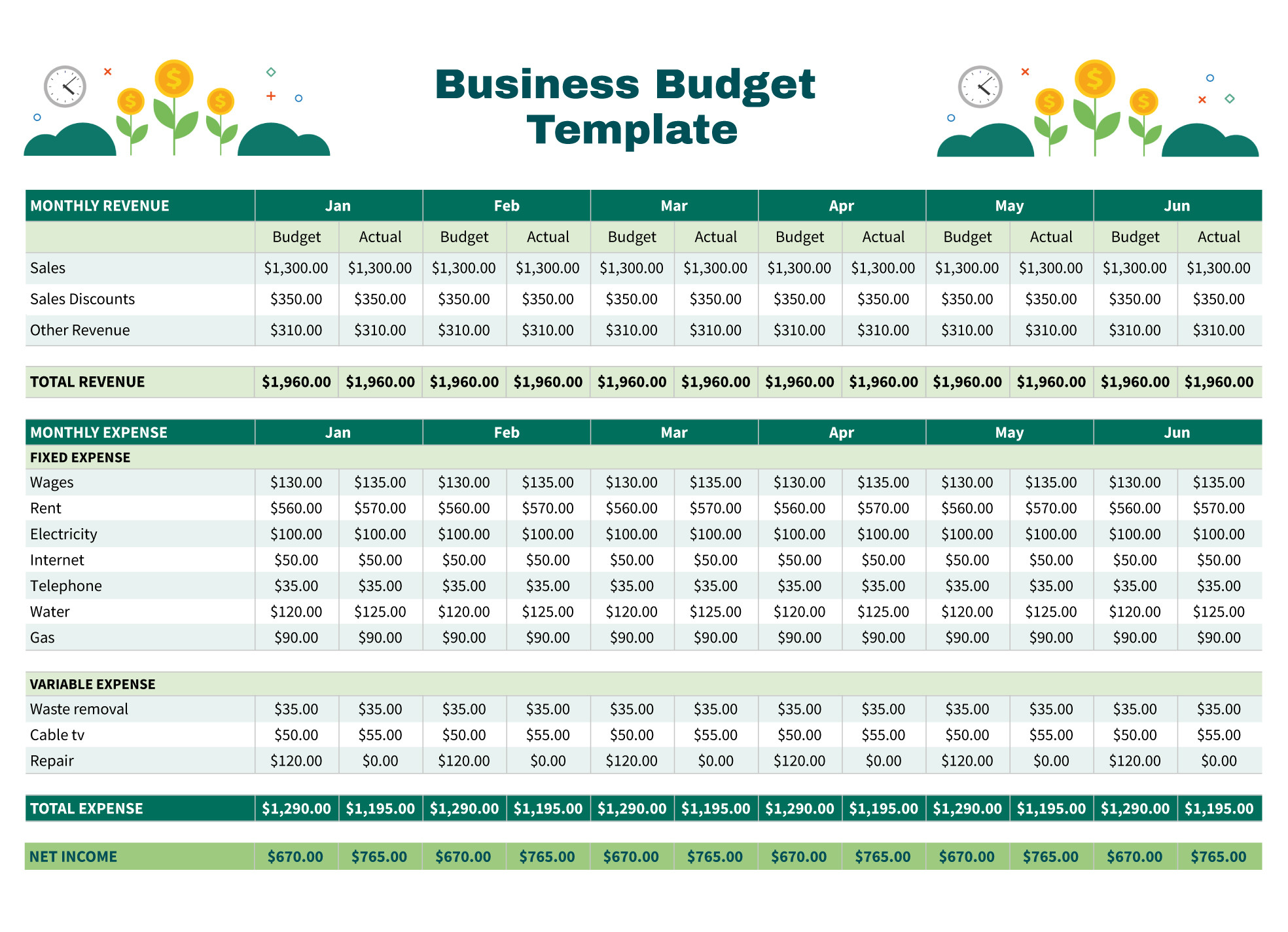

A company budget template is a pre-formatted spreadsheet or document that outlines the expected income and expenses for a specific period, typically a fiscal year. It serves as a roadmap for financial planning and allows businesses to allocate resources efficiently. The template usually includes sections for various categories such as revenue projections, operating expenses, capital expenditures, and cash flow analysis. By using a budget template, companies can monitor their financial performance, identify areas of improvement, and make informed decisions to achieve their financial goals.

The Purpose of Using a Company Budget Template

Image Source: templatelab.com

The primary purpose of using a company budget template is to establish a financial plan that aligns with the business objectives. By detailing income sources and anticipated expenses, the template helps businesses forecast their financial position and make informed decisions about resource allocation. Additionally, a budget template allows companies to track actual financial results against the budgeted figures, enabling them to analyze variances and adjust their strategies accordingly. Overall, the purpose of a company budget template is to promote financial discipline, transparency, and accountability within the organization.

Why You Need a Company Budget Template

Having a company budget template is crucial for several reasons. First and foremost, it provides a structured framework for financial planning, which is essential for the success of any business. A budget template helps businesses set realistic financial goals, monitor their progress, and identify potential risks or opportunities. Moreover, by using a budget template, companies can improve communication among stakeholders, align resources with strategic priorities, and ensure financial stability in the long run. In essence, a company budget template is a valuable tool that can help businesses achieve financial success and sustainability.

How to Create an Effective Company Budget Template

Image Source: generalblue.com

Creating an effective company budget template requires careful planning and attention to detail. Here are some steps to help you develop a comprehensive budget template for your business:

1. Define Your Financial Goals

Before creating a budget template, clearly define your financial goals and objectives. Identify key performance indicators (KPIs) that are relevant to your business and establish measurable targets to track your progress.

2. Gather Financial Data

Image Source: gdoc.io

Collect all relevant financial data, including historical financial statements, revenue forecasts, expense estimates, and cash flow projections. Make sure to verify the accuracy of the data and consider any external factors that may impact your finances.

3. Allocate Resources Wisely

Determine how you will allocate resources across different categories such as marketing, operations, human resources, and capital investments. Ensure that your budget template reflects realistic assumptions and considers both fixed and variable costs.

4. Monitor and Review Regularly

Image Source: storyblok.com

Once you have created your budget template, monitor your financial performance regularly and compare it against the budgeted figures. Conduct periodic reviews to identify variances, analyze trends, and make adjustments as needed to stay on track.

5. Communicate with Stakeholders

Share your budget template with key stakeholders such as management team, investors, and employees. Keep them informed about the financial goals, performance metrics, and budgetary constraints to foster transparency and accountability.

6. Use Technology to Streamline the Process

Image Source: smartsheet.com

Consider using budgeting software or tools to automate the budgeting process and improve accuracy and efficiency. These tools can help you create dynamic budget templates, generate reports, and perform scenario analysis to make informed decisions.

7. Seek Professional Advice if Needed

If you are unsure about creating a budget template or need assistance with financial planning, consider seeking advice from a financial advisor or accountant. They can provide valuable insights, guidance, and best practices to help you develop a robust budget template for your business.

8. Continuously Improve Your Budgeting Process

Image Source: workfeed.io

Lastly, strive to continuously improve your budgeting process by soliciting feedback from stakeholders, analyzing performance metrics, and incorporating lessons learned into future budget cycles. Adapt your budget template to changing market conditions, business priorities, and growth opportunities to ensure its relevance and effectiveness.

Tips for Successful Budgeting with a Company Budget Template

Set Realistic Goals: Establish achievable financial targets that align with your business objectives.

Track Expenses Closely: Monitor your expenses regularly and identify areas where you can cut costs or reallocate resources.

Stay Flexible: Be prepared to adjust your budget template as needed to respond to changing circumstances or unexpected events.

Involve Stakeholders: Engage key stakeholders in the budgeting process to gain buy-in, foster collaboration, and ensure alignment with strategic goals.

Review and Reflect: Reflect on your budgeting process at the end of each fiscal period, analyze your performance, and identify opportunities for improvement.

Seek Continuous Learning: Stay informed about industry trends, best practices, and new technologies to enhance your budgeting skills and capabilities.

Image Source: smartsheet.com

In conclusion, a company budget template is a vital tool for financial planning, performance monitoring, and decision-making. By creating an effective budget template and following best practices for budgeting, businesses can optimize their financial resources, achieve their financial goals, and sustain long-term success. Whether you are a startup or an established company, investing time and effort in developing a comprehensive budget template can help you navigate the complexities of financial management and drive your business forward.