When sending or obtaining payments, you have got various choices. Amongst these solutions, it is possible to use cash, checks, or digital payments. Most businesses prefer that last choice-otherwise recognized to be a direct deposit. In fact, you’re often necessary to implement direct deposit. The good news is, it is a safe and inexpensive payment selection for all associated functions.

Precisely what is Direct Deposit?

Direct deposit is definitely an digital payment from just one bank account to a different. For instance, funds might transfer from an employer’s bank account to an employee’s bank account, although there are actually various other methods to use direct deposit. To finish transfers, banking institutions utilize the Automatic Clearing Home (ACH) network, which coordinates these payments among the banks.

Absolutely Computerized Transactions

When you get funds by using a direct deposit, your account harmony will routinely maximize when the payment comes. You really don’t need to settle for the payment or deposit funds for your account, which would be required should you obtained hard cash or maybe a check. Similarly, once you pay with direct deposit, your checking account equilibrium will mechanically minimize if the payment leaves your bank.

Prevalent Payment Technique

Direct deposit has grown to be more and more well known due to the fact it does absent with pointless paperwork. Billions of ACH payments choose location every single calendar year.? For instance, branches of presidency such as Social Stability Administration, no longer print checks. In its place, they call for that you acquire funds electronically-either via a direct deposit to the examining account or via a reloadable debit card.? Employers of all dimensions enjoy the ease of constructing payments to both equally staff and suppliers by direct deposits.

Explanations to create the Swap

You will discover many explanations for both of those corporations and buyers to implement direct deposit.

Automated Deposits Are Effortless

When obtaining funds by direct deposit, the cash are included to your account without having any action expected on the section. Regardless of whether you are outside of town or far too busy to help make it for the bank, your account will probably be credited.

Going Electronic Will save Funds and Sources

With electronic payments, you don’t must print checks or pay back to mail them. This saves the small business dollars when preserving assets associated with printing checks and transporting them. It is generally cost-free to obtain payments, and sending money by ACH is often cheaper than other available choices.

Digital Information Won’t Fill File Cabinets

That has a direct deposit transaction, absolutely everyone contains a file from the payment. It is simple to see what occurred in your checking account’s transaction historical past. That transaction might be there whenever you need to reference it. You really do not should manually write down information about payments, help you save spend stubs in a file cabinet, or otherwise keep track of paperwork.

Electronic Payments Tend to be more Secure

Nobody can steal a check, alter it, or make an effort to money it when the payment is delivered digitally. The money seamlessly transfer from 1 checking account to a different. When it comes to getting the income from just one bank account into an additional, direct deposits are among the most secure strategies to finish the transaction.

direct Deposits Promptly Complete Transactions

All those receiving paid through direct deposit typically obtain their payment ahead of these obtaining compensated by way of paper verify. The direct deposit may perhaps get there in one payee’s account ahead of a further payee gets a paper sign in the mail. Even if they do arrive on the same time, the paper verify payee should have to take the extra phase of depositing the check out and waiting for those money to crystal clear.

Environment Up direct Deposit to Get Payments

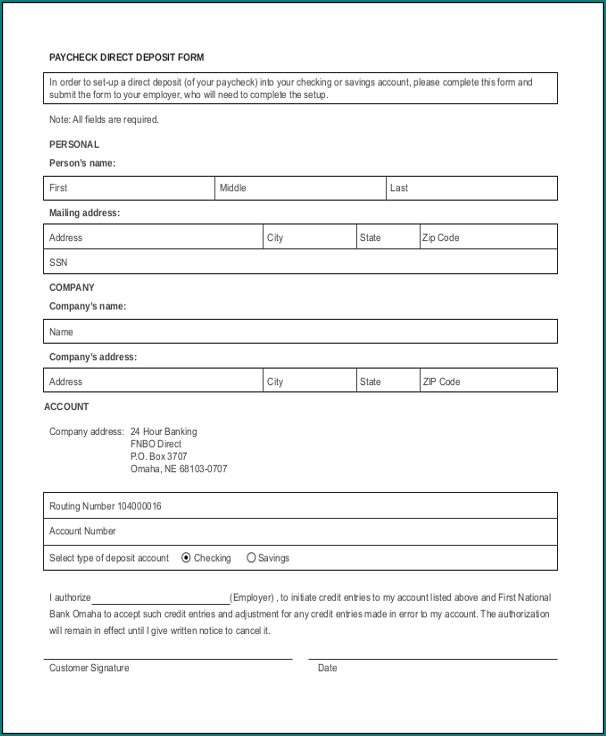

To get payments electronically, you’ll need to supply bank account details to your business that may be paying you. They may demand that you simply use a unique form (this form of being a direct deposit form) or they may request you to supply a voided check out. Occasionally, you can have to provide your account information online.

