For anyone who is starting a company, you frequently get started little and out of your own private pocket. You might generally see that you’ll need to apply for your line of credit history to obtain your business from the ground. Perhaps you happen to be a loan provider for this form of fledgling firms. Whichever facet of your table you happen to be on, you will need an excellent Application form for that condition.

These free of charge organization credit application varieties will let you acquire and arrange the suitable information so both the loan provider and borrower can keep to the identical site and make knowledgeable selections.

How come I would like a Credit application form?

This document is helpful for both financial institution and borrower. Even though pleading or granting a personal loan orally may well be just as successful plus a complete great deal less difficult than drafting a form, an formal application form is likely to make certain all the proper details is collected and organized.

Why Really should I Extend Credit score Applying a Credit rating application form?

Unsure you’re all set to increase credit history? Consider of it this way; you are almost certainly currently undertaking it. Anytime your organization accepts credit card payments, checks and even sends invoices to customers, you are effectively extending credit history. You take these payment forms over the assumption that prospects may have the cash to pay with the transaction. The only big difference is the fact when you’re accepting credit card payments, your service provider account company shoulders the chance. After you lengthen credit as a result of invoices or checks, nevertheless, the risk is transferred to you personally. You are the a person to blame for verifying and accepting payments and taking care of the dangers that come with them.

Some industries, this form of as construction firms or manufacturers, generally lengthen credit history by invoicing. Invoices are generally owing internet 30 days, or thirty days from receipt.

A single with the key good reasons businesses provide credit is usually to enable client aim considerably less on rates and even more on their requires. Getting a credit history option can assist you make extra product sales and enhances your connection together with your client.

It is essential to note that extending credit rating will set you back funds if it is done incorrectly. After you sell something on credit rating, you won’t have immediate reimbursement so you will need to temporarily make up for the price, which ordinarily implies borrowing funds stream from other areas of the working capital.

And if something transpires along with your consumers are not able to pay, it’s possible you’ll stop up expending income on asformment activity along with other costly measures to test to recoup your losses.

Ahead of handing out a credit form to your entire large customers, guantee that you’ve got a authentic organization explanation to increase credit rating. Evaluate the hazards of getting numerous within your bigger consumer default. If a fiscal disaster occurs, will you manage to stay afloat with out counting your exceptional invoices as cash flow? In case you cannot shoulder considerably danger, it might not be the appropriate time and energy to lengthen credit score on your shoppers. Try to be ready to extend credit rating without starting to be overly reliant on it for profits. Put simply, your money stream is your funds circulation, and superb invoices might or might not be paid. Will it damage your cash flow to extend credit that will not be paid out again? If that is so, it may well not be the proper time for you to give credit options in your purchaser base.

What Ought to My Credit rating Application Template Include?

When you are preparing to start a fresh credit plan for your personal buyers, you’ll require to have, and preserve, all of your current customers’ particulars in creating, and often question them when the info is appropriate any time you send the statement during the mail. The applying you use may have important to documentation in the event of fraudulent or delinquent credit score transactions.

