Budgeting is an essential aspect of managing personal finances, and having a clear budget template can make the process much easier. One popular type of budget template is the 2 person budget template, designed for couples or roommates who want to track their expenses and savings goals together. This template allows both individuals to have a clear view of their financial situation and work towards common financial goals. In this article, we will explore the purpose of a 2 person budget template, why it is important, how to create one, and tips for successful budgeting with a partner.

What is a 2 Person Budget Template?

A 2 person budget template is a tool that helps couples or roommates track their income, expenses, and savings goals together. This template typically includes sections for each individual’s income, shared expenses, personal expenses, savings goals, and a summary of overall finances. By using a 2 person budget template, both individuals can see where their money is going, identify areas where they can save, and work together towards achieving their financial goals.

The Purpose of a 2 Person Budget Template

Image Source: filekitcdn.com

The main purpose of a 2 person budget template is to provide a clear overview of both individuals’ financial situation and help them work together towards common financial goals. By tracking income, expenses, and savings goals in one place, couples or roommates can easily identify areas where they can cut back on spending, increase savings, and make informed financial decisions. Additionally, a 2 person budget template promotes transparency and open communication about money matters, which is essential for a healthy financial relationship.

Why Use a 2 Person Budget Template?

Using a 2 person budget template is important for several reasons. First and foremost, it allows both individuals to have a clear understanding of their financial situation and work together towards common goals. By tracking income and expenses in one place, couples or roommates can avoid misunderstandings about money matters and ensure that both parties are on the same page. Additionally, a 2 person budget template can help identify areas where they can save money, reduce unnecessary expenses, and prioritize savings goals.

