The profit and loss statement may be a simplified view of a company’s revenue and expenses for a selected accounting period. you’ll report a profit and loss statement on a monthly, quarterly or annual basis. Many self-employed individuals are required to supply a profit and loss statement, also called a P&L Statement, when seeking business loans or financing. you are doing not need an accountant to make a P&L statement. Create statements for your business at your convenience in minutes.

Create the header for your profit and loss statement either by hand, if you’re writing the statement, or within the word-processing application of your choice. Title the report “Profit and Loss Statement” or “Income Statement.” On subsequent line, enter “For the reporting period ending (month) (year).” Center the 2 lines at the highest of the page.

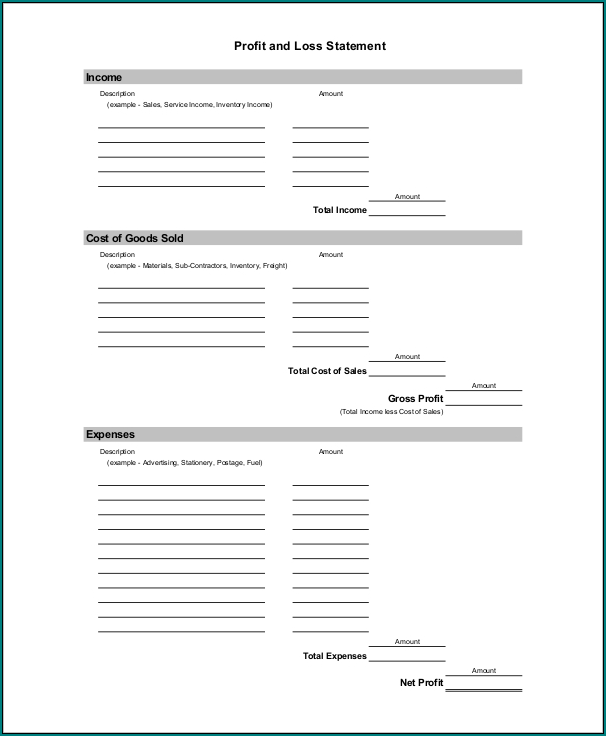

Create a neighborhood on the left margin of the page labeled “Revenue” or “Income.” List every source of income for your business, slightly indented under the section title. If your business has just one source of income, you’ll only need one listing here. If there are multiple sources of income for your business, add a line at rock bottom of the list titled “Total Income” or “Total Revenue” and list the sum of all of your income sources.

Create a neighborhood on the left margin of the page labeled “Expenses.” List your expenses supported the main reporting categories of your accounting records. These categories are going to be things like office expenses, advertising, employee cost, taxes and utilities. List each expense category and therefore the applicable expense amount. Add a line at rock bottom of the list titled “Total Expenses” and list the sum of all of the expense accounts.

Create a line at rock bottom of the report labeled “Net Income.” Subtract the entire expenses from the entire income. If the amount is negative, report it in parenthesis to point out that it’s a negative figure. A positive number constitutes revenue while a negative number reports a loss.

When Do i want to organize a Profit and Loss Statement?

Periodic P&L. Every business must prepare and review its profit and loss statement periodically – a minimum of quarterly . Reviewing the profit and loss statement helps the business make decisions and to organize the business income tax return . Your business income tax return will use the knowledge from the P&L because the basis for the calculation of net , to work out the tax your business must pay.

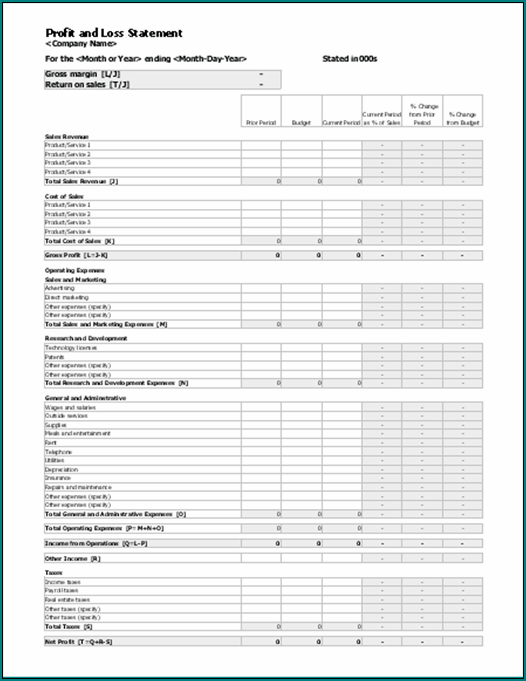

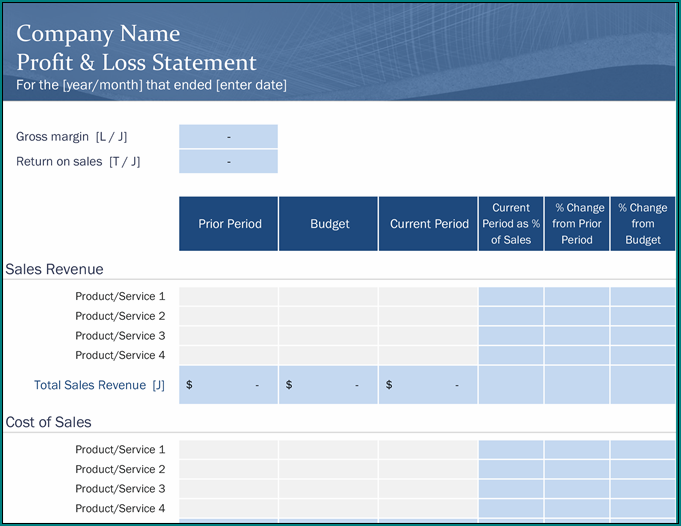

Samples of Year To Date Profit And Loss Statement :

Pro Forma P&L. a replacement business must create a profit and loss statement at startup. This statement is made pro forma, meaning that it’s projected into the longer term . Your business also will need a professional forma P&L when applying for funding for any new business project.

Year To Date Profit And Loss Statement | Excel download