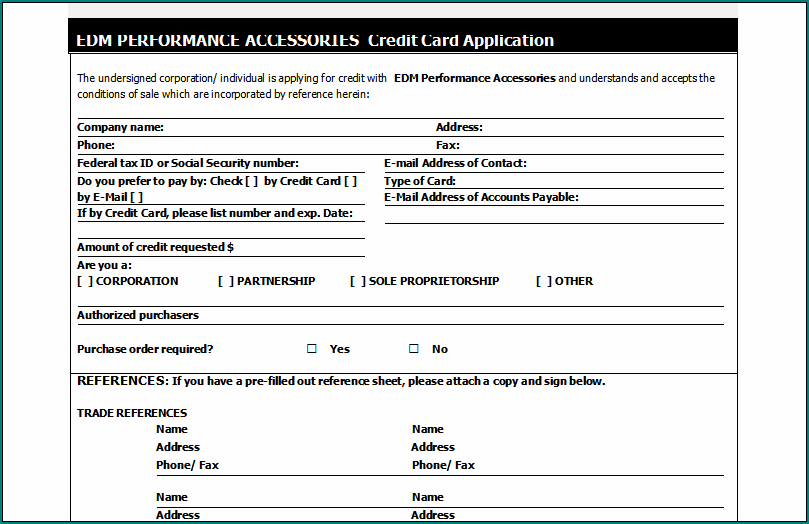

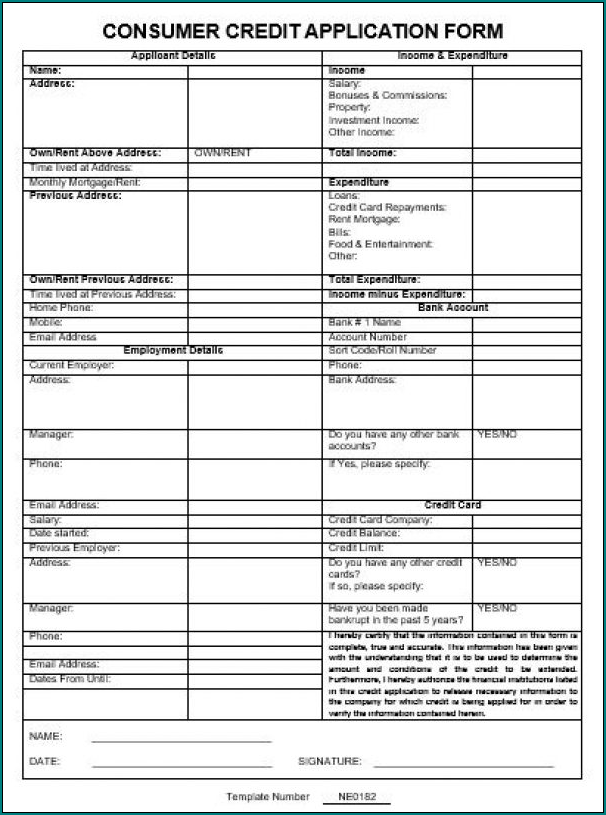

Other facts that you will have to have on the credit application template:

Revenue verification: For people, what this means is that you’ll want tax files, bank statements, or maybe the number of the HR office to verify specifics of work. For businesses, you might question for just a revenue and loss statement, lender statements, tax files, or other information and facts that displays their common gain.

References: You will require to question for economical references. For shoppers applying for credit rating, what this means is banks, credit score accounts, etcetera. For enterprises trying to get credit, this implies distributors and every other collectors that they might have.

Addresses: Addresses that somebody has lived at inside the earlier two yrs are a significant section of pulling a credit report. You are going to desire to understand what states, counties, and towns the individual has lived in so you can pull an exact credit score report. For a organization, you are going to want every one of the addresses the corporate does business at.

Get hold of Cell phone Quantities: For individuals, this will likely be their cell phone, household cell phone, and perform telephone number. For enterprises, you’ll want to get data on that’s chargeable for paying invoices.

Tax ID and also other identifying facts: For individuals, this is certainly their social security form. For corporations, you will want their tax ID and employer ID.

History info, belongings: For individuals, you are going to want the names in their final two businesses, work dates, and any collateral this form of as equity inside a residence. For businesses, you’ll would like to know very well what style of fairness they might give, and exactly how extended they’ve been in small business, and could even ask for backup paperwork this form of for a copy with the marketing strategy.

Signature: This is certainly certainly important. Usually do not system a credit history application with no signature supplying permission in your case to drag a credit rating report.

Own Guarantees: Some people will likely have someone that has a better credit history history co-sign their credit history application forms. That’s wonderful, but you’ll want to get all the info for this particular person, too, ideally on yet another application form. If you are extending credit history to a organization, you’ll want to get particular aspects within the individual chargeable for payment if your company fails to pay in time. This may normally be an officer of the company, the CEO, or someone else in an higher administration place.

Samples of Credit Card Application Form :

When armed with this particular info, you may pull a alternatively thorough credit report for possibly a person or even a organization. Credit studies commonly demonstrate facts with the past seven years. There are actually 3 credit score bureaus for unique people in the usa; Equifax, Transunion, and Experian. Equifax and Experian also have places of work abroad, through Europe, besides an organization named Callcredit Plc . Nowadays, lots of corporations issuing credit will pull and collect a blended credit history report which includes element from three bureaus. For any little organization, this may be much too high-priced to muster. If you’re not sure which bureau to make use of, it’s possible you’ll want to purchase a replica of your respective own credit score experiences and see which bureau seems to possess the most exact, up-to-date facts.

Whenever you pull a credit report for the business enterprise, you will in all probability be utilizing Dunn & Bradstreet to pull the information. It’s the largest and most well-known small business credit bureau in america. Along with a D& B organization report, it’s possible you’ll also would like to pull a company’s Prospectus if they’re publicly traded. It is best to also check out facts on their reputations when it comes to their shoppers. What do people say about them on Yelp? Have they had any Much better Organization Bureau or other complaints? Is the corporation viewed favorably during the media, or have they been plagued with mismanagement and scandals? These aspects can tell you more about the health of the organization than financials can. You are going to be able to tell if a company is in trouble by taking the time to check these out.

Credit Card Application Form | Word download