What Is A Checkbook Register?

A Checkbook register is a valuable report for monitoring your Bank adjusts for individual and business accounts. In basic terms, it records all stores and withdrawals for a given financial records and utilized for performing bank compromise.

The Checkbook Register is an essential archive to stay on top of your financials. It encourages you to look where the cash is coming/going from and what amount is left with you.

A checkbook register is an archive that is utilized to record check numbers, installment dates, and names of payees and installment sums for all check installments. The data in the register is likewise essential in accommodating bank subtleties. It’ll likewise manage on the watches that have been given, those that have been cleared by the bank, and those on the holding up list.

Motivation behind Maintaining A Checkbook Register

Numerous a period, it happens that bank authorities submit a few mix-ups. In the event that you keep up Checkbook Register, you can distinguish those mistakes and get them remedied.

Moreover, you can likewise forestall ricocheting back of checks because of the inaccessibility of equilibrium. Consequently, maintaining a strategic distance from pointless expenses charged for you.

For what reason would it be advisable for you to utilize a checkbook register?

Albeit most organizations lead their exchanges on the web, each organization needs to keep up a checkbook register. This is basic since your accessible equilibrium might be incorrect, other than banks do commit errors, and you may likewise neglect to make passages for certain exchanges.

A checkbook register will support you:

Track your paid obligations by sum and date.

Spot bank botches

Dispose of skiped checks and the related costs

Identify fraud and make the essential move as expected

Track your exchanges and guarantee you have satisfactory cash in your check account.

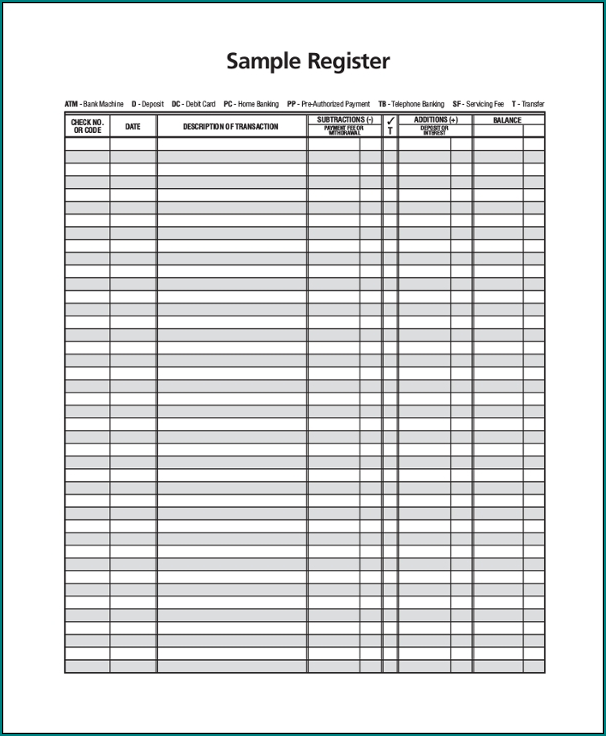

Samples of Checkbook Register Template :

What to remember for a checkbook register?

A checkbook register will ordinarily incorporate the accompanying areas:

Check number: conventionally check numbers follow a sequential request. These numbers for the most part include at the right-hand side of the checkbook register. You’re ready to utilize the check nu be decay track your checks.

Date: this is the day you’ve composed the check. The sections in this segment must be exact to build effectiveness.

Exchanges subtleties: These segments will incorporate essential data about explicit exchanges, for example, the name of the payee, organization, or business.

Installment sum: the specific sum paid is entered in this part.

Pull out sum: on the off chance that you pulled out cash for the financial records for any reason, you should record the subtleties in this part.

Charge sum: any costs related with the exchange ought to be rescored precisely in this section.

Store sum: any cash you store in your financial records ought to be entered in this section.

Move: in case you’re working two records, you have to record any cash you’ve moved starting with one record then onto the next.

Equilibrium: this is one of the basic areas of your checkbook register. It shows data on the exchanges you’ve made and their impact on the financial records.

Checkbook Register Template | Excel download