On the off chance that you need to assume responsibility for your accounts, it may require in excess of a number cruncher and a scratch pad to deal with your cash. Regardless of whether you live alone, have an enormous family with a great deal of costs, or even maintain your own personal business, having an individual budget set up is a basic initial step to monetary opportunity.

A budget can enable you to perceive what you are at present spending, assist you with coordinating your reserve funds, and figure out what other place you ought to apply your cash.

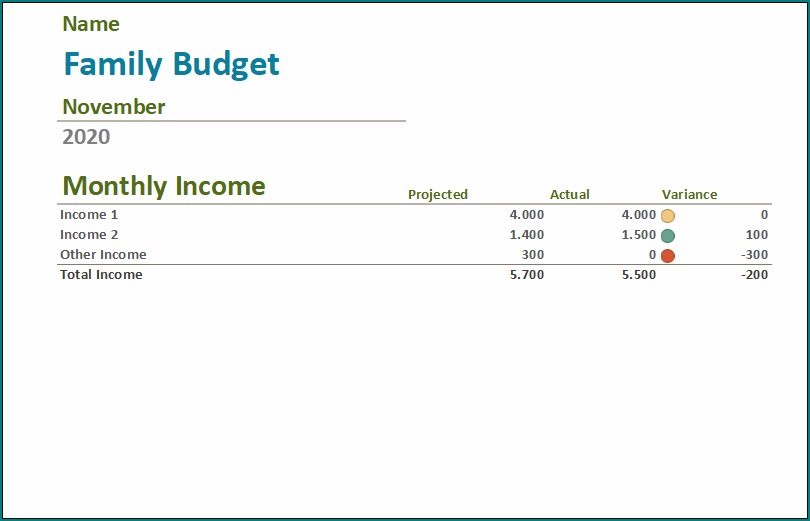

A budget template will assist you with following your month to month pay versus your month to month costs with precision. Utilizing a budget template causes you effectively deal with your cash and know precisely where your cash is going every month.

What Are Family Budget Templates?

A family budget template is a pre-caused answer for help you to order and dissect your family funds for a specific period, for example, a month, quarter, or year. Templates fluctuate in intricacy and highlights yet are commonly planned so that there is a simple to follow configuration to assist you with dealing with your cash.

To put it plainly, an individual budgeting template is intended to be easy to utilize. Envision the entirety of your month to month bills and your approaching money. As you separate your month to month expenses, these should coordinate all around ok with what you have coming in so you can cover your tabs, set aside cash, and meet other monetary objectives.

Advantages of Using an Excel Family Budget Template

We’ve just addressed a couple of the reasons that you should utilize a budgeting arrangement. Nobody needs to live check to check or, more regrettable, find that they are missing the mark toward the finish of consistently. Facing your funds head on is the most ideal approach to reign in your spending and accomplish your objectives. A couple of different advantages of utilizing a budgeting template include:

Get an away from of your ways of managing money. You may have no clue about the amount you are going through every month on caramel macchiatos until you see the figures clearly. The most ideal approach to distinguish runaway spending is to make a budget and track every consumption.

Cut unimportant costs. The subsequent stage is to cut some unnecessary costs from your budget. Perhaps you can lessen eating out from eight to six times each month and lower the sum spent shopping on the web.

Accomplish investment funds and different objectives. At the point when you have the information accessible to follow your spending and lessen costs, you’ll have the option to accomplish some other budgetary objectives. These might incorporate making a crisis investment funds reserve, putting something aside for retirement, paying off past commitments, or putting something aside for a genuinely necessary excursion.

Make basic corrections to budgeting strategies. A budgeting accounting page template will permit you to make snappy and basic changes in accordance with your methodologies. You can change rates and different figures to assist you with bettering deal with your cash as you increase a superior handle of your monetary circumstance.

Samples of Home Budget Worksheet Template :

A budget template is a speedy and simple approach to budget your cash. To begin with, start by recording your complete salary.

At that point snatch the entirety of your month to month charges and record where you are going through your cash.

Basically take your pay short your costs to rapidly observe where your cash is going every month.

Before you begin on utilizing these month to month budget templates, ensure you know why it is so imperative to have a budget.

You can become familiar with all the budgeting tips and deceives you need yet the main thing to begin a straightforward month to month budget.

Home Budget Worksheet Template | Excel download