To obtain payments, you will must deliver the details underneath for the business that will be paying out you.

Bank account number

Routing number

form of account (generally a checking account)

Bank identify and address-you can use any branch of your bank or credit score union you employ

Identify of account holders listed around the account

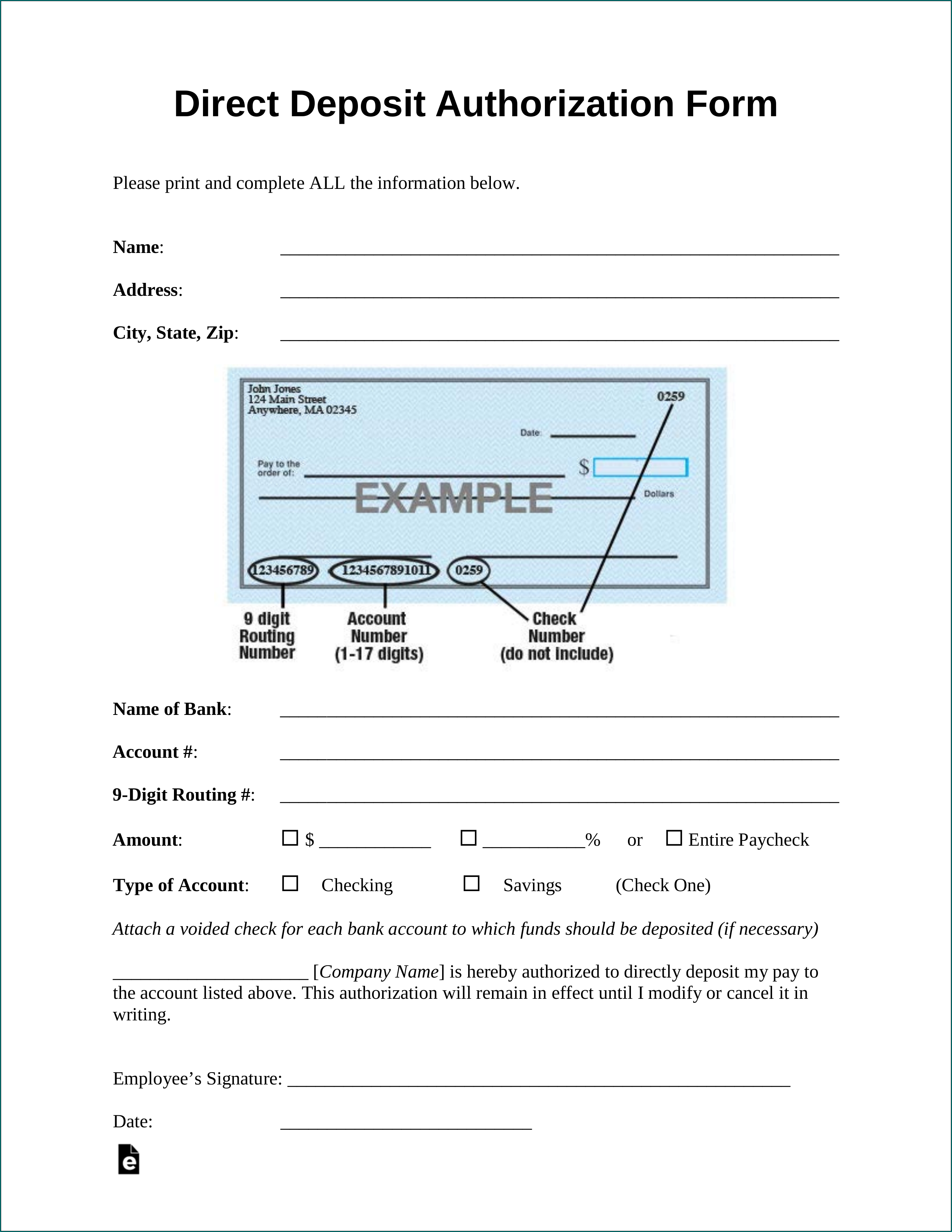

You could obtain most of that data on any private check.

Samples of Bank Direct Deposit Form :

The routing selection usually seems over the entrance from the check out in the base left side. The account quantity will be simply to its proper.? Alternatively, it is possible to connect with your bank and question for direct deposit facts. Particulars are often readily available on line at the same time, but it is best to log in towards your account for exact details.

Setting up direct deposit can take any where in between a couple of days and a few months. Inquire your employer what to anticipate so that you do not glimpse on your payments within the improper area.

The moment anything is set up, your payments will arrive within your bank account automatically. Make sure you check out the out there equilibrium in your checking account ahead of you are trying to spend any of that money. Government payments like tax refunds and Social Stability benefits are typically available quickly, as are payments from companies, though it depends on your own bank.? Other payments may possibly be held to get a number of times.

Bank Direct Deposit Form | Word download