How to Create a 2 Person Budget Template

Image Source: smartsheet.com

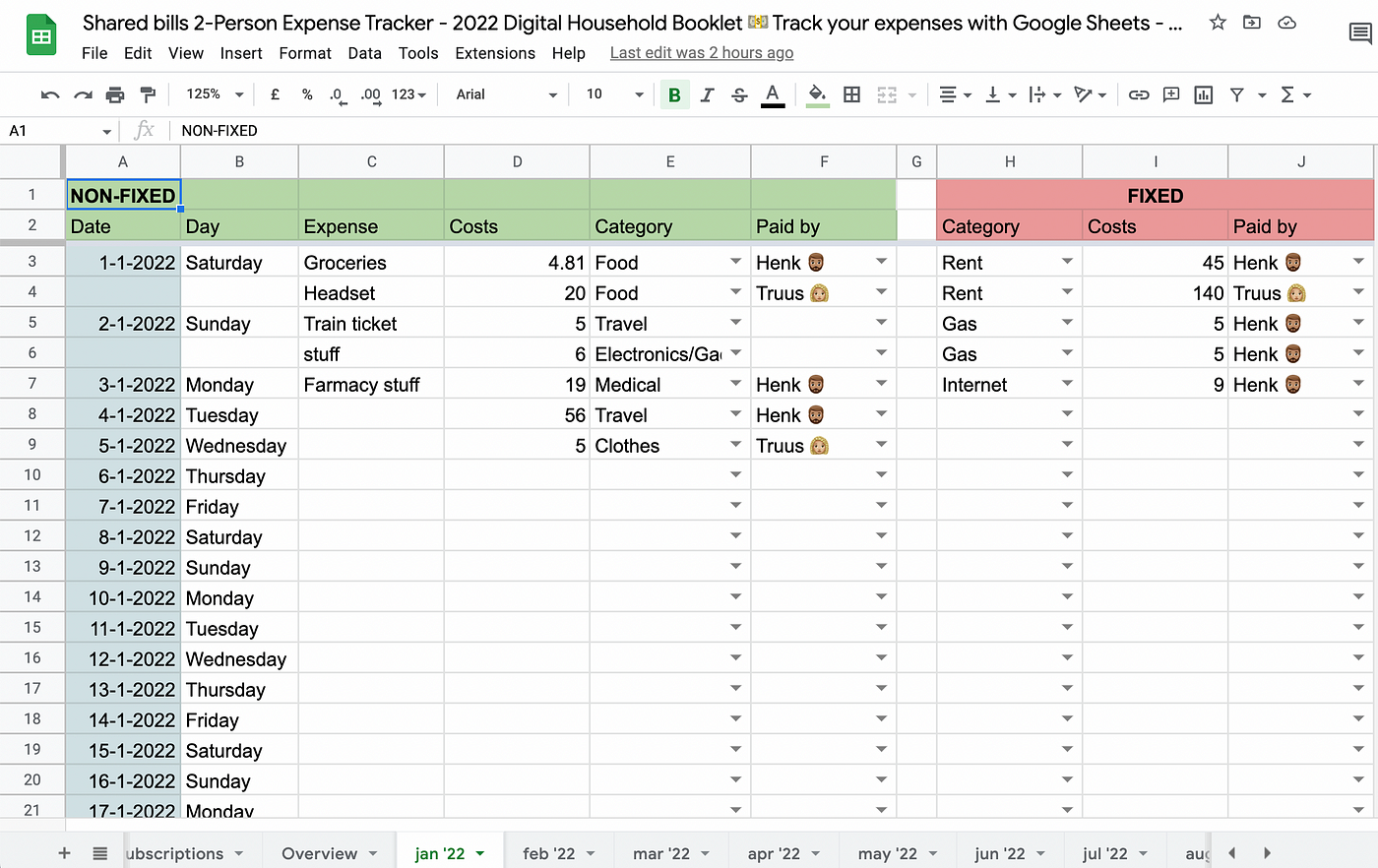

Creating a 2 person budget template is relatively simple and can be done using a spreadsheet program like Microsoft Excel or Google Sheets. Here are some steps to create a 2 person budget template:

1. Determine your income sources

Start by listing all sources of income for both individuals, including salaries, bonuses, and any other income sources.

2. Track your expenses

Image Source: pinimg.com

List all shared expenses, such as rent, utilities, groceries, and transportation costs. Then, track individual expenses like personal shopping, dining out, and entertainment.

3. Set savings goals

Discuss and agree on common savings goals, such as building an emergency fund, saving for a vacation, or investing for retirement.

4. Create a budget template

Image Source: generalblue.com

Use a spreadsheet program to create a budget template with sections for income, expenses, savings goals, and a summary of overall finances.

5. Regularly update your budget

Make it a habit to update your budget template regularly, at least once a month, to track your progress towards your savings goals and adjust your spending as needed.

6. Review and adjust as needed

Image Source: thesavvymama.com

Review your budget template regularly with your partner, discuss any changes or adjustments that need to be made, and continue working towards your financial goals together.

7. Seek professional help if needed

If you are struggling to create or stick to a budget, consider seeking help from a financial advisor or counselor who can provide guidance and support.

8. Celebrate milestones

Image Source: medium.com

Celebrate your financial milestones, whether it’s paying off debt, reaching a savings goal, or sticking to your budget for a certain period. Acknowledge your achievements together and continue working towards your financial future.

Tips for Successful Budgeting with a Partner

Budgeting with a partner can be challenging, but with the right approach, it can also be rewarding and beneficial for your relationship. Here are some tips for successful budgeting with a partner:

Image Source: etsystatic.com

Communicate openly: Regularly discuss your financial goals, priorities, and concerns with your partner to ensure that you are on the same page.

Set realistic goals: Set achievable savings goals and create a budget that reflects your current financial situation and lifestyle.

Be flexible: Be open to making adjustments to your budget as needed, and be willing to compromise on certain expenses or savings goals.

Track your progress: Regularly review your budget template and track your progress towards your savings goals to stay motivated and focused.

Celebrate small wins: Celebrate each small milestone you reach in your financial journey, whether it’s paying off a credit card or sticking to your budget for a month.

Seek help if needed: If you are struggling with budgeting or financial issues, don’t hesitate to seek help from a financial advisor or counselor who can provide guidance and support.

In conclusion, a 2 person budget template is a valuable tool for couples or roommates who want to manage their finances together effectively. By tracking income, expenses, and savings goals in one place, both individuals can work towards common financial goals, improve communication about money matters, and achieve financial success together. With the right approach and commitment, budgeting with a partner can lead to a stronger financial future and a healthier relationship.

Image Source: medium.com