Are you a part of a condo association looking to create a budget template that suits your needs and helps you manage your finances effectively? Developing a comprehensive condo association budget template is crucial for ensuring the financial health and stability of your community. By having a well-structured budget in place, you can plan for expenses, track income, and make informed decisions about future projects and initiatives. In this article, we will explore the purpose of a condo association budget template, why it is essential, how to create one, and tips for successfully managing your budget.

What is a Condo Association Budget Template?

A condo association budget template is a financial planning tool that outlines the anticipated income and expenses for a specific period, typically a fiscal year. This template serves as a roadmap for managing the association’s finances and helps board members and property managers make informed decisions about spending and saving. The template should include categories for revenue sources, such as monthly dues and special assessments, as well as expenses like utilities, maintenance, insurance, and reserves.

The Purpose of a Condo Association Budget Template

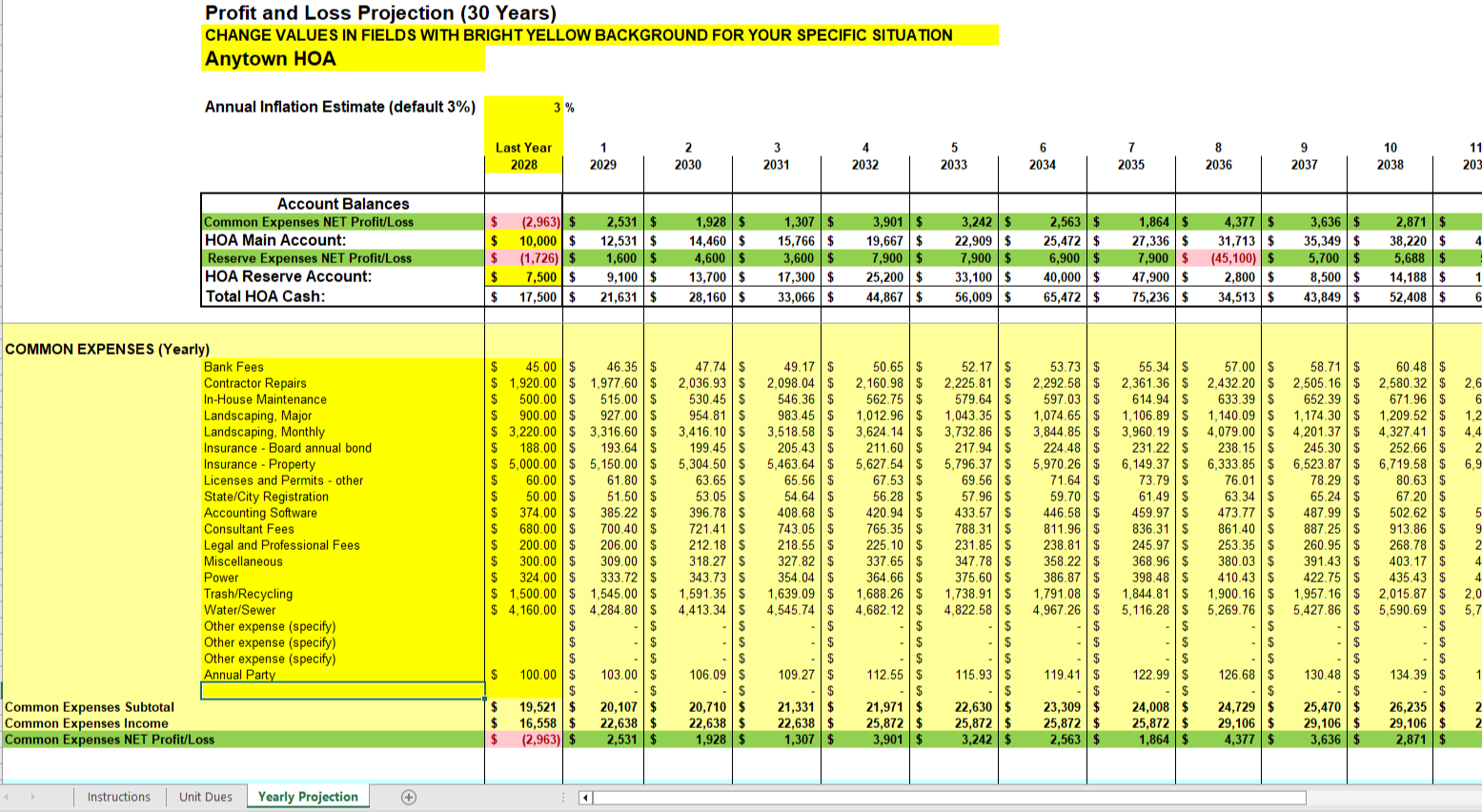

Image Source: moneyminder.com

The primary purpose of a condo association budget template is to provide a clear overview of the association’s financial standing and facilitate strategic financial planning. By creating a budget template, the board can establish financial goals, allocate resources effectively, and prioritize spending based on the community’s needs and priorities. Additionally, the budget template can help identify potential cost savings opportunities, anticipate cash flow fluctuations, and ensure that the association remains financially stable in the long run.

Why is a Condo Association Budget Template Essential?

A condo association budget template is essential for several reasons. Firstly, it helps prevent overspending and ensures that the association operates within its financial means. By having a budget in place, the board can avoid financial surprises, mitigate risks, and maintain transparency with residents regarding financial decisions. Furthermore, a well-documented budget can help the association secure financing for major projects, demonstrate fiscal responsibility to lenders, and build trust among homeowners.

How to Create a Condo Association Budget Template

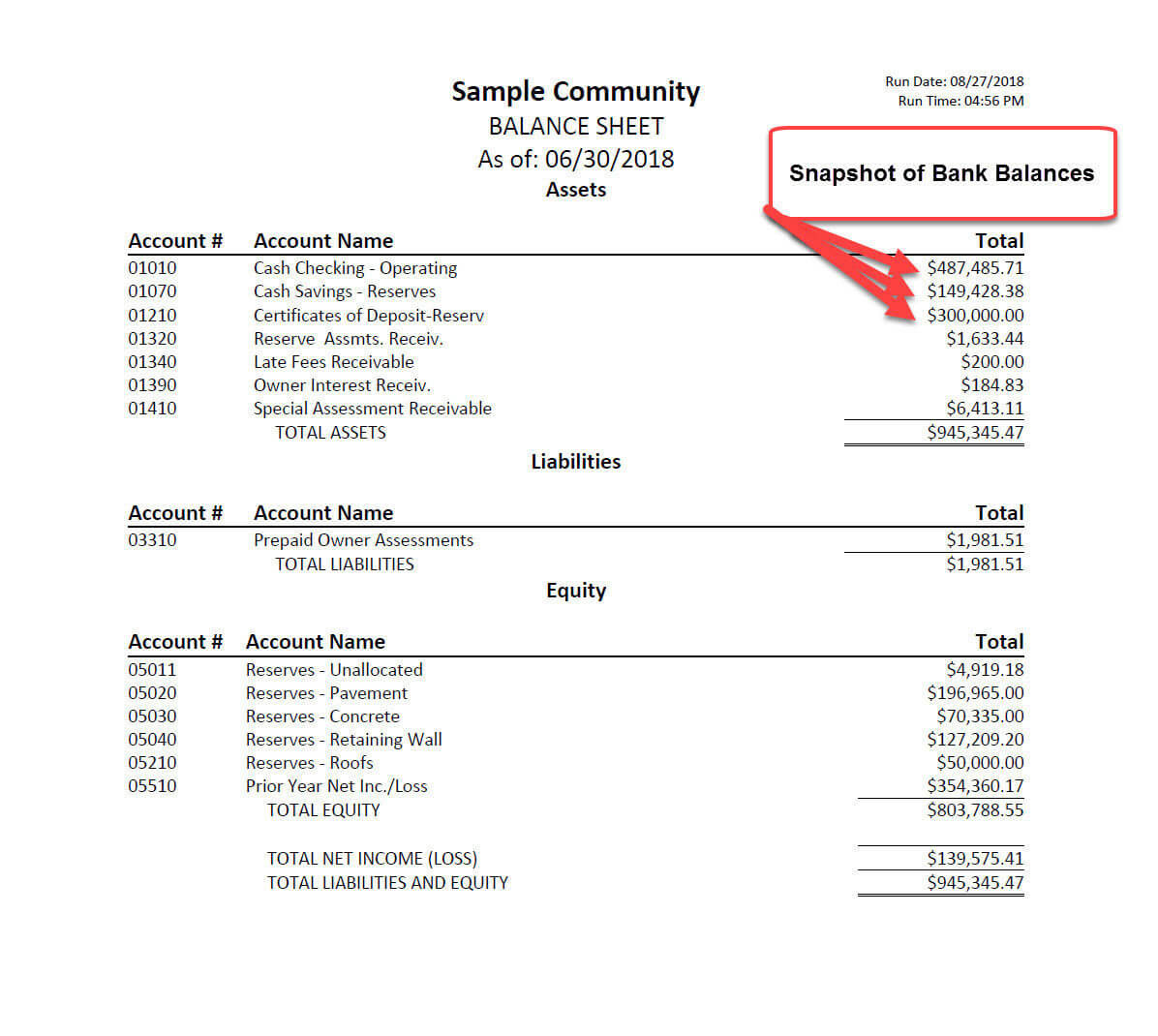

Image Source: communityfinancials.com

Creating a condo association budget template requires careful analysis of the association’s financial history, current expenses, and future needs. Here are some steps to help you develop an effective budget template for your community:

1. Review Financial Statements

Before creating a budget template, review the association’s financial statements from previous years to understand revenue trends, expense patterns, and areas of potential improvement.

2. Identify Budget Categories

Image Source: cheapreservestudy.com

Determine the key budget categories for your template, such as operating expenses, capital expenditures, reserves, and contingencies. Customize the categories to align with the specific needs of your association.

3. Estimate Income Sources

List all sources of income for the association, including monthly dues, special assessments, rental income, interest earnings, and any other revenue streams. Estimate the amount of income expected from each source.

4. Project Expenses

Image Source: communityfinancials.com

Forecast the association’s expenses for the upcoming year, taking into account regular maintenance costs, utilities, insurance premiums, legal fees, and any planned capital improvements. Be sure to allocate funds for contingencies and unexpected expenses.

5. Calculate Reserves

Determine the amount of reserves needed to cover major repairs, replacement projects, and emergency situations. Make sure to prioritize building up reserves to ensure the long-term financial health of the association.

6. Review and Finalize

Image Source: pinimg.com

Once you have outlined all income and expenses, review the budget template with the board members, property manager, and financial advisor. Make any necessary adjustments, finalize the budget, and seek approval from the association.

7. Monitor and Update Regularly

After implementing the budget template, monitor the association’s financial performance regularly, track actual income and expenses, and make adjustments as needed. Update the budget template annually to reflect changing financial circumstances and priorities.

8. Communicate with Residents

Image Source: communityfinancials.com

Keep residents informed about the association’s budgeting process, financial goals, and outcomes. Provide regular updates on budget performance, financial challenges, and opportunities for resident input or feedback.

Tips for Successful Condo Association Budgeting

To ensure the success of your condo association budget template, consider the following tips:

Image Source: communityfinancials.com

Involve Stakeholders: Engage board members, property managers, and residents in the budgeting process to gain diverse perspectives and foster collaboration.

Be Realistic: Set achievable financial goals, prioritize essential expenses, and avoid overestimating income or underestimating costs.

Plan for the Future: Anticipate future expenses, save for reserves, and consider long-term financial sustainability when creating the budget template.

Seek Professional Advice: Consult with financial experts, accountants, or community association managers for guidance on budgeting best practices and compliance with regulations.

Monitor Performance: Regularly track budget performance, compare actuals to projections, and make adjustments to stay on track and address any financial challenges proactively.

Communicate Transparently: Keep residents informed about budget decisions, financial updates, and the impact of their contributions on the association’s financial health.

In Conclusion

Image Source: pinimg.com

Developing a condo association budget template is a critical step in managing the finances of your community effectively and ensuring long-term financial stability. By following the steps outlined in this article and implementing the tips for successful budgeting, you can create a comprehensive budget template that meets the needs of your association and supports its financial well-being. Remember to review and update the budget template regularly, communicate openly with residents, and seek professional guidance when needed to navigate financial challenges and achieve your community’s financial goals.

Image Source: pinimg.com