Business financial planning is the process of creating a roadmap for a company’s financial success. It involves analyzing the current financial situation, setting financial goals, and developing strategies to achieve those goals. This planning process helps businesses make informed decisions about budgeting, investing, and managing their finances.

Why is Business Financial Planning Important?

Business financial planning is essential for several reasons:

1. Financial Stability: By creating a financial plan, businesses can ensure a stable financial future. It helps in managing cash flow, reducing debt, and maintaining a healthy financial position.

2. Goal Setting: Financial planning enables businesses to set realistic financial goals and develop strategies to achieve them. It provides a clear direction and helps in tracking progress towards these goals.

3. Risk Management: Financial planning helps businesses identify potential risks and develop contingency plans to mitigate them. It allows for better risk management and ensures business continuity.

4. Investment Decisions: A well-designed financial plan helps businesses make informed investment decisions. It guides them in choosing the right investment opportunities and maximizing returns.

5. Business Growth: Financial planning plays a crucial role in driving business growth. It helps in identifying expansion opportunities, developing marketing strategies, and allocating resources effectively.

The Process of Business Financial Planning

The process of business financial planning involves several key steps:

1. Assessing the Current Financial Situation

The first step in financial planning is to assess the current financial situation of the business. This includes analyzing income, expenses, assets, liabilities, and cash flow. It helps in understanding the company’s financial strengths and weaknesses.

2. Setting Financial Goals

Once the current financial situation is assessed, businesses need to set clear financial goals. These goals can include increasing revenue, reducing costs, improving profitability, or expanding into new markets. Setting specific, measurable, achievable, relevant, and time-bound (SMART) goals is crucial.

3. Developing a Budget

Based on the financial goals, businesses need to develop a budget that outlines expected revenue and expenses. It helps in allocating resources effectively and monitoring financial performance.

4. Creating an Investment Strategy

Businesses should develop an investment strategy that aligns with their financial goals. This involves identifying suitable investment opportunities, diversifying the investment portfolio, and managing investment risks.

5. Implementing the Financial Plan

Once the financial plan is developed, it needs to be implemented. This involves executing the strategies outlined in the plan, monitoring financial performance, and making necessary adjustments as required.

6. Regular Monitoring and Review

Financial planning is an ongoing process that requires regular monitoring and review. Businesses should regularly track their financial performance, compare it to the set goals, and make adjustments to the plan if necessary.

The Benefits of Business Financial Planning

Business financial planning offers several benefits:

1. Improved Decision-Making: Financial planning provides businesses with the information they need to make informed decisions. It helps in evaluating the financial impact of different options and choosing the best course of action.

2. Increased Profitability: A well-executed financial plan can lead to increased profitability by optimizing revenue generation and cost management.

3. Better Cash Flow Management: Financial planning helps in managing cash flow effectively, ensuring that there is enough liquidity to meet financial obligations.

4. Enhanced Risk Management: By identifying potential risks and developing contingency plans, financial planning helps businesses mitigate risks and protect their financial interests.

5. Improved Stakeholder Confidence: A robust financial plan instills confidence in stakeholders, such as investors, lenders, and employees, who rely on the company’s financial stability.

Final Thoughts

Business financial planning is a critical process that every company should undertake. It helps in achieving financial stability, setting realistic goals, managing risks, making informed investment decisions, and driving business growth. By implementing a comprehensive financial plan, businesses can enhance profitability, improve cash flow management, and gain the confidence of stakeholders. Ultimately, effective financial planning is key to long-term success in today’s competitive business environment.

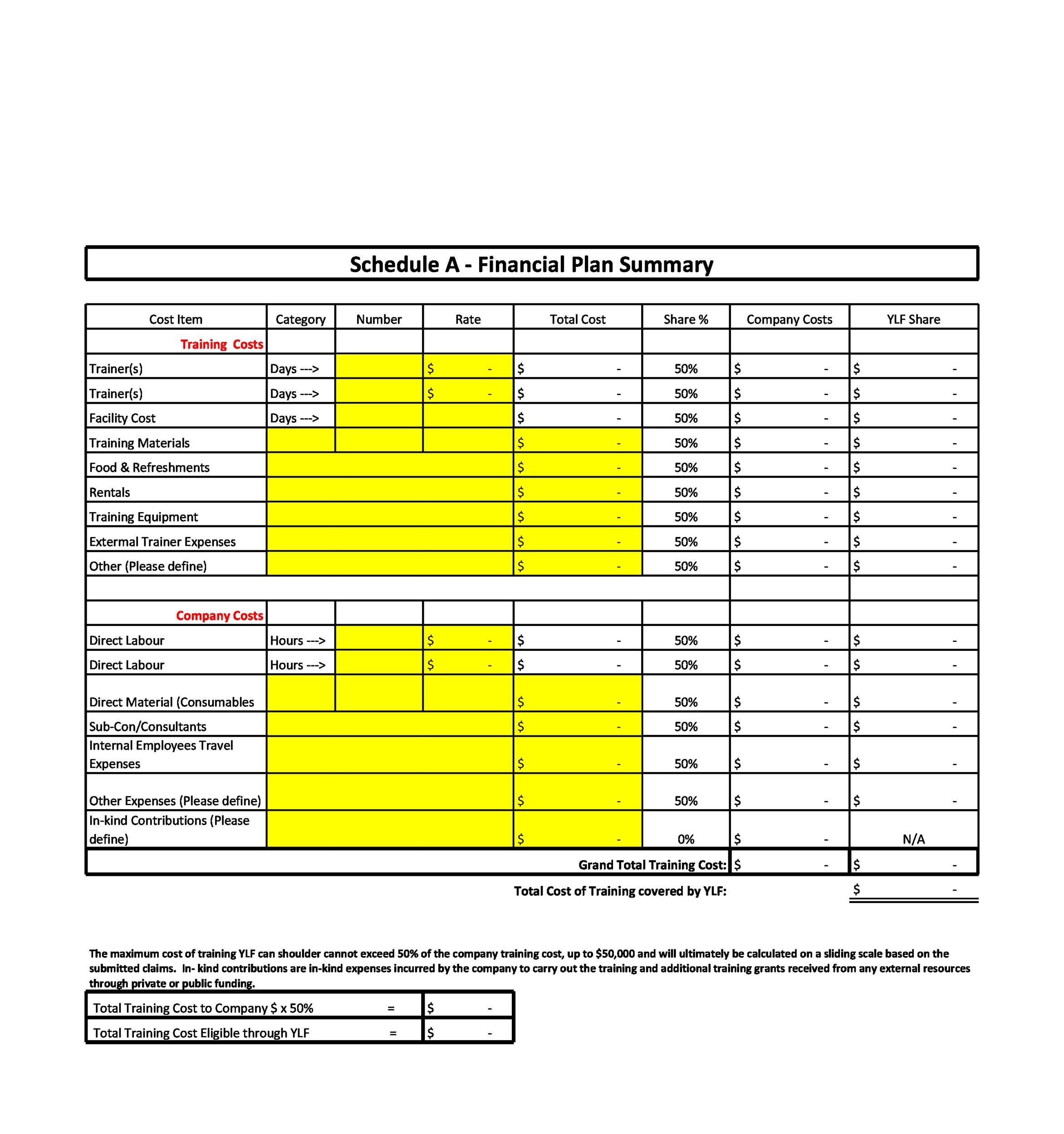

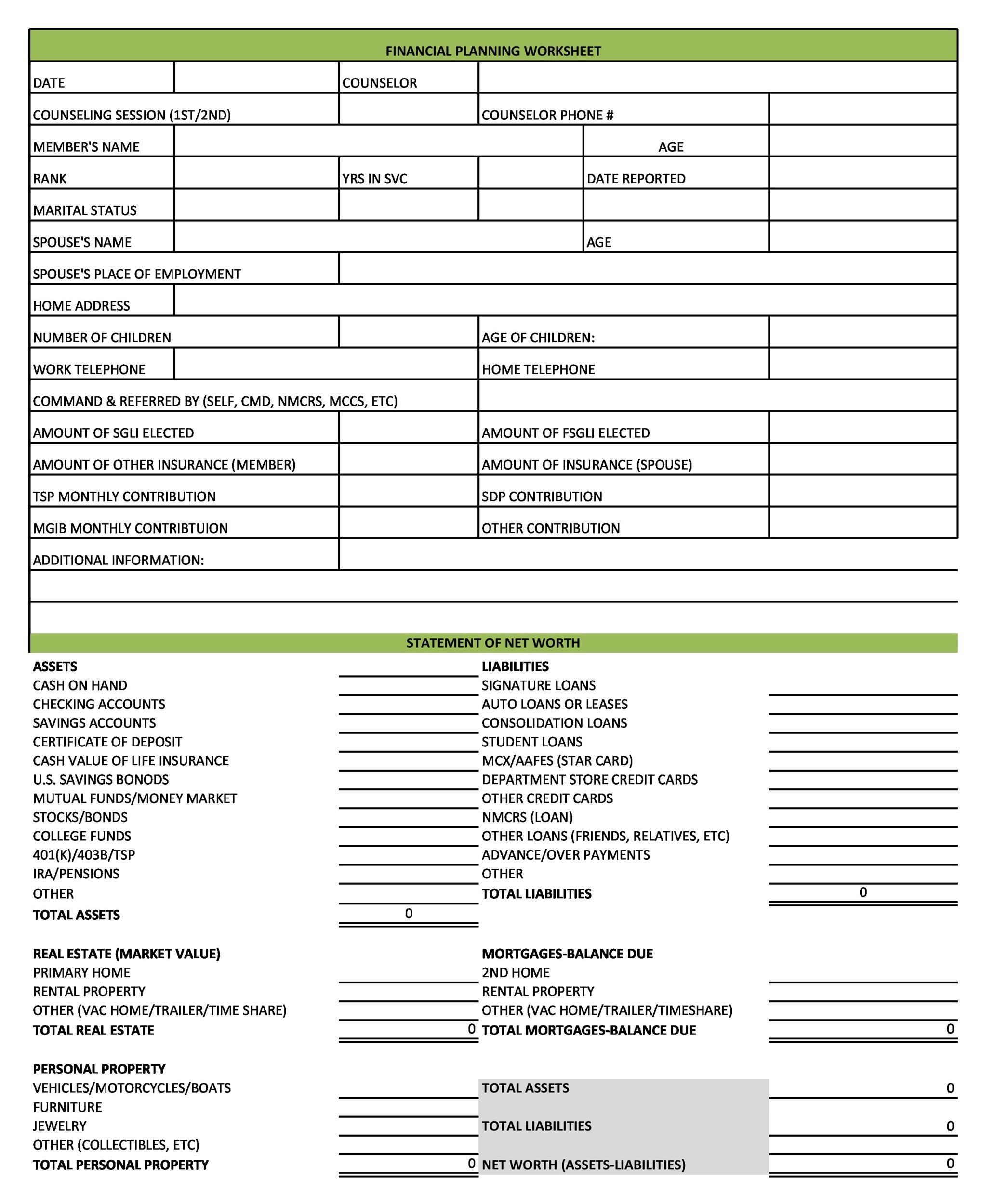

Business Financial Planning Template Excel